The Federal Reserve held interest rates steady on Wednesday, a move markets largely expected. Bitcoin stayed relatively firm even as the US dollar weakened, but traders are still asking why crypto is down despite a supportive macro setup.

Rates stayed in a 3.5% to 3.75% range, but the dollar’s drop changed the mood.

This comes as traders already watched the Fed meeting results closely. For crypto, the pullback stems partly from historical patterns, Bitcoin declined after seven of eight 2025 FOMC meetings, and a rotation toward established stores of value. Yet, this dollar slide could subtly favor risk assets over time, as cheaper borrowing indirectly supports liquidity flows.

EXPLORE: Top Solana Meme Coins to Buy in 2026

Fed’s Cautious Pause Signals Economic Resilience

Policymakers described the economy as expanding at a solid pace, with job gains moderating but the labor market showing signs of stabilisation. Inflation remains somewhat elevated, prompting a deliberate wait-and-see approach before any further easing.

The 10-2 vote included dissent from two governors favouring a 25-basis-point cut, yet Chair Jerome Powell emphasised that current rates are appropriate and not overly restrictive.

We do not need to be in a hurry to adjust our policy stance

Markets reacted with composure: equities ended mixed, with the S&P 500 holding near record levels. Gold surged.

The #Fed in its latest #FOMC speech basically gave the middle finger to the Trump admin by refusing to cut rate.#Gold gave the Fed the middle finger by printing a $235 green candle to take its spot price to a new all time high of $5,415, a 95.5% gain YOY.

Gold is behaving like… pic.twitter.com/ZovEg9DmRJ

— Ten Reps (@tenrepsauthor) January 28, 2026

So, Why Is Crypto Down? Dollar Slide Draws Capital Elsewhere

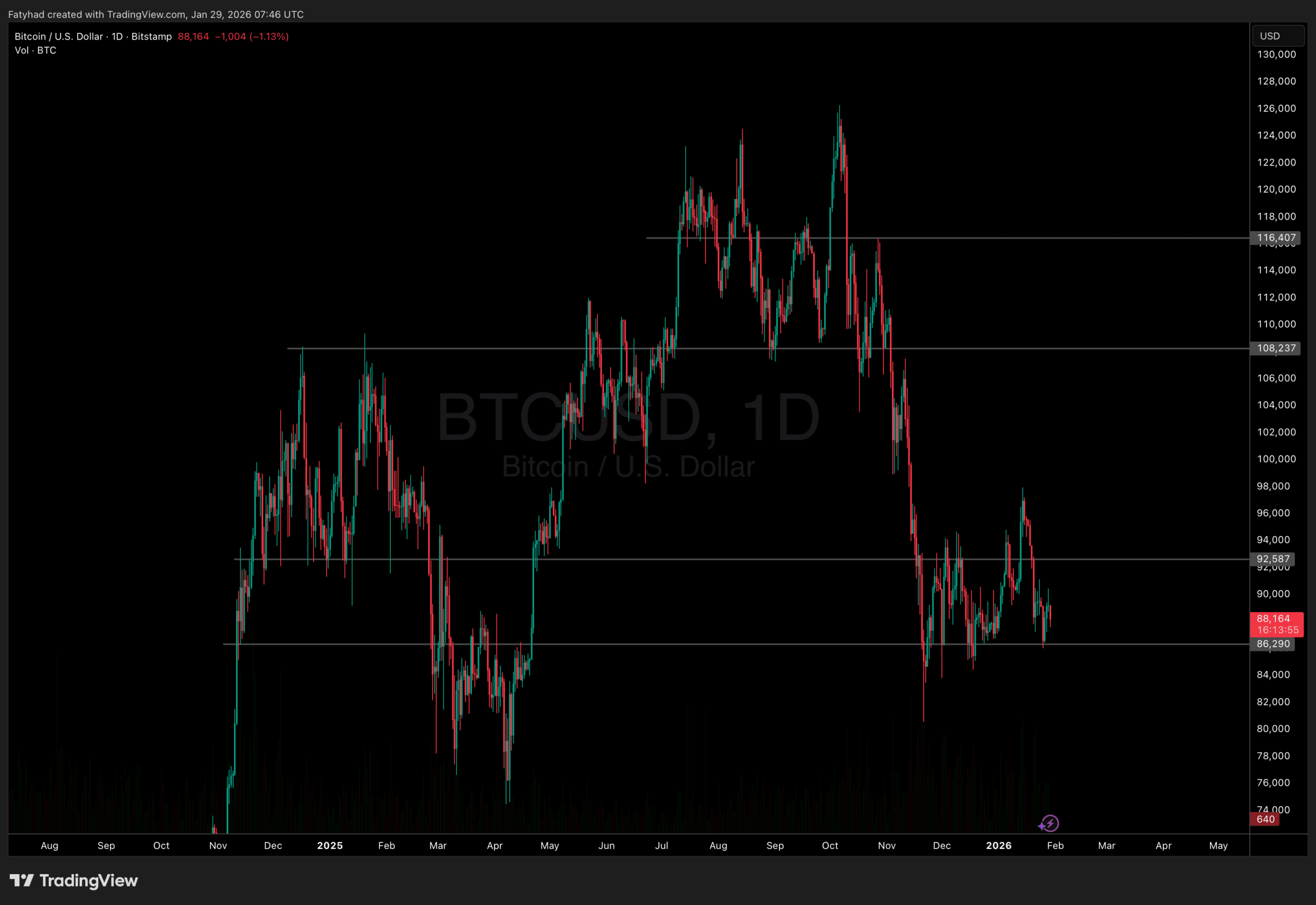

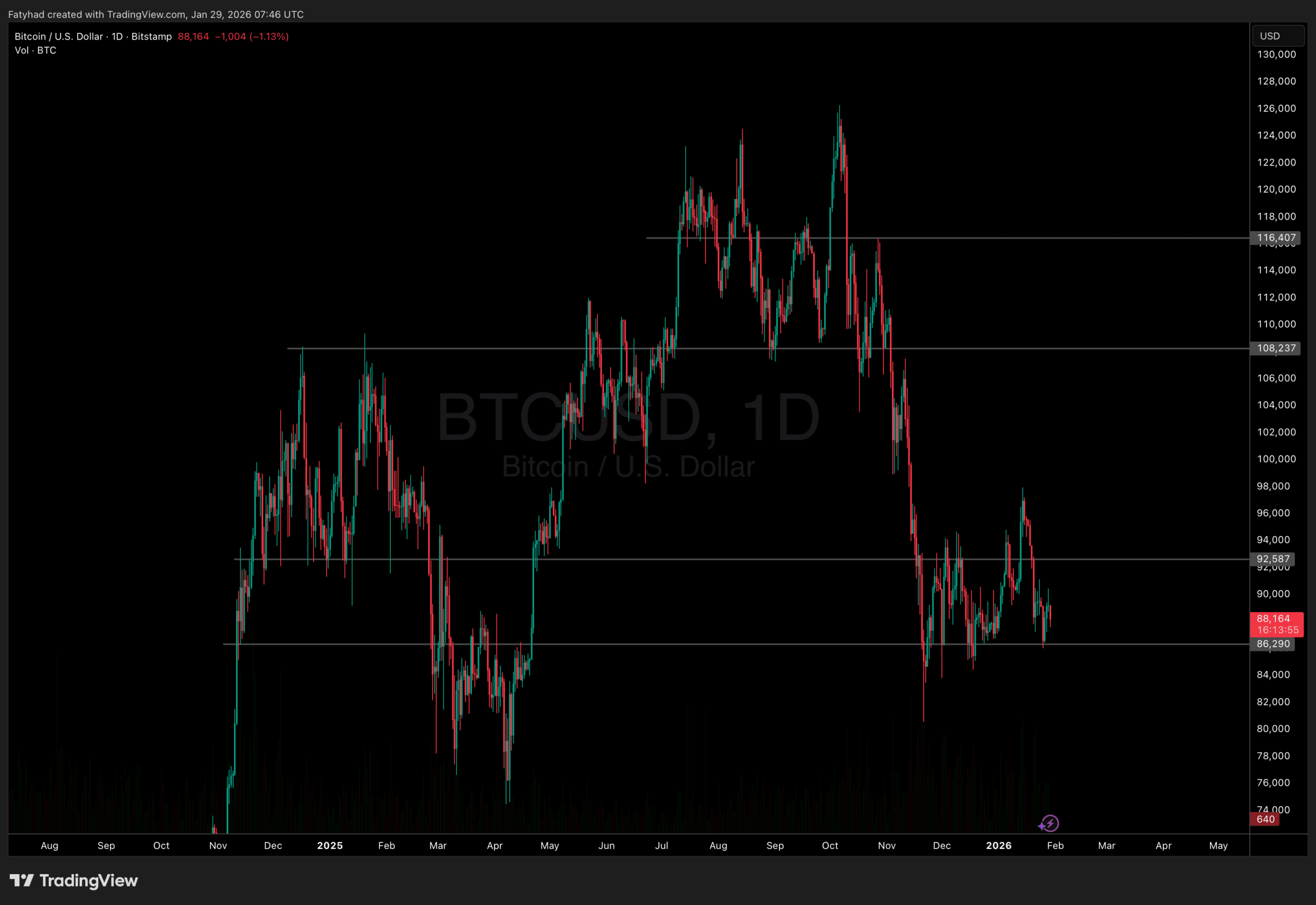

Bitcoin dipped to around $88,000–$89,000 following the announcement, extending a choppy pattern seen after many recent Fed meetings. From a technical perspective, Bitcoin faces resistance near $92,000–$95,000, while key support sits around $86,000 and $80,000.

(Source: TradingView)

While the rate hold aligned with expectations, the broader retreat stems from a pronounced dollar weakness: the US Dollar Index touched four-month lows near 96, down significantly in January and marking one of its weakest annual starts in years. Investors rotated toward traditional havens like gold, which reached fresh records above $2,800 per ounce, pulling focus from riskier assets.

Historical tendencies play a role too: Bitcoin has often softened post-FOMC announcements. The weaker dollar could still improve liquidity conditions over time, but that effect often lags.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

The Dollar Is Tanking, And This Could Shape Bitcoin as Well

The US dollar just logged its worst annual performance since 2017 and hit four-year lows this week. Market watchers argue that letting the dollar slide acts like a quiet rate cut. For Bitcoin, this supports the long-running “hedge” story that also fuels the gold versus Bitcoin debate.

This also explains why big institutions keep watching Bitcoin ETFs. After approvals in 2024, these funds pulled in over $10 billion as investors looked for shelter from dollar erosion.

Regulators still want guardrails. Recent SEC guidance on crypto exchange-traded products stresses disclosures, which protect buyers during sharp swings. Public companies now also face stricter reporting on crypto holdings through filings tracked on federal disclosure databases.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Why is Crypto Down? Fed Pauses Rates, Weak Dollar Sends Gold Higher appeared first on 99Bitcoins.

Bitcoin (BTC) News Today, Bitcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]