What is XAUT? Tether Gold (XAUT) gives crypto users a way to buy real gold without touching a vault key. Each XAUT token represents ownership of one fine troy ounce of physical gold on the London Good Delivery bar, but it trades with the speed and ease of a stablecoin.

Gold demand climbed through 2025, and tokenized gold followed. On-chain data shows XAUT supply backed by roughly 246,000 ounces of gold, stored in Swiss vaults, as interest in real-world assets moved on-chain.

With gold spot prices shattering the $5,000 ceiling and silver rallying over 140% in the last year, the “boring” metal markets are suddenly witnessing crypto-like volatility.

Whales are buying gold.

0x2788 withdrew 1,500 $XAUT($7.58M) from #OKX 2 hours ago.

0x4E3c withdrew 931.33 $PAXG($4.75M) from #Binance 4 hours ago.

0xDea3 bought 732.8 $PAXG($3.74M) 1 hour ago.https://t.co/qJ6krFEk9ohttps://t.co/vG4ilPIR9jhttps://t.co/wDzfNwjYh5 pic.twitter.com/2wtRXkC9x8

— Lookonchain (@lookonchain) February 4, 2026

The New Volatility: Gold Now Trades Like Crypto

For years, gold was the slow-moving hedge against inflation. That changed in late 2025. As geopolitical fractures widened, gold and silver began seeing double-digit daily swings, behaving more like meme coins than commodities.

This shift forced major exchanges to adapt. Binance and other top-tier platforms have aggressively listed gold and silver perpetual contracts, acknowledging that the volume is moving on-chain.

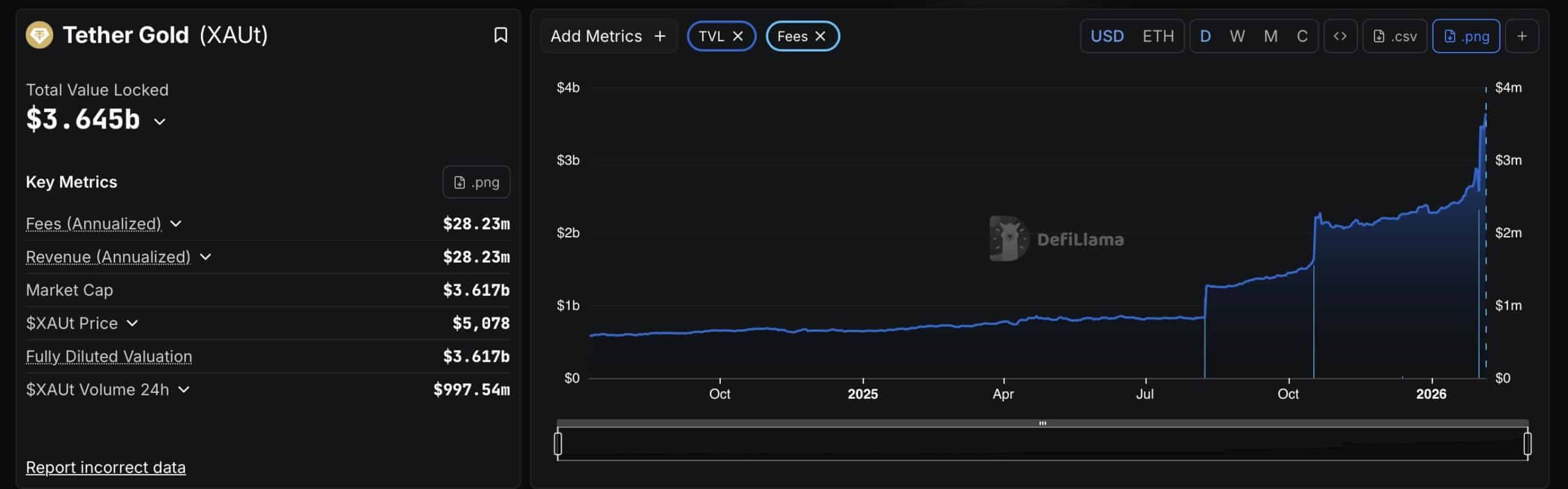

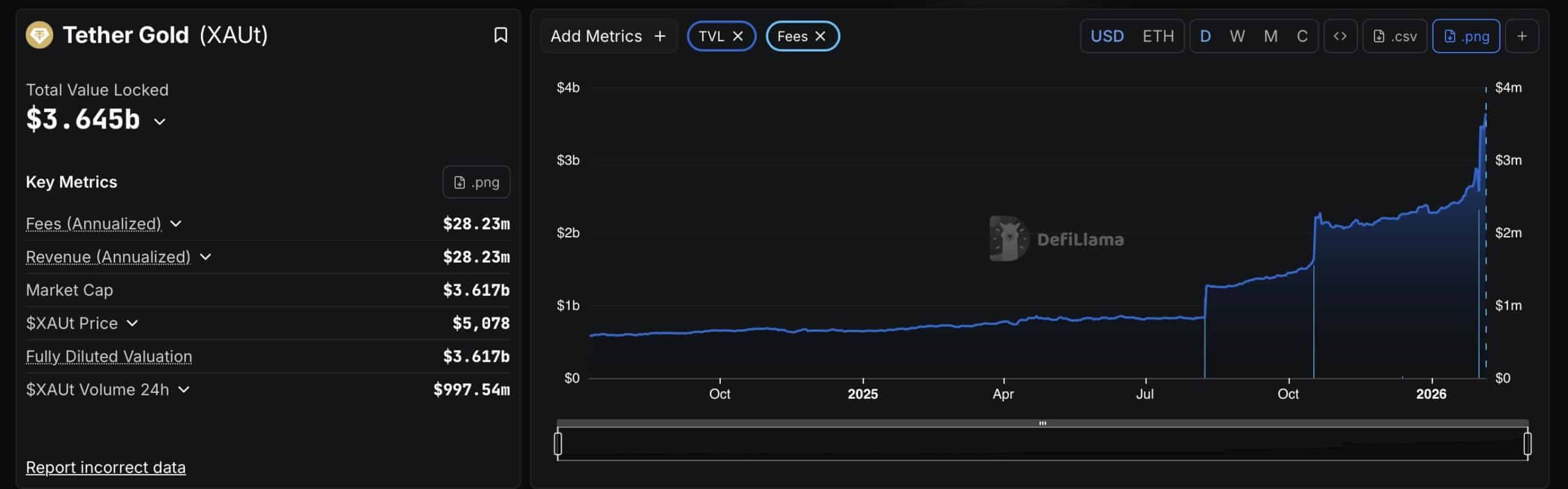

XAUT has been a primary beneficiary of this frenzy, with 24-hour trading volumes frequently topping $1 billion.

EXPLORE: Top Solana Meme Coins to Buy in 2026

What Exactly is XAUT, and How Does it Work?

At its core, Tether Gold (XAUT) is a direct digital receipt for physical metal. Unlike ETFs, which can be bureaucratic and slow to settle, XAUT is an ERC-20 token living on the Ethereum and TRON blockchains.

- Trust & Backing: Every token is 1:1 backed by physical gold stored in Swiss vaults.

- Verification: Investors can identify the specific gold bar associated with their address via Tether’s lookup website.

- Access: It removes the need for custody fees and physical transportation, allowing users to transfer millions of dollars in gold globally in seconds.

XAUT also borrows trust from Tether’s history with stablecoins like USDT and Tether gold reserves. Holdings are published on-chain, so anyone can verify how much gold backs the tokens.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

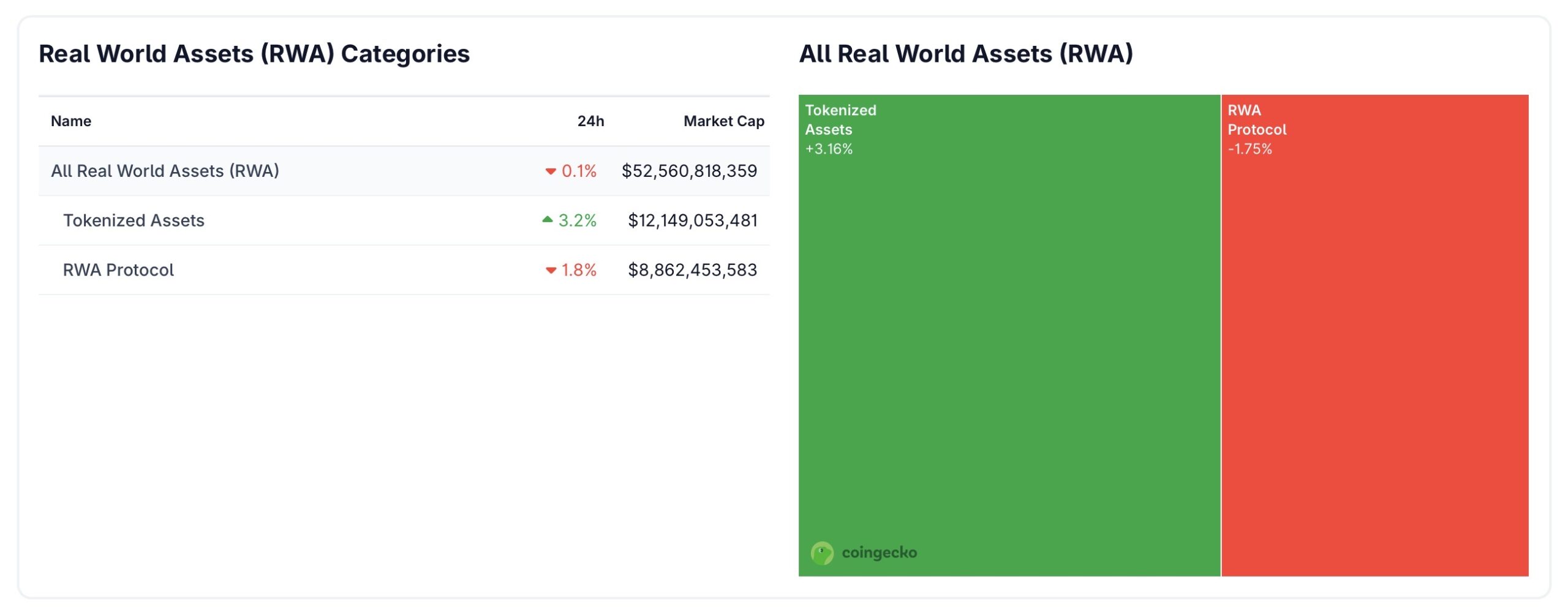

XAUT Is Leading the Real-World Asset (RWA) Boom

XAUT is not just a trading tool; it is the flagship of the Real-World Asset (RWA) sector. The RWA market has exploded in 2026, with total value locked now approaching $52 billion.

(Source: Coingecko)

As of February 2026, XAUT’s circulating supply has surged to over 712,000 ounces (up from 246,000 just a few years ago). While competitors like Paxos (PAXG) offer similar products, Tether’s dominance in liquidity makes XAUT the go-to pair for whales and institutions looking to exit volatile crypto positions without leaving the blockchain ecosystem.

This trend also explains why the Tether XAUT token controls a large share of tokenized gold trading. Liquidity attracts liquidity.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post What is XAUT? The Tokenized Gold Rush Hitting $5,000 an Ounce appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]