With the dollar in collapse, capital flees to proven stores of value. Wall Street heavyweights like Ray Dalio are sounding the alarm: cracks in the USD are spreading fast amid escalating global tensions, massive debt loads, and eroding trust in the world’s reserve currency. Markets moved instantly: gold smashed fresh ATHs near $4,800–$4,900 (with analysts calling $5,000+ in 2026 very much on the table), while Bitcoin dipped below $90,000, hovering around $89,000–$89,500 as risk-off vibes hit hard.

This isn’t random; it’s part of a macro rotation. Right now, that’s gold stealing the spotlight while BTC gets treated like a high-beta risk asset.

Ray Dalio: “Gold does well when other assets do poorly, it’s the perfect diversifier.”

Trust in fiat is eroding, so investors are shifting from fiat-denominated assets to hard assets.

Tariffs between allies and political tensions are only accelerating the erosion of trust. https://t.co/mABBwQRgb1 pic.twitter.com/w01VmO3ufa

— Oguz O. | 𝕏 Capitalist

(@thexcapitalist) January 21, 2026

DISCOVER: Why is Crypto Down Today? Trump Vows to Keep US the ‘Crypto Capital,’ But Bitcoin USD Drops to $90k

Why the Dollar Is Getting Rekt

The USD is the global savings account everyone used to park in, but trust is cracking and for good reasons. Dalio warns of “capital wars,” enormous vulnerabilities from $9T in foreign-held US debt, and policy risks that could accelerate de-dollarization.

US national debt just blasted past $38 trillion, with interest payments alone nearing $1T/year and set to eclipse Medicare soon. DXY (dollar index) is down ~8–9% over the past year, trading near 98.5–99 after heavy 2025 weakness: its worst stretches in decades.

Inflation ghosts, trade tariff threats (Greenland drama, Europe spats), and fiscal blowouts are forcing defense mode. When the dollar wobbles, hard assets moon and history show gold leads the charge.

Bitcoin, which many call “digital gold,” did not follow this time. Instead, it sold off toward $88k–$89k support as traders dumped risk assets first.

EXPLORE: Positioning for 2010-Level Bitcoin Returns With Bitcoin Hyper Despite Geopolitical Uncertainty

Dollar Collapse, Gold and Silver Steal the Show: Both Hit New ATHs

Gold and silver might feel boring, but this is exactly why they are winning. In moments of stress, large funds prefer assets with a long history and low daily swings.

Bitcoin still trades like a high-risk tech stock in the short term. When fear hits fast, traders sell it first. That dynamic showed up again as Bitcoin slid toward the $88,000 support zone.

This gap between gold and Bitcoin has appeared before. We covered similar dollar collapse fears earlier this month.

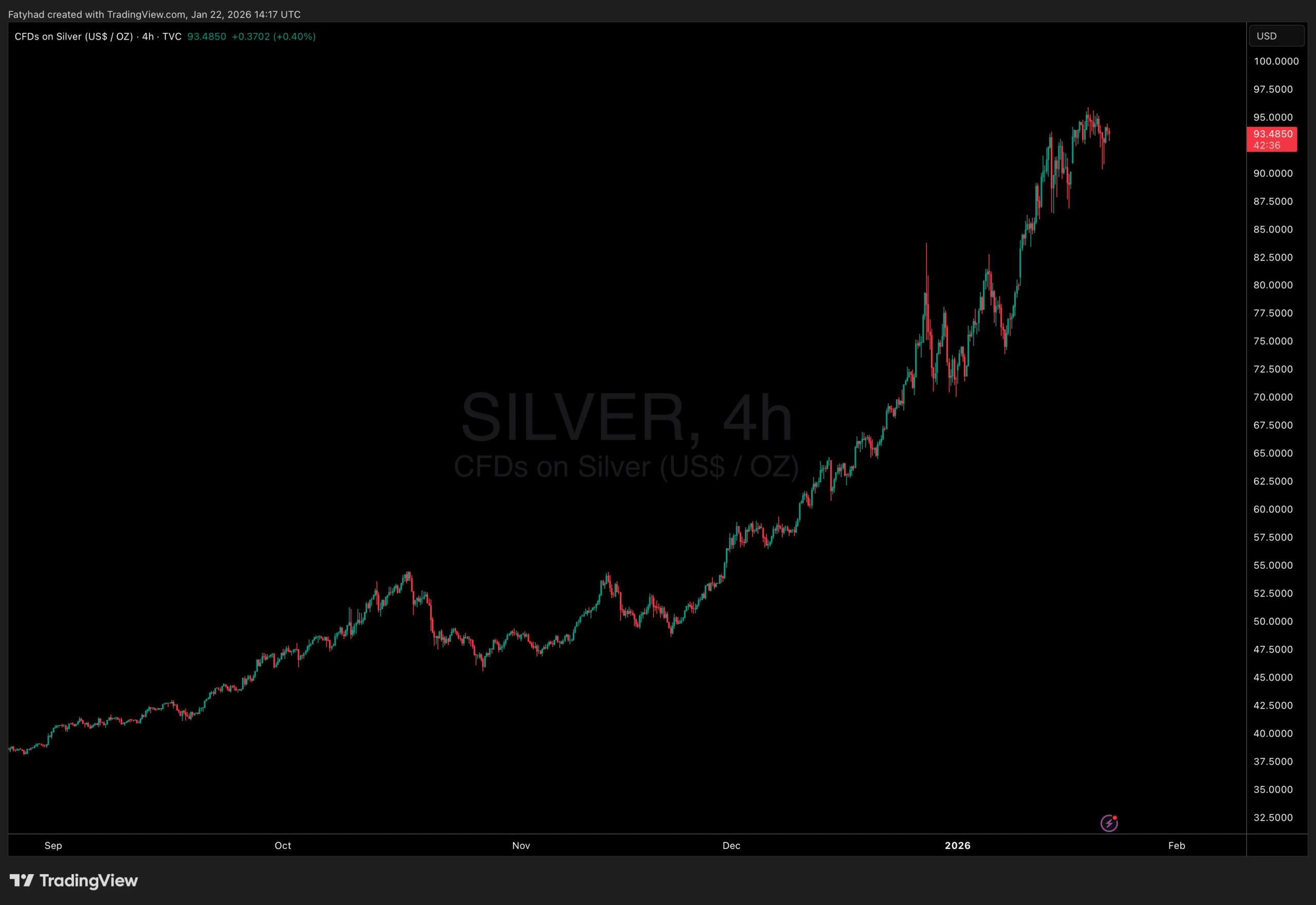

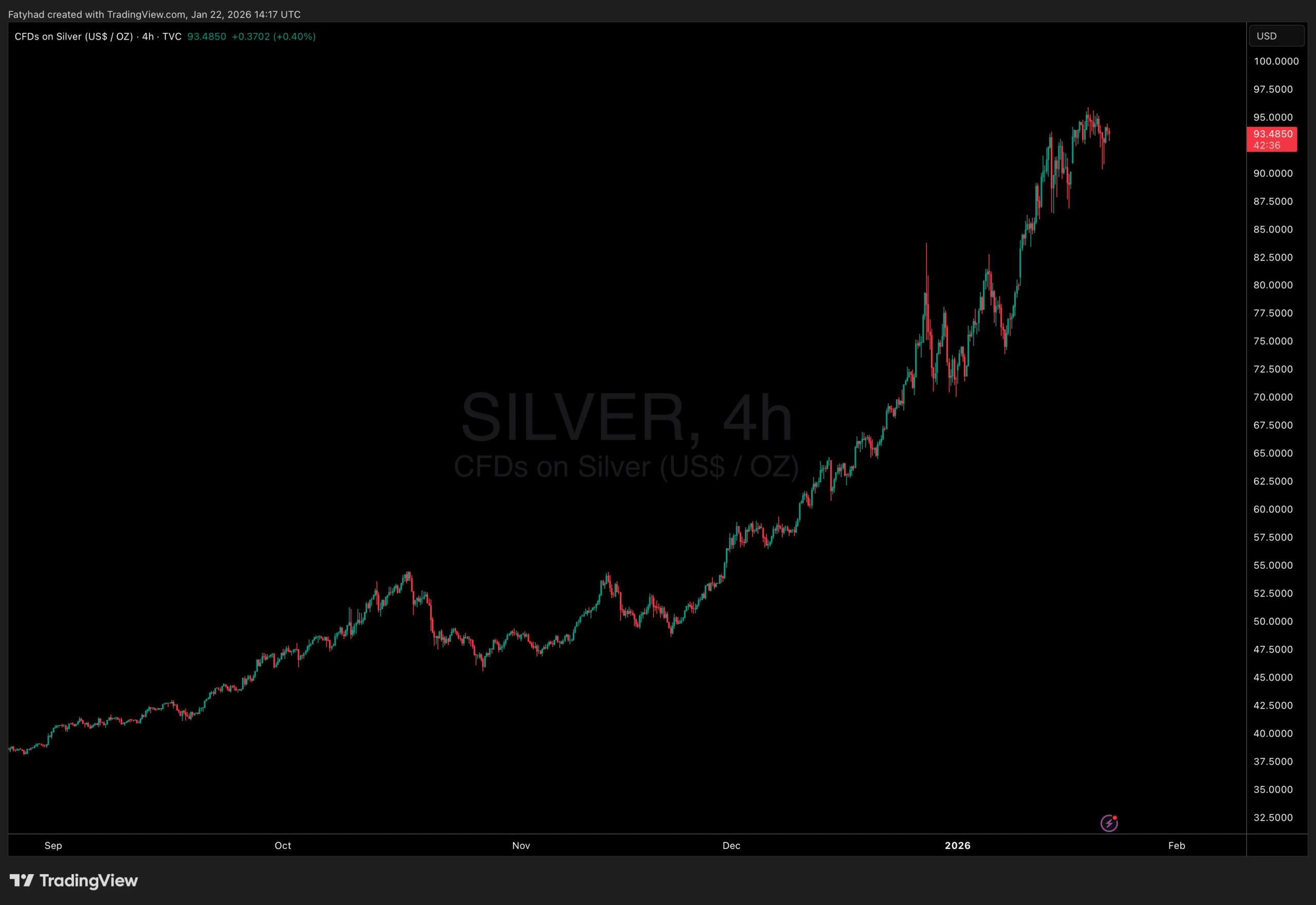

Silver trades near $93–$94 per ounce, up 25–30% year-to-date after a remarkable 140%+ rally in 2025. Key drivers include chronic supply deficits, surging industrial demand from solar, EVs, and AI sectors, plus strong investor safe-haven flows amid economic and geopolitical uncertainty, positioning silver firmly in a bullish trend with upside potential toward $100.

(Source: TradingView)

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Dollar Collapse Fears Rise as Gold Soars and Bitcoin Slips appeared first on 99Bitcoins.

Bitcoin (BTC) News Today, Bitcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]