Supercycle narrative, once treated like gospel, took a serious hit as BTC USD slid all the way to $60,000 and ETH USD cracked below $2,000. Is this just another brutal shakeout or the moment the supercycle myth finally broke? Either way, BTC USD and ETH USD are now inseparable from rock bottom sentiment.

Crypto Fear and Greed Chart

1y

1m

1w

24h

What made us feel the selloff sting is that we just don’t know where the fire comes from. No surprise rate hike, no exchange collapse, no overnight regulation hammer. The total crypto market cap just somehow dropped to $2.3 trillion after a sharp 7% daily decline, almost half of $4,2 trillion top.

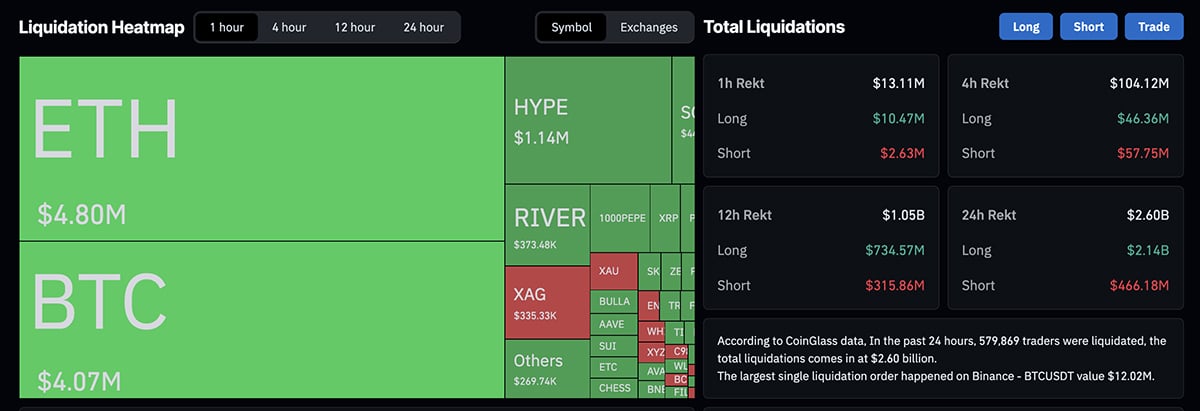

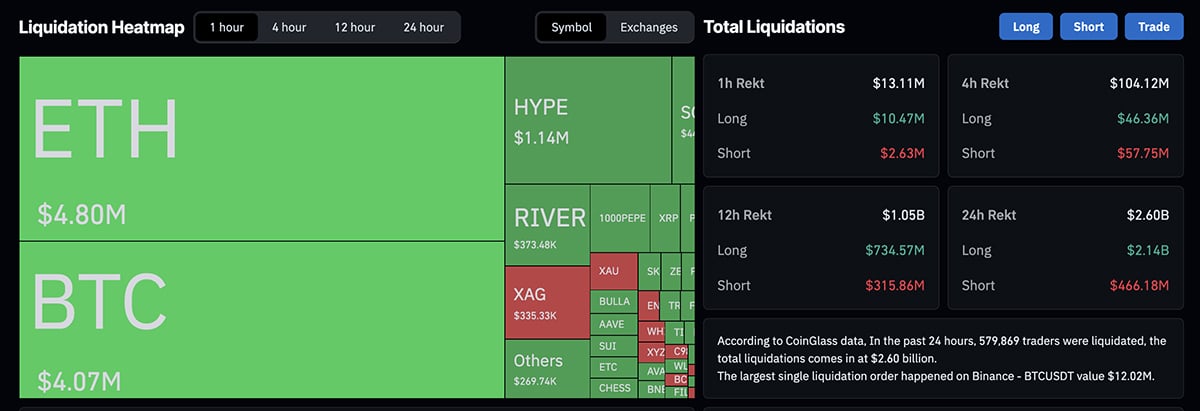

More than $2.6 billion vanished in a single day, with realized Bitcoin losses hitting past black swan events. Long positions worth over $2.1 billion were erased; it was just a brutal bloodbath. Nobel laureate Paul Krugman called it a “crisis of faith” as both ETH and BTC don’t respect narratives. The supercycle debate becomes emotional before it becomes analytical in a cycle low condition.

If this is a supercycle, it’s not the smooth, up-only version people sold on podcasts. If.

(source – Coinglass)

Supercycle Stress Test for BTC USD and ETH USD

Strategy CEO Phong Le said that BTC USD would need to collapse to $8K and stay there for years to truly threaten corporate balance sheets. At the same time, $4.3 billion in Bitcoin flowed out on Binance in just two days, more than any other exchange, even as on-chain data showed long-term holders barely moving.

Phong Le: #Strategy’s balance sheet remains resilient, and #BTC would need to fall to $8K for years to threaten its convertible debt. pic.twitter.com/8blEcLbYHL

— Coinpaper (@coinpapercom) February 6, 2026

The market has shed nearly $1 trillion since mid-January, with analysts now openly floating USD 40K scenarios for BTC, just as bears hold the momentum. ETH USD, meanwhile, continues to wrestle with its own identity crisis as Layer-2 drama and ecosystem politics muddy the waters. The supercycle is limping if it exists.

Although beneath the noise, adoption headlines didn’t stop. Russia’s Sberbank is preparing crypto-backed loans for corporates. Binance’s CZ keeps pushing the idea that every national currency belongs on-chain. Coinbase’s Brian Armstrong compared crypto and AI to “siamese twins” of applied math, destined to reconnect. Builders building while prices bleed.

There are reports that Sovcombank has discussed potential crypto-backed lending, especially for miners, under Russia’s evolving regulatory framework – but there’s no official launch yet.

Separately, Sberbank has piloted a Bitcoin-backed corporate loan. pic.twitter.com/sFxYDmUsj0

— CryptoPotato Official (@Crypto_Potato) February 5, 2026

DISCOVER: 10+ Next Crypto to 100X In 2026

Reality Check: Is it Checking?

From a technical standpoint, BTC USD breaking from $70K and tagging $60K pushed momentum indicators into extreme territory. Daily RSI dipped near 22, a range lower than that of “Covid Crash”. A good rebound could target the $75K zone if volume helps the course, but failure here opens the door to $40K based on Fibonacci retracements from October highs. The 200-day moving average is saying that $55K is the line to watch.

ETH USD looks equally tense as it’s slipping under $2K, completing a descending triangle, with $2.2K now acting as stubborn resistance. MACD remains bearish, but stochastic indicators are starting to diverge, hinting at a relief bounce. A push toward $2.5K isn’t impossible, yet a clean break below $1.8K would likely drag ETH toward $1.5K. So it comes down to whether the supercycle is really going to go again.

Total crypto market cap excluding BTC and ETH USD is down by 16% this week, while DeFi TVL slid to $93 billion, losing 7%. Sentiment gauges are deep in extreme fear. However, it is somewhat bullish as it shows that most retail has already left the room.

As this week closes, remind ourselves that every cycle feels like the end when you’re holding. Whether the supercycle survives, BTC USD and ETH USD have reached levels where patience pays in many instances. The fire looks scary up close, but step back and look how beautiful it is from afar.

For me, I’ll be singing “Have a Cigar” for Bitcoin

Come in here, dear boy, have a cigar, you’re gonna go far.

You’re gonna fly, you’re never gonna die.

And did we tell you the name of the game, boy?

We call it riding the gravy train.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Did Stablecoin Minting Stop Bitcoin Price From Breaking Below $60K?

Tether and Circle minted more than $3 billion in new stablecoins in just a few days as the Bitcoin price retested $60,000. BTC briefly bounced at that level, but the buying power many traders expected never showed up. That gap tells us a lot about how defensive this market feels right now.

Bitcoin price lost its grip on $70,000 earlier this week and drifted back to a price zone that has acted more like quicksand than a springboard. At the same time, the supply of USDT and USDC jumped. On the surface, that looks bullish; more digital dollars usually mean more ammo to buy crypto.

But this time was different. The money came in, but the buying pressure did not.

Pump.fun Buys Vyper as It Pushes Into Cross-Chain Trading

Pump.fun just bought Vyper, a trading execution terminal, as it pushes deeper into cross-chain trading. The deal lands as memecoin activity has dried up on Solana, where Pump.fun operates as the leading meme coin token launchpad.

It comes as the ongoing crypto crash wiped out a further $200Bn from the total market cap overnight, with SOL USD among the hardest hit, falling over -17% to $70 before an early-morning rally took it back above $80.

While the market is currently in turmoil, Pump.fun’s moves can only be positive for the Solana price and its broader ecosystem. The PUMP

token fared slightly better than SOL, dropping just -9% to $0.002, offering optimism that better days lie ahead for the meme coin space.

While on the topic of Solana, Bitcoin Hyper (HYPER) is the first-ever Layer-2 protocol for Bitcoin, built on the Solana Virtual Machine (SVM), and just raised $31.2M in an ICO despite the ongoing crypto crash. Stick around to the end to find out why HYPER is one of the most hyped crypto presales in recent memory.

We’re proud to announce that Vyper has been acquired by @Pumpfun

Vyper’s infrastructure will soon be migrated to @TradingTerminal. As part of that process, Vyper will soon be sunsetting.

To celebrate, all Vyper users get a limited-time 90% cashback on Terminal!

Learn more

pic.twitter.com/TFJIrR2bWy

— Vyper (@TradeonVyper) February 5, 2026

Read the full story here.

Gemini Pulls Out of UK, EU, Australia as It Bets on US Rules

Crypto can’t exist in isolation. True, it promises decentralization and diffuses power back to the people. The problem is that fiat is needed to buy these assets, and some of the best cryptos to buy are still priced in USD, Euros, and many other fiat currencies.

Exchanges like Gemini, Coinbase, and Binance that enable the trading of these assets are important channels. Every day, they cumulatively handle billions in trading volume, meeting the demand of users from across the world. As crypto goes global, trading volume will only rise. With this comes the need for clear laws so that the trader and the exchange act within the bounds of the law.

As part of this adjustment, Gemini, one of the first crypto exchanges, announced its planned exit from the UK, the European Union, and Australia while cutting about 25% of its staff. The move landed quietly amid the crypto meltdown, which has seen the Solana price collapse below $100.

Read the full story here

Tether $150M Deal With Gold.com: Stablecoin Giant Wants to Own the Supply Chain

The obsession with gold continues: Tether, the stablecoin giant, is once again expanding its gold exposure. In a move that signals a major pivot toward hard assets, Tether has struck a definitive deal to invest $150 million into Gold.com. The agreement buys Tether approximately <a class=”general-link” href=”https://ir.gold.com/news-events/press-releases/detail/216/gold-com-announces-150-million-strategic-investment-from-tether” target=”_blank” rel=”noopener”>12% of the precious metals giant</a> and a seat on its board.

But this isn’t just an isolated bet; it’s a strategic deployment of capital fueled by a fortress balance sheet that just reported over $10 billion in annual profits. For Tether, this is a significant achievement compared to the rest of the market.

With gold prices surging and inflation narratives sticking, Tether is effectively building a bridge between its massive digital liquidity and the physical logistics of the bullion market.

Tether backs https://t.co/YdevlebMZU with $150M deal@Tether is investing $150 million to acquire a 12% stake in https://t.co/YdevlebMZU, partnering to integrate its XAU₮ gold token and expand access to both digital and physical gold.

The collaboration will allow users to… pic.twitter.com/pNlVPh3Jfd

— Crypto Miners (@CryptoMiners_Co) February 6, 2026

Read the full story here.

What Does the Strategy Q4 Earnings Reveal Amid a Brutal Bitcoin Crash

Michael Saylor’s Strategy used its Q4 earnings call to double down on its ‘all-in’ Bitcoin plan. The timing matters, as the ongoing Bitcoin crash has pushed BTC USD below Saylor’s average buy price of $76,000.

Overnight, the Bitcoin

price fell by more than 14%, briefly touching $60,250, but it has since rallied slightly and now trades at $65,000. Saylor and Strategy, along with the rest of the crypto market participants, will be hoping that the bottom is in and

The long-term future of Strategy is uncertain, but the firm seems confident it can stay afloat amid a brutal market downturn. MSTR shares closed yesterdays trading session down -17%, marking yet another issue for Saylor to deal with as investor confidence dwindles.

As for the rest of us in the market, the Fear and Greed Index just hit 9 and briefly went to 4, levels not seen since the COVID crash in March 2020.

Crypto Fear and Greed Chart

1y

1m

1w

24h

Read the full story here.

Over $1T Wiped From The Market But Bitwise Says Crypto Winter Is Near Its End

Bitwise CIO Matt Hougan recently described the crypto market as locked in a full-blown winter since January 2025. A brutal, 2022-style downturn driven by excess leverage, widespread profit-taking by early holders, and sustained price pressure across the board. He likens it to “Leonardo DiCaprio in The Revenant”: harsh, prolonged, and not just a routine pullback.

Institutional ETF inflows and treasury adoption masked much of the damage for months, keeping surface optimism alive while retail and altcoin holders faced steep drawdowns.

I visited a bunch of financial advisors this week and can confirm they’re still generally bullish. Those who haven’t invested yet see the pullback as an opportunity and those who bought earlier plan to hold.

That said, if there is one thing this pullback has taught us, it’s that… https://t.co/SCi7POOuaC

— Matt Hougan (@Matt_Hougan) February 5, 2026

Read the full story here.

Lummis Wants Banks to Embrace Stablecoins, CLARITY Act Stalls

Billionaires managing multi-trillion-dollar portfolios are bullish on a future that is tokenized. They expect real estate, bonds, currencies, and pretty much everything of value to float on public ledgers like Ethereum and Solana in the coming months.

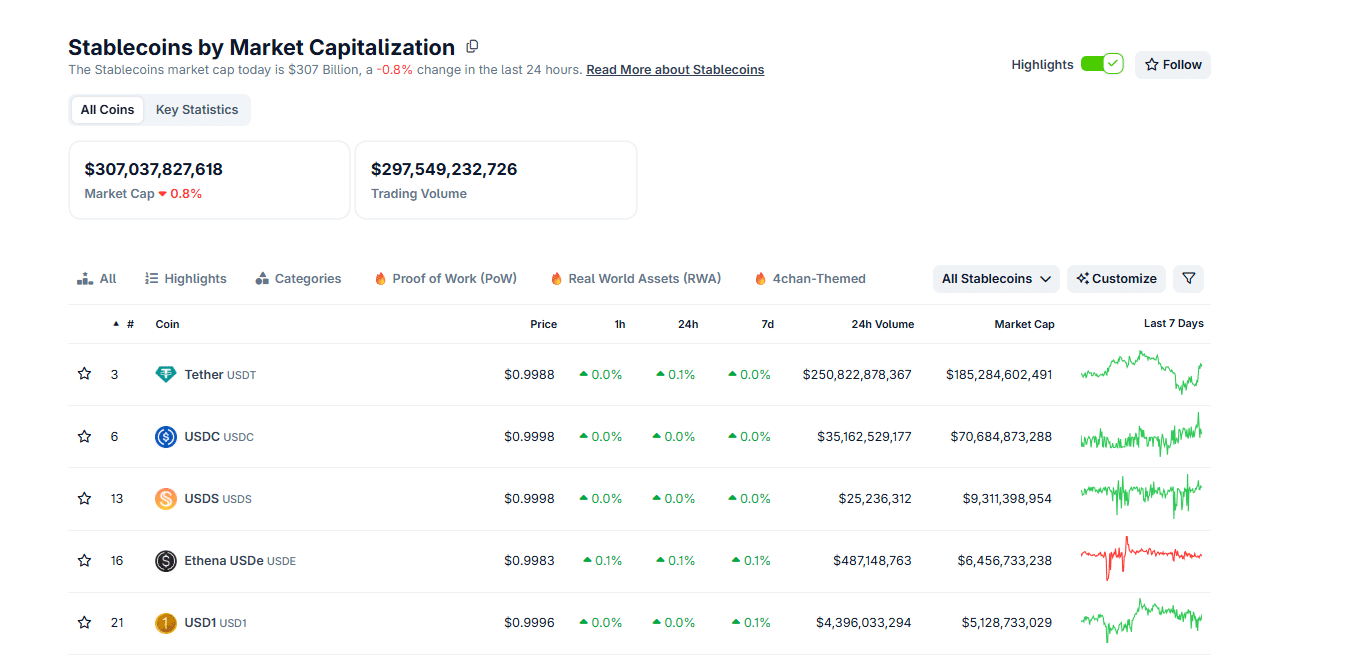

Tokenization of fiat, like the USD and Euro, has been a huge success. As of February 6, over $308Bn of stablecoins, most of them tracking the greenback, are in circulation on Ethereum and other popular smart contract platforms.

(Source: Coingecko)

Given this success and first-mover advantage, especially that of the USD, it is not surprising that Senator Cynthia Lummis of Wyoming wants traditional banks in the US to embrace stablecoins. Her comments come even as Congress hits another roadblock on crypto regulation.

Read our full coverage here.

Kalshi Tightens Surveillance as Super Bowl Bets Hit $170M

Kalshi just tightened its trading surveillance days before the Super Bowl, adding an independent oversight committee and new data partners. Nearly $170 million has already flowed into Kalshi Super Bowl bets, putting unusual attention on how fair those markets really are. Prediction markets are expanding fast in the US, while states and federal agencies question where forecasting ends and illegal gambling begins.

The Super Bowl remains the undisputed king of this sport betting volume. This year, legal wagers in the US are expected to hit a record $1.76 billion for the February 8 kickoff at 6:30 p.m. ET.

Kalshi currently commands over 50% of the regulated US market share, but competition is fierce. Polymarket remains the heavyweight for the crypto-native crowd, dominating offshore flows with nearly $4 billion in monthly activity.

open your venmo app

3 days before the Super Bowl:

kalshi x venmo pic.twitter.com/Hzat0GgkyX

— Tarek Mansour (@mansourtarek_) February 5, 2026

Read more here.

MARA Digital Moves $87M in Bitcoin BTC as Miner Treasuries Shift

Balls of steel; that’s what those who HODLed Bitcoin yesterday needed when prices plunged by more than $10,000. As the digital gold acts more like a volatile Solana meme coin, institutions are recalibrating.

True, some like MicroStrategy, or Strategy now, might be smiling, but they remain under immense pressure. However, looking at on-chain data, there are some refreshing moves after MARA Holdings, formerly Marathon Digital, readjusted its treasury.

Yesterday, on February 5, on-chain data showed that the miner moved 1,318 BTC as part of an internal miner treasury adjustment. This comes as crypto mining firms across the globe face tighter margins, made worse by plummeting prices and the lingering effects of the Halving event of April 2024.

The Bitcoin mining firm #MARA transferred 1,318 $BTC($86.89M) to Two Prime, BitGo, and Galaxy Digital in the past 10 hours.https://t.co/9DlN5ZPsBz pic.twitter.com/ubPZM5iwWi

— Lookonchain (@lookonchain) February 6, 2026

Read more here.

The post Crypto News Today, February 6: Supercycle They Say! Sentiment Hit Rock Bottom, BTC USD Touched $60K, ETH Under $2K appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]