Bitcoin is almost ending the year with chaotic and frustrating price actions. It now hovers at $20,000 below where it stood when Donald Trump officially became president, a gap that is sending BTC lower on a year-to-year basis for the 3rd time.

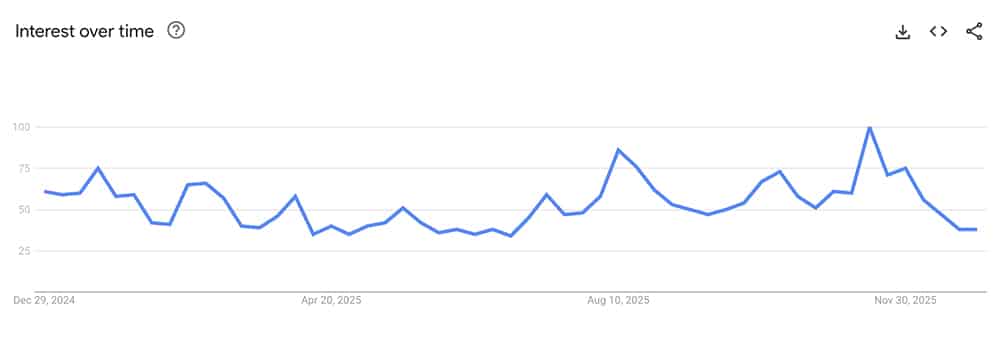

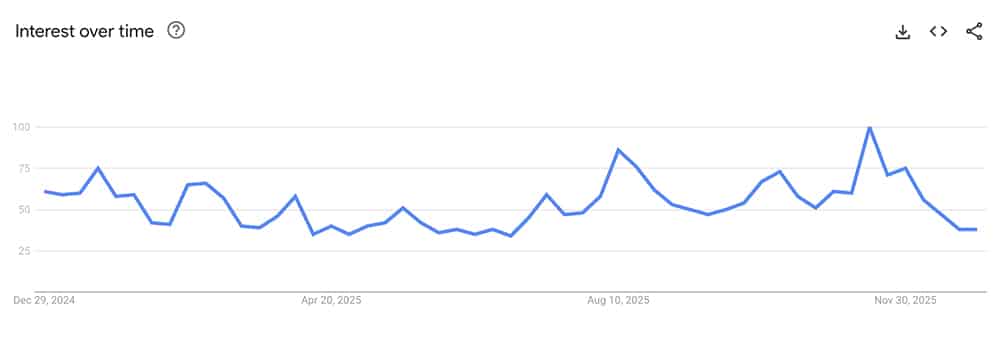

Right now, retail interest has cooled, with Google Trends showing searches for Bitcoin at their lowest point in a year. For many of us, this Bitcoin price is just unexpected.

(source – Google Trends)

However, not all assets are down or have a frustrating price chart like Bitcoin. Silver, following gold, has just recorded a breakout that hasn’t been seen in more than forty years. As we know, strength in precious metals has often signaled shifting liquidity conditions. When capital begins flowing into hard assets, the Bitcoin price has frequently followed, although not immediately.

Silver’s chart shows a familiar pattern with a long, boring base, slow upward movement, and plenty of giving up before the real move began. The current Bitcoin structure looks similar. This “painful” phase is uncomfortable, but it’s where momentum usually builds.

(source – BTC USD, Silver, TradingView)

DISCOVER: 10+ Next Crypto to 100X In 2025

Bitcoin Price and Liquidity Clues From Metals

Liquidity doesn’t always announce itself all at once; it shows up in places, and this time it’s at metals, long before it reaches crypto. The metals run is a sign that financial conditions are easing.

This lag is normal. Bitcoin price movements tend to frustrate us, as usual, right before the real run begins. Sharp pullbacks and sideways action are designed to wear down conviction, and the odds increase that Bitcoin price will eventually respond to the same macro forces.

The popular 4-year Bitcoin price cycle is widely accepted, but it’s based on only three historical examples. When longer economic cycles are considered, such as the 18-year real estate pattern or the Benner cycle, the timeline points toward 2026 as a major peak.

18-year real estate cycle says 2026=CYCLE PEAK

200 year old farmer chart says 2026=CYCLE PEAK

pic.twitter.com/WPkC11hMZe

— Quinten | 048.eth (@QuintenFrancois) November 2, 2025

Bitcoin and crypto behavior have consistently aligned with real-world business cycles. Extended US debt refinancing and post-pandemic monetary policy stretched the current cycle, delaying the explosive phase we expected after the last halving. That delay really explains why Bitcoin price has felt muted.

Encouragingly, leading indicators are beginning to stabilize. Past data suggests that as metrics turn up, Bitcoin price rallies usually begin. This December might be the beginning, not the end.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

A Quietly Bullish Setup

Recent derivatives data show cooling leverage, neutral funding rates, and reduced speculation. On-chain metrics also show steady accumulations by whales, even as sentiment hit fear.

–>

Crypto Fear and Greed Index

Fear

<!–

<!–

–>

Extreme

Fear

Fear

Neutral

Greed

Extreme

Greed

<!—->

From the technical point of view, Bitcoin continues to consolidate above key support as panic selling stopped, and we saw this as the price starting to stabilize. Once liquidity continues to improve, Bitcoin will likely follow metals higher, with 2026 shaping up as the cycle peak. We just need to remember, Bitcoin is here to stay to revolutionize the banking system.

The banks…will deprive the people of all property until their children wake-up homeless on the continent their fathers conquered…. The issuing power should be taken from the banks and restored to the people, to whom it properly belongs.” — Thomas Jefferson

DISCOVER: 10+ Next Coin to 100X In 2025

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

Viral ‘Bank Blowup’ Silver Price Rumor Hides $675M Margin Squeeze

A viral post claiming a “major US bank blew up” on a silver trade sent finance X into meltdown, but the real story sits in a boring notice from the CME. As the silver price spiked toward $72 while Bitcoin chopped sideways, a margin change quietly hit traders with an estimated $675 million extra collateral bill. That kind of mechanical shock matters for crypto too, because the same leverage physics that often wrecks silver traders can spill over into Bitcoin and altcoins.

REPORT: Major Bullion Bank COLLAPSES After Silver Shorts LIQUIDATED!!

Friday, we asked whether a large bullion bank massively short silver was about to be LIQUIDATED after being unable to make a margin call Friday afternoon. https://t.co/In3xNc2imt

Fast forward to… pic.twitter.com/d8p4DEAmbO

— SilverTrade (@silvertrade) December 29, 2025

Tom Lee’s BitMine Aggressively Adds 44k Ethereum, Now Controls 3.4% of Total Supply

Name one single good thing that Ethereum does. *crickets*. Well, regardless that hasn’t stopped the Ethereum Grayscale price from some positive news heading into 2026.

Bitmine Immersion Technologies is swallowing the

1.58%

Ethereum

ETH

Price

$2,969.41

1.58% /24h

Volume in 24h

$16.01B

<!–

?

–>

Price 7d

supply whole. Ahead of its January 2026 annual meeting, the firm revealed $13.2 Bn in assets, anchored by a 4.11 Mn ETH position that now represents more than 3% of global ether supply.

“Year-end tax-loss related selling is pushing down crypto and crypto equity prices, and this effect tends to be greatest from 12/26 to 12/30,” said Tom Lee.

At this pace, Bitmine is reshaping itsownership map for ETH and has even bigger plans for 2026.

Here’s what to know.

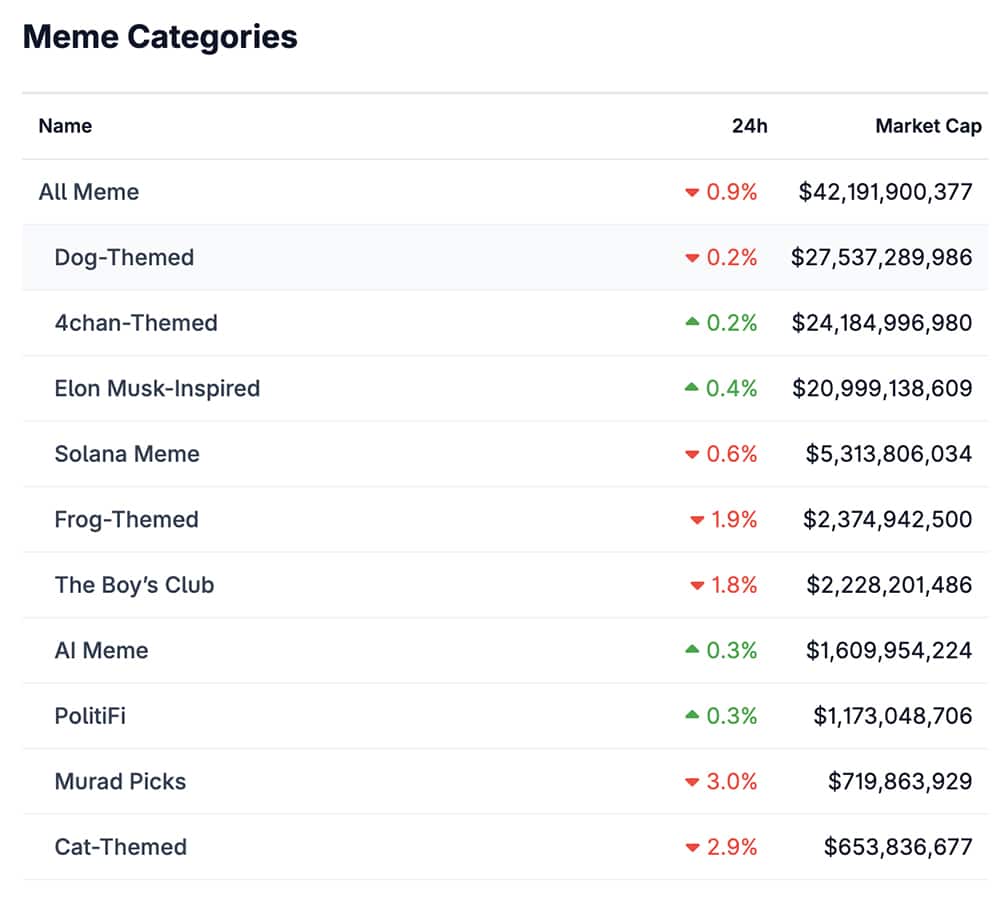

Dog Meme Coins Lead 2025: Here’s Why The Man’s Best Friend Is Still The Top Memecoin To Buy in 2026

As we approach the 2026 new year, dog meme coins remain at the forefront, and those to buy in 2025, even with dozens of new narratives popping up, the dog-related memecoin sector continues to command attention, liquidity, and loyalty. For us, the search for a memecoin to buy in 2026 still circles back to dog meme coins, just because they’ve already proven they can last.

Dog meme coins manage to stay relevant while other sectors fade. Markets change fast, meme hype comes and goes, yet dog coins keep showing up in every cycle. As a memecoin to buy in 2026, they feel less like a short-term gamble as they become a familiar presence people return to when trends burn out.

And yes, according to CoinGecko, the dog-themed sector is dominating with a $ 27 billion market cap in the $ 42 billion memecoin industry.

(source – CoinGecko)

Read the full story here.

The post Crypto Market News Today, December 30: Bitcoin Price Struggles To Bounce as Year Ends | Expecting 2026, What’s Next? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]