They say a month in crypto feels like a year if you’re deep in it, and this 2025 felt like a twelve-year speedrun. Narratives flipped weekly, conviction trades got punished, and even some of the best of us were humbled at least once. Through it all, crypto news revolved around just one thing. Where the Bitcoin price and Ethereum are going to head next, and whether this cycle was different or just “not yet”.

Reflecting back now, crypto wasn’t clean or linear this 2025. Bitcoin made history with its all-time highs, lost price support, and made it again before cracking under macro pressure. Ethereum moved more slowly but smarter, carried by real upgrades, though it lags in price. Around them, majors like

1.17%

Solana

SOL

Price

$124.58

1.17% /24h

Volume in 24h

$3.04B

<!–

?

–>

Price 7d

,

1.35%

Cardano

ADA

Price

$0.3408

1.35% /24h

Volume in 24h

$479.06M

<!–

?

–>

Price 7d

,

0.11%

Avalanche

AVAX

Price

$12.43

0.11% /24h

Volume in 24h

$230.54M

<!–

?

–>

Price 7d

,

0.27%

XRP

XRP

Price

$1.84

0.27% /24h

Volume in 24h

$1.59B

<!–

?

–>

Price 7d

, and

0.56%

Chainlink

LINK

Price

$12.28

0.56% /24h

Volume in 24h

$314.50M

<!–

?

–>

Price 7d

fought for relevance in a year where attention was the most valuable currency.

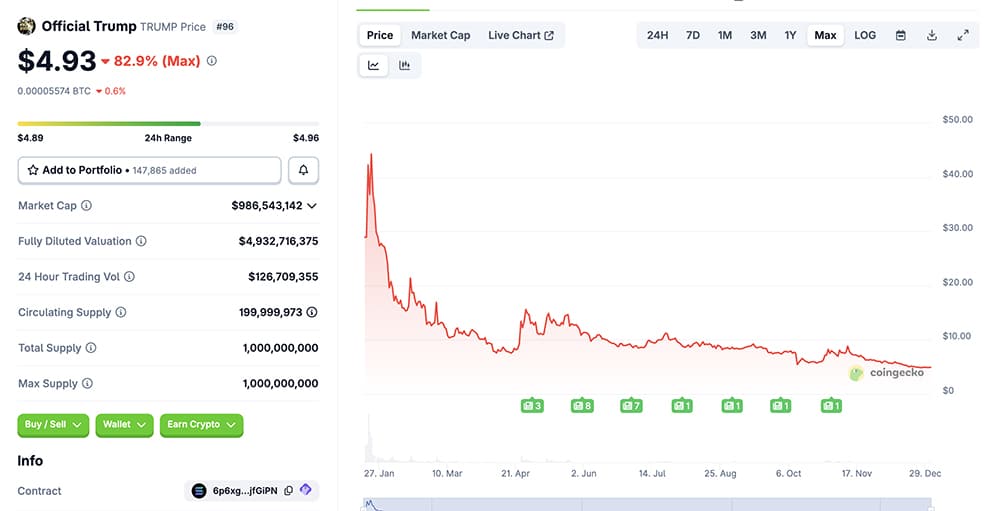

January opened with optimism and chaos in equal measure. The Trump memecoin launched just before the inauguration and briefly hit a top-15 market cap, only to age poorly weeks later. Regulators unexpectedly helped sentiment when the SEC removed SAB 121, easing the path for banks to custody crypto. Ross Ulbricht’s pardon was huge, symbolically, Binance Labs became YZi Labs with a sharper AI focus, and total crypto market cap pushed beyond $4 trillion for the first time.

(source – CoinGecko)

February reminded everyone how fragile the infrastructure still is. Bybit’s $1.4 billion exploit became the largest hack in crypto history. Argentina’s LIBRA token collapsed amid rug pull accusations. At the same time, Bitcoin price dropped over 20% on tariff fears, liquidating more than $2 billion. Solana inflation debates resurfaced, while CZ’s “Broccoli” dog meme somehow became a distraction amid the chaos.

Fraud that crushed this cycle:

Trump coin

Libra Coin (Remember when the President of Argentina rugged his coin and Threadguy went into hiding?)

10/10

Pump Fun extraction

ICOs?If anything, this cycle’s crime has been far worse than any previous cycle. https://t.co/yZBOBFUCbr

— Emperor Osmo

(@Flowslikeosmo) December 29, 2025

DISCOVER: 10+ Next Crypto to 100X In 2025

Crypto News 2025 in Review: Bitcoin and Ethereum Price Through the Cycle

March shifted the tone. The US announced a Strategic Bitcoin Reserve holding seized BTC alongside ETH, SOL, and XRP, a moment that changed how institutions viewed crypto in 2025. The SEC dropped its Ripple appeal, XRP caught a bid, and Binance’s “Vote to List” campaign showed how important community governance is in crypto.

The United States has established a Strategic Bitcoin Reserve.

Why it’s historic and what it means for all of us

pic.twitter.com/FEBsKObIS2

— Natalie Brunell

(@natbrunell) March 8, 2025

April hit hard. Trade tensions sparked a sharp sell-off, dragging Bitcoin price below $100,000 and wiping out more than $1 billion in leveraged positions. MANTRA collapsed nearly 90%, a reminder that hype and narrative don’t protect bad token design. Also in April, Coinbase’s Jesse Polak’s “tokenize everything” became the RWA mantra.

Momentum returned in May and June. ETH Pectra upgrade went live without drama, which somehow fueled adoption as Ethereum price responded with one of its strongest monthly candles in years. Meanwhile, Bitcoin price pushed past $110,000 as US states approved BTC reserves. Coinbase is joining the S&P 500, and Circle’s IPO added crypto legitimacy, while DeFi TVL recovered across major protocols.

Remember, in 2025 $ETH got 2 major upgrades

Upgrade #1 – Pectra (May 2025)

Cut costs and boosted throughput by scaling blobs for L2

Upgrade #2 – Fusaka (Dec 2025)

Pushed scalability and UX even further

These two upgrades made for a more stable, predictable settlement layer. pic.twitter.com/B7GaWx8tnk

— Sōka_Data

(@Soka_Data) December 29, 2025

July and August leaned euphoric. Bitcoin held strong at $120,000 level, SOL launched the first spot ETF, and Ethereum quietly turned upward. August saw Ethereum price peak just below $5,000 as DeFi activity exploded. CEX tokens like CRO and OKB ripped, perp DEXes like Hyperliquid went mainstream, and ASTER gained traction with BNB and CZ backing.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

What’s Next? Crypto Hard Reset?

September broke tradition by avoiding the usual dump, helped by rate cuts. October didn’t forgive complacency. Bitcoin price briefly touched $126,000, a new all-time high, before a government shutdown and tariff shock triggered $19 billion in liquidations during the October 10 flash crash. Solana’s ETF went live globally, Zcash’s privacy narrative returned, and weaker projects quietly disappeared.

RUMOR: Few major crypto funds blew up during the October 10th flash crash that wiped out $19 billion. They’re now being forced to sell Bitcoin and ETH to cover losses, which explains the relentless dumping. This also fits why Alt/Btc pairs are holding up well. pic.twitter.com/sB1pFdwIKd

— Ash Crypto (@AshCrypto) November 20, 2025

November and December 2025 closed crypto on a sobering note. Bitcoin fell below $80,000, DOGE and XRP ETFs launched, and prediction markets exploded. Ethereum’s Fusaka upgrade shipped, stablecoins surpassed $300 billion in market cap, and RWAs grew 185% despite a year-end slump that erased gains across majors.

Today, at the end of 2025, crypto feels more mature, if less forgiving. What comes next? Only God knows.

For now, Happy New Year!! Manifest this: ” We will come back stronger next year!”

DISCOVER: 10+ Next Coin to 100X In 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

US Targets Ethereum DeFi MEV Case Again as Prosecutors Fight Industry Input

US prosecutors pushed back against a DeFi advocacy group in a high‑profile Ethereum case, as they allegedly prepare for a retrial of two brothers accused of a $25 million MEV exploit.

But the headlines did not shake crypto prices in a big way, even if they added one more regulatory cloud over Ethereum and DeFi. For us onchainers, this case follows the trend of US authorities tightening their grip on how people build and use crypto tools.

Beyond a lawyer drama, the ruling will help decide where the line sits between smart on-chain strategies and criminal “exploitation.”

The Peraire-Bueno brothers, accused of laundering $25M from Ethereum, face a possible February retrial after a mistrial was declared due to jurors’ inability to reach a verdict. #Ethereum #Crypto #Fraud

pic.twitter.com/npoaroUO2L

— Abcrypt

(@abfxcrypt) November 12, 2025

Bitcoin Order Books Show Hidden Sell Walls Quietly Strangling Price Rallies

While we are waiting for another Bitcoin price rally, fresh data from CoinGlass shows Bitcoin trading inside a tight “box,” with thick sell orders stacked above the price and buy orders sitting below. It’s that ugly.

BTC has hovered in the high $80,000 for weeks while volatility shrank, even as headlines talk about institutional demand and new ETF flows. Under the surface, big traders and market makers now allegedly steer price action by parking large Bitcoin orders that cap every rally before it starts.

Cypherpunk’s $29M Zcash Bet Pushes Privacy Coins Back in Play

Something interesting is developing: Cypherpunk Technologies, a Nasdaq-listed treasury company backed by Winklevoss Capital, just bought another $29 million worth of Zcash (ZEC), lifting its stash to almost 290,000 coins.

ZEC, the privacy coin, now trades around $514 to $536 after jumping more than 800% in a year, while Bitcoin sits roughly 5% lower over the same period. This move lands in the middle of a heated fight over financial privacy, tighter regulations, and a quiet but real comeback for privacy coins.

So what’s next for Zcash? Why is Cyberpunk so in love with it? Does buying now mean we fall into the FOMO trap?

Crypto Perp DEX Wins The Crypto Narrative of The Year, Outpacing RWA and the Expected AI: Best Altcoin to Buy Next Year?

At the start of this year, most of us expected RWA and AI to dominate the crypto narrative. However, that didn’t quite happen. Instead, Perp DEX platforms took over trading activity and ended up shaping the 2025 narrative. While tokenized assets and artificial intelligence projects stayed theoretical, perpetual decentralized exchanges delivered something far more practical.

The shift was consistent, crypto Perp DEX usage kept growing even when RWA adoption slowed, and AI narratives cooled. By the time volumes became impossible to ignore, people had already made their choice. Execution speed, liquidity, and simple incentives run it fast; perp DEX is revolutionary.

2025 was really a great year for crypto with lots of narrative shaping the space.

Below is the list of narratives that cooked in 2025

1. Perp Dex e.g Hyperliquid, Aster, Lighter

2. Prediction market e.g polymarket, Kalshi, limitless

3. Privacy e.g Zama, octra, Miden

4.… https://t.co/Tcr0w1hsBA pic.twitter.com/bJY8SewdRa

— Rasta (@sodeindemueez) December 31, 2025

Read the full story here.

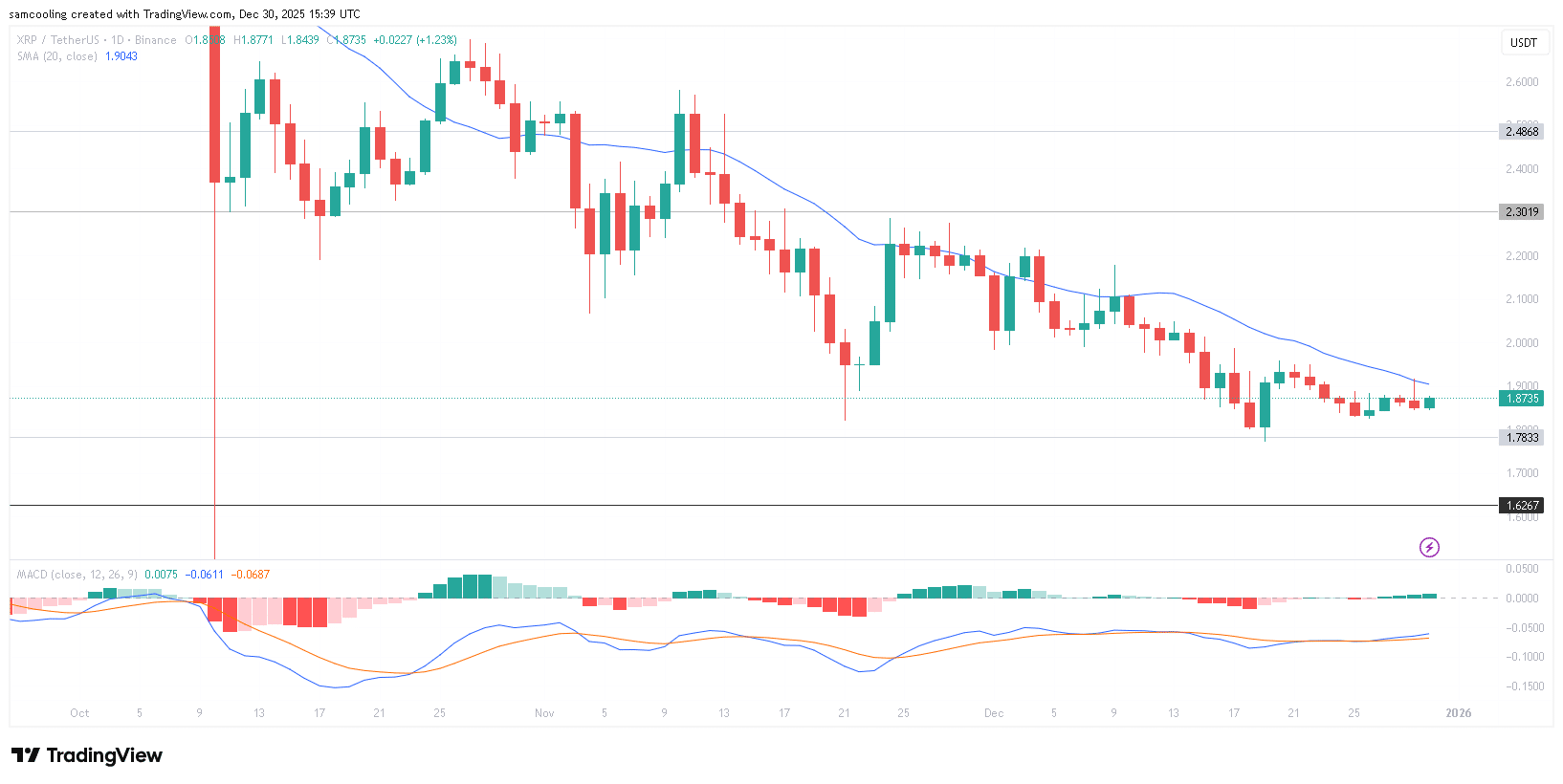

Standard Chartered’s $8 XRP Call: Bullish Signal or Hype Risk?

Standard Chartered’s head of digital assets research, Geoffrey Kendrick, just raised his XRP price target to $8 by 2026, implying a +330% jump from its recent $1.86 price. XRP USD barely moved on the headline, which shows that many traders still treat bank research as background noise, not a buy signal. But when a major global bank starts modeling XRP USD Price years out, it tells you something about how far crypto has moved into mainstream finance.

This call comes after Ripple’s long legal battle with the SEC ended and as fresh XRP exchange-traded funds (ETFs) draw in over $1Bn in the US. Kendrick ties his target directly to this new regulatory clarity and ETF demand.

But while Kendrick looks to 2026, the ‘now’ is messier. Even with record ETF inflows, the Moving Average Convergence Divergence (MACD) is beginning to show a bearish divergence. This means that despite the bank hype, the market might need to flush out the ‘weak hands’ toward lower support before Kendrick’s $8 story can truly begin.

(Source – TradingView, XRP USD)

The question is not “Will XRP price hit $8?” but “How should I treat bold forecasts like this without gambling my rent money?”

The post Crypto Market News Today, December 31: 2025 Retrospectives on Bitcoin Prices, Ethereum, and Major Altcoins appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Donald Trump, Live Updates, SEC

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]