The crypto market woke up with the Fed confirming there would be no rate cut, keeping benchmark rates locked in the 3.5%–3.75% range. That stance landed just as US Shutdown fears cooled, sending the market down with ETH USD back under the $3,000 psychological support.

The Fed decision to hold off on a rate cut came with Chairman Jerome Powell striking a cautious tone. Growth, he said, remains solid despite cracks in housing and the looming wildcard of tariffs pushing prices higher. Inflation is still sticky, and the Fed clearly isn’t ready to declare a rate cut and victory. Two governors dissented in favor of a Fed rate cut, but they were outvoted as rates will stay higher for longer.

These are three clocks ticking at different speeds. We see monetary policy, politics, and crypto price action all pulling attention together, and not to forget, the metals price.

No Fed Rate Cut Aftermath and US Shutdown Odds

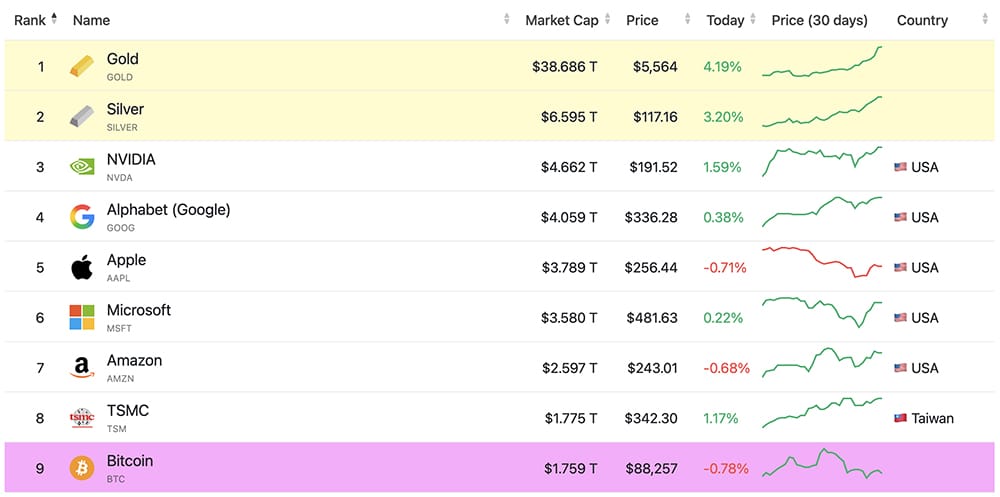

Following the decision, gold surged past $5,500, touching $5,555 after Powell spoke, a daily gain of 2.5%. For perspective, gold took centuries to crawl toward $1,000 before 2008, then added another $1,000 in just 28 days. This latest pump added an estimated $1.75 trillion in market value, or the total value of Bitcoin.

(source – CompaniesMarketCap)

However, Bitcoin tends to follow gold with a noticeable lag. When gold topped or formed lower highs in past cycles, Bitcoin often went parabolic shortly after. This is probably why crypto has paused. The lack of a Fed rate cut keeps pressure on risk assets for now, but it also reinforces the inflation-hedge narrative that keeps Bitcoin strong.

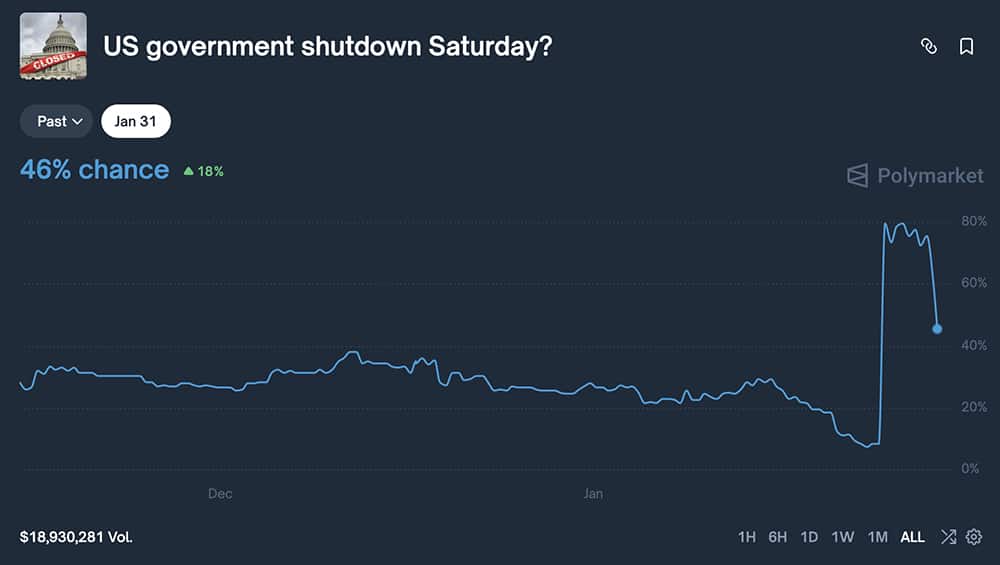

Beyond rates, the US Shutdown odds became the political subplot we should watch. On Polymarket, the probability of avoiding a shutdown rose as talks between the White House and Democrats showed signs of progress. With a continuing resolution expiring January 30, the sentiment has improved. With $19 million in volume, it is a good political indicator.

The odds of a

US Government Shutdown by Saturday is falling.

This is bullish for crypto! pic.twitter.com/msSkyIvdnA

— Mister Crypto (@misterrcrypto) January 29, 2026

A full US Shutdown would impact as much as 78% of federal spending, disrupting healthcare, transportation, and regulatory processes. For crypto, this will force a market stress that could drain liquidity. The easing of shutdown fears, combined with no immediate Fed rate cut, has created a calm sentiment, unexpectedly.

The odds were 80% yesterday and have fallen to under 50% for now.

(source – Polymarket)

DISCOVER: 10+ Next Crypto to 100X In 2026

ETH USD Below $3K, But?

At first glance, ETH USD slipping under $3,000 looks bad. It’s down by 1.3% today. According to Coinglass, open interest stays at $39 billion, and liquidations stayed contained. A low-volume week.

(source – Coinglass)

The chart, though, is coiling into a symmetric triangle, frustrating the impatient, but could reward hodlers. Holding above the $2,900 zone keeps the ETH USD structure is still intact, and a clean break higher still puts $3,400–$3,700 back on the radar.

BitMine, with Tom Lee, recently staked more than 209,000 ETH, pushing its total holdings past 2.2 million ETH, north of $6.5 billion at current prices. These all while Ethereum continues dominating decentralized finance, anchoring the bulk of the $121 billion in total value locked while quietly absorbing 60% of the real-world asset market, now valued at $23.59 billion. Tokenized Treasuries has chosen Ethereum.

Tom Lee(@fundstrat)’s #Bitmine staked another 250,912 $ETH($745M) in the past 18 hours.

In total, #Bitmine has now staked 2,582,963 $ETH($7.67B), 61% of its total holdings.https://t.co/P684j5YQaG pic.twitter.com/kHKaLmMgP4

— Lookonchain (@lookonchain) January 29, 2026

The rollout of ERC-8004 for trustless AI agents and a focus on post-quantum security are the long-term games ETH USD is playing. For now, below $3,000 reflects macro nerves, just like what the whole market is experiencing.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Metaplanet Plans $137M Bitcoin Buy Using Overseas Stock Deal

Before MicroStrategy began buying Bitcoin in November 2020, it was unheard of for a public company to stack up “risky” cryptos. True, some of the best cryptos to buy have had more than 100X since their launch. However, the lack of clear regulations was a massive obstacle.

This rapidly changed after Michael Saylor went all-in on Bitcoin, buying billions worth of BTC. In January 2026, Strategy sold shares and bought over $3Bn of Bitcoin. Not to be left behind, Metaplanet is also executing its own plan to raise funds and buy Bitcoin.

第三者割当による新株式及び第 25 回新株予約権の発行に関するお知らせ pic.twitter.com/YPhua9p7d3

— Metaplanet Inc. (@Metaplanet) January 29, 2026

All this is happening just when the Bitcoin price is stuck below $90,000, with hopes fading that the BTC USD price will break $100,000 in the next two weeks. Sentiment remains bearish, but looking at the fundamentals, there could be a chance for buyers to show their hand.

MegaETH Sets Feb. 9 Mainnet Launch Date After 35K TPS Stress Test

MegaETH, a high-speed Ethereum Layer-2, scheduled its public mainnet launch for Feb. 9 after a week-long stress test pushed the network to 35,000 transactions per second. The test processed 10.7 billion transactions, more than Ethereum has handled in its entire history. This launch lands as Ethereum users keep hunting for cheaper and faster ways to use apps without paying $2 to $5 per transaction.

INITIATING: MegaETH Global Stress Test.

Experience real-time apps with ultra-low fees while we blast the chain with 18-35k real TPS.

For community investors

→ We sent some ETH to get you startedOthers

→ Use our uncapped native bridgeLIVE NOW. (link below) pic.twitter.com/MN28shWGUw

— MegaETH (@megaeth) January 22, 2026

Most Ethereum activity now happens on Layer-2 networks as congestion and fees push beginners away from the main chain. MegaETH wants to grab attention by promising near-instant transactions at a fraction of today’s costs.

Read the full story here.

Oil prices jump and that puts fresh pressure on Bitcoin

Bitcoin is a commodity in the eyes of the SEC and the CFTC. Well, technically, rising oil prices should push the Bitcoin price higher. However, this logic seems not to be holding up at spot rates.

From what’s evident, crypto is crashing, and the Bitcoin price is under immense selling pressure. The digital gold is still capped below $90,000, and bears seem to be unyielding. Overall, the general expectation among traders is that the downtrend of Q4 2025 is over, and prices will soon break higher.

Time matters. Before then, however, eyes are shifting to oil prices. At the moment, oil prices are climbing fast, and that shift just added another headwind for Bitcoin. West Texas Intermediate (WTI) crude jumped nearly +12% this month to $64, while Bitcoin slid below $90,000 after peaking near $126,000 in October.

The backdrop is scary: markets are already nervous about inflation and stubbornly high interest rates. If oil prices rise further, closing the week strongly, it is likely that high energy prices will end up squeezing risk assets like crypto.

Read the full story here.

Coinbase Opens Prediction Markets in All 50 States

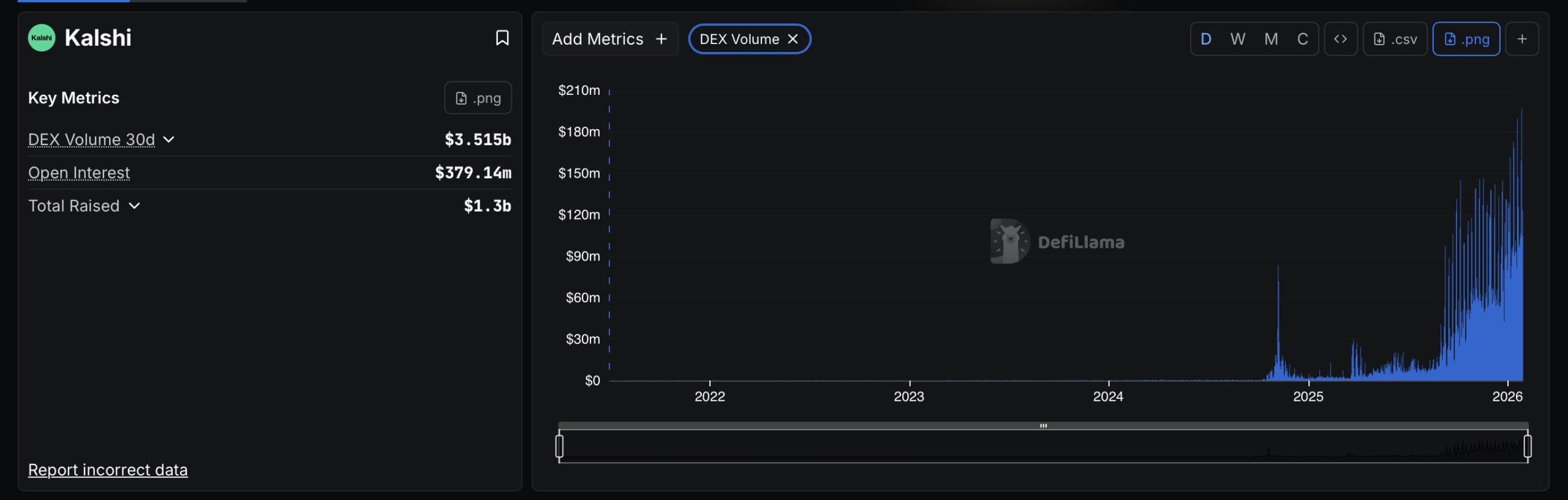

Coinbase just flipped the switch on prediction markets across all 50 US states. Coinbase built this using Kalshi, a federally regulated platform overseen by the US Commodity Futures Trading Commission.

This move pushes Coinbase closer to its “everything exchange” goal. The same app that holds your Bitcoin could soon offer stocks, tokenized assets, and event contracts in one place.

https://twitter.com/coinbase/status/2016582529407488133?s=61

Coinbase’s huge user base gives it a real advantage, especially as it rolls out extras like crypto futures. Kalshi itself sits at an $11 billion valuation, showing how big this space has grown, and the partnership runs through Coinbase Financial Markets, open almost around the clock with just quick weekly check-ins.

(Source: DefilLama)

What edge does Coinbase have in the prediction markets sector? Beginners already trust Coinbase with custody and compliance, especially compared to offshore rivals like Polymarket, which has drawn heat from state regulators and lawmakers.

It also puts pressure on competitors. Robinhood offers event contracts in limited states, while crypto-native platforms face tighter scrutiny. Coinbase’s scale gives it an edge, especially as it keeps adding new products like recently listed crypto futures.

Read the full story here.

Worldcoin Jumps on Reports OpenAI May Build Bot-Free X Rival

Two years ago, Worldcoin WLD was the coin to buy. Fast-forward one crypto winter later, and WLD USD is not doing very well. To put it in numbers, WLD USD is down -95% from all-time highs. This month, it plunged to record lows.

A combination of sliding crypto prices, regulatory headwinds, and token unlocks hammered WLD crypto. However, things are beginning to look up.

As January comes to a close, WLD USD is back in the limelight. This time, not because Bitcoin and some of the best cryptos are ticking higher, but because of solid news related to OpenAI. Worldcoin’s co-founder, Sam Altman, is closely tied to the AI tech company.

Read more here.

WisdomTree Brings Tokenized Funds to Solana in Wall Street Shift

Top asset managers like BlackRock are confident the future will be tokenized, not on private chains but on public ledgers like Solana and Ethereum. Already, billions worth of US treasuries and USD already “float” about in these chains.

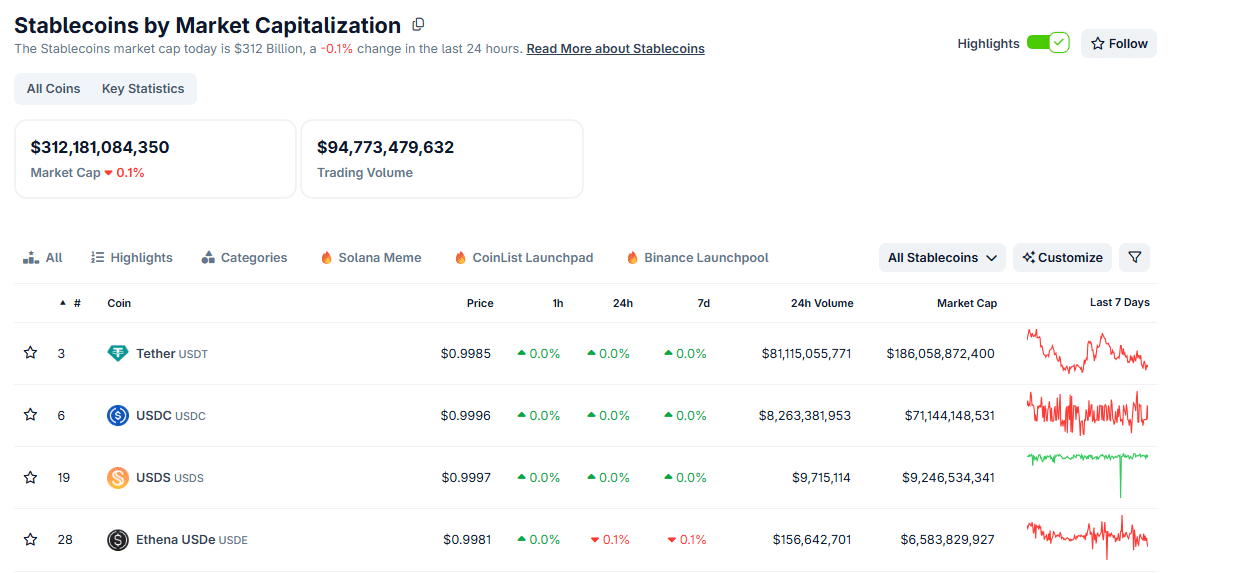

As of late January 2026, over $312Bn worth of stablecoins had already been minted on multiple chains, mainly on Ethereum, Tron, and Solana. At the same time, parallel data shows that funds are racing to tokenized common trading instruments in the US, including ETFs.

(Source: Coingecko)

With momentum picking up and tokenization inevitable, yesterday, WisdomTree said it would open its tokenized investment funds on Solana, expanding from other chains, including Ethereum and Stellar. In this way, they will give everyday and institutional investors a new way to access Wall Street products onchain.

In response to the news, the Solana price remained in a sideways chop, stuck below $125. Despite the lack of volatility, this news only reinforces Solana’s role as a serious financial rail, not just a trading network.

Read our full coverage here.

Sony Adds $13M to Soneium Bet After Mainnet Reality Check

Rollups, privacy-focused or not, are a cornerstone of Ethereum. Without platforms like Arbitrum, Base, or Optimism, the Ethereum mainnet would still be struggling with high fees. This all changed when developers made it their primary objective to scale Ethereum by all means necessary.

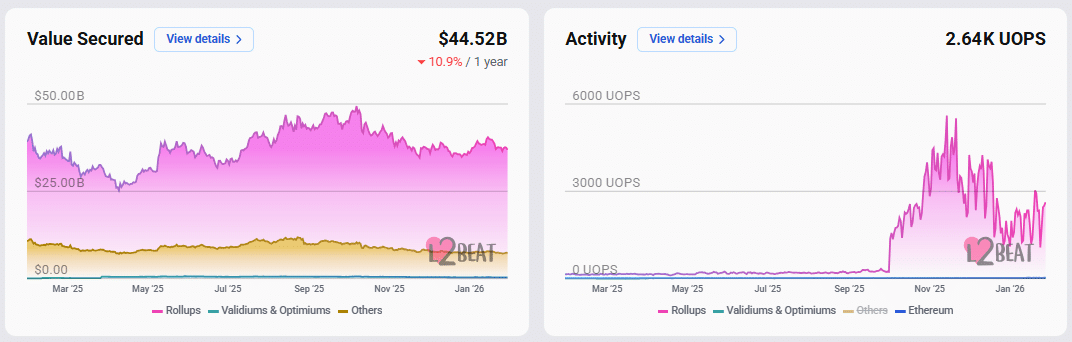

Given the complexities of scaling the primary chain first, roll-ups were seen as a feasible option. As of late January 2026, Ethereum Layer 2s (L2s) managed over $41Bn worth of assets. In this fast-growing scene, Sony’s Soneium is a major player.

(Source: L2Beat)

Although it doesn’t have a native token, much like Base, Soneium is actively used by developers. It currently manages over $42 million worth of assets, of which nearly $4M have been minted natively.

Read the full story here.

The post Crypto Market News Today, January 29: No Fed Rate Cut, US Shutdown Odds Falling, ETH USD Back Below $3K appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, FOMC News, Live Updates, rate cut

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]