Something subtle but important is happening beneath the market’s surface. The latest Federal Reserve liquidity injection, totaling $8.306 billion and settling tomorrow, is coming right at a moment when investors are already nervous, defensive, and are looking for a hint or two from the market.

The anxiety can be seen in price action. A fresh Gold ATH of $4,717 per ounce is proof, while Bitcoin USD falls to the $95,000 support zone. However, when the Federal Reserve injects liquidity, and Gold keeps its ATH behavior going, Bitcoin USD is preparing for a lift-off.

Federal Reserve, Liquidity, and Pressure

The New York Fed focused this operation on Treasury bills maturing between February and May, a narrow window with its own story. By injecting liquidity directly into banks, the Federal Reserve is making sure reserves stay ample without reopening the political fight around QE. It is a perfect example of expensive housekeeping.

In total, the Federal Reserve’s monthly liquidity injections now reach $55.4 billion. This liquidity is not screaming for stimulus, but we now know what excess reserves tend to do. They leak, slowly at first, then all at once as liquidity hell breaks loose.

BREAKING: Fed will inject $55.3 BILLION into markets over the next 3 weeks.Starting TUESDAY.

That’s not QE. That’s not rate cuts. That’s DIRECT LIQUIDITY.

$55.3B flooding into risk assets in 21 days.

And you’re still wondering if it’s “too late” to buy crypto?

Position.… pic.twitter.com/gg1l5ODHOe

— Gordon

(@GordonGekko) January 18, 2026

When it does, Bitcoin USD usually enters the picture. Reduced funding stress lowers borrowing costs and encourages risk-taking. Even conservative funds begin reallocating when cash feels abundant. Federal Reserve liquidity has a way of forcing capital to move; it’s always the same known mechanism.

DISCOVER: 10+ Next Crypto to 100X In 2026

Gold ATH Rings Alarm Bells

The push to another Gold ATH is likely driven by central banks, tariffs, and geopolitical pressure that keeps pressuring. This year, 755 tonnes of official gold (the amount of gold expected to be purchased by central banks worldwide in 2026, forecasted by J.P. Morgan) is to be symbolic and strategic.

(source – TradingView)

But, again, as Gold is blasting ATH after ATH, the narrative coexists with Bitcoin and its strength against the USD. Gold still attracts the first wave of fear-driven capital, and Bitcoin, historically speaking, usually catches the second wave, especially once investors start thinking about mobility, seizure risk, and portability.

People have such a short memory!

If you’re scared of $GOLD going up, you don’t understand how bullish this actually is.

The higher gold goes, the more powerful the eventual Bitcoin breakout will be.The gold trade always gets boring. When that happens, rotation begins and it… pic.twitter.com/dDX3ad4kry

— ₿εKα (@beka_web3) January 20, 2026

A Gold ATH often reflects mistrust in systems and currencies and doesn’t stop at bullion vaults. Federal Reserve liquidity only sharpens the contrast by reminding markets how quickly balance sheets can expand once again.

Will Bitcoin Follow?

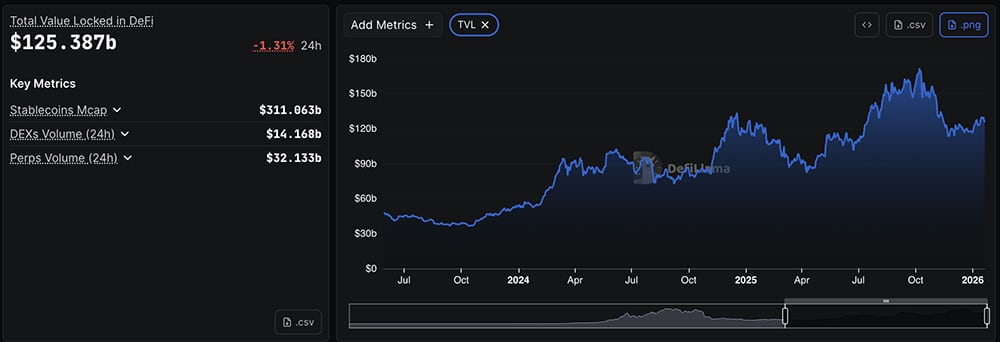

Recent on-chain data doesn’t look euphoric, and that’s the point. Liquidations are muted, but DeFi value locked is rising. Bitcoin USD dominance still sits close to 60%, on firm ground. These conditions have appeared before aggressive moves. We know that when the Federal Reserve injects liquidity, volatility stays compressed, and pressure accumulates.

(source – Defillama)

Dollar weakness over the past year also adds another layer. With the greenback down double digits, Bitcoin USD absorbs some of that release valve pressure. ETFs make the process cleaner, faster, and less ideological than past cycles. The institution’s drive is here this cycle.

Gold’s 2025-2026 run is already one of its strongest in decades, the strongest since the 1970 era. But Bitcoin USD doesn’t need to outperform gold immediately. It needs time, liquidity, and a reason. Right now, the Federal Reserve is supplying two of those three, liquidity and reason. Gold had more time, something that BTC will have in decades.

Will Bitcoin bounce against USD? Has the cycle ended? Gold may be at an ATH, so is Silver, but Bitcoin is coiling.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

End to ‘Rich Rule’ in Crypto: Vitalik Criticises DAO Governance

Ethereum co-founder Vitalik Buterin is criticising DAO governance, arguing that the current standard of token-based voting is failing the industry. While major governance tokens hold billions in market value, voter apathy has left protocols vulnerable to centralization by wealthy “whales.” This push for reform comes as participation rates in top DAOs frequently dip below 10%, signaling a need for new management structures.

A DAO (Decentralized Autonomous Organization) is like a company that runs on code instead of managers. Instead of a CEO making decisions, people who own “governance tokens” vote on changes. It sounds fair, but in reality, it works like a shareholder meeting where only the richest investors get a real say.

Buterin argues this “plutocratic” model, where money equals power, is dangerous. If a few large investors control the votes, they can push for changes that boost short-term profits but hurt the project’s long-term health.

Read the full story here.

Sandbox Crypto Quietly Returns: Metaverse Season Coming?

GameFi has enjoyed a mini-resurgence in recent days, with Axie Infinity (AXS) leading the charge, posting a +115% pump over the past week. Now, Sandbox crypto (SAND) is seemingly the next big mover, surging by +25% over the last 7 days, sparking talk of an incoming ‘Metaverse Szn’.

Recent price action for OG Metaverse tokens such as AXS

and SAND has been bullish and coming at a time when the crypto market is down -2% overnight, with BTC slipping -2.2% and ETH falling -3.5% since yesterday.

However, both AXS and SAND are still down -98% from their 2021 all-time highs, highlighting just how far the GameFi space has fallen since its explosion five years ago.

Read our full coverage here.

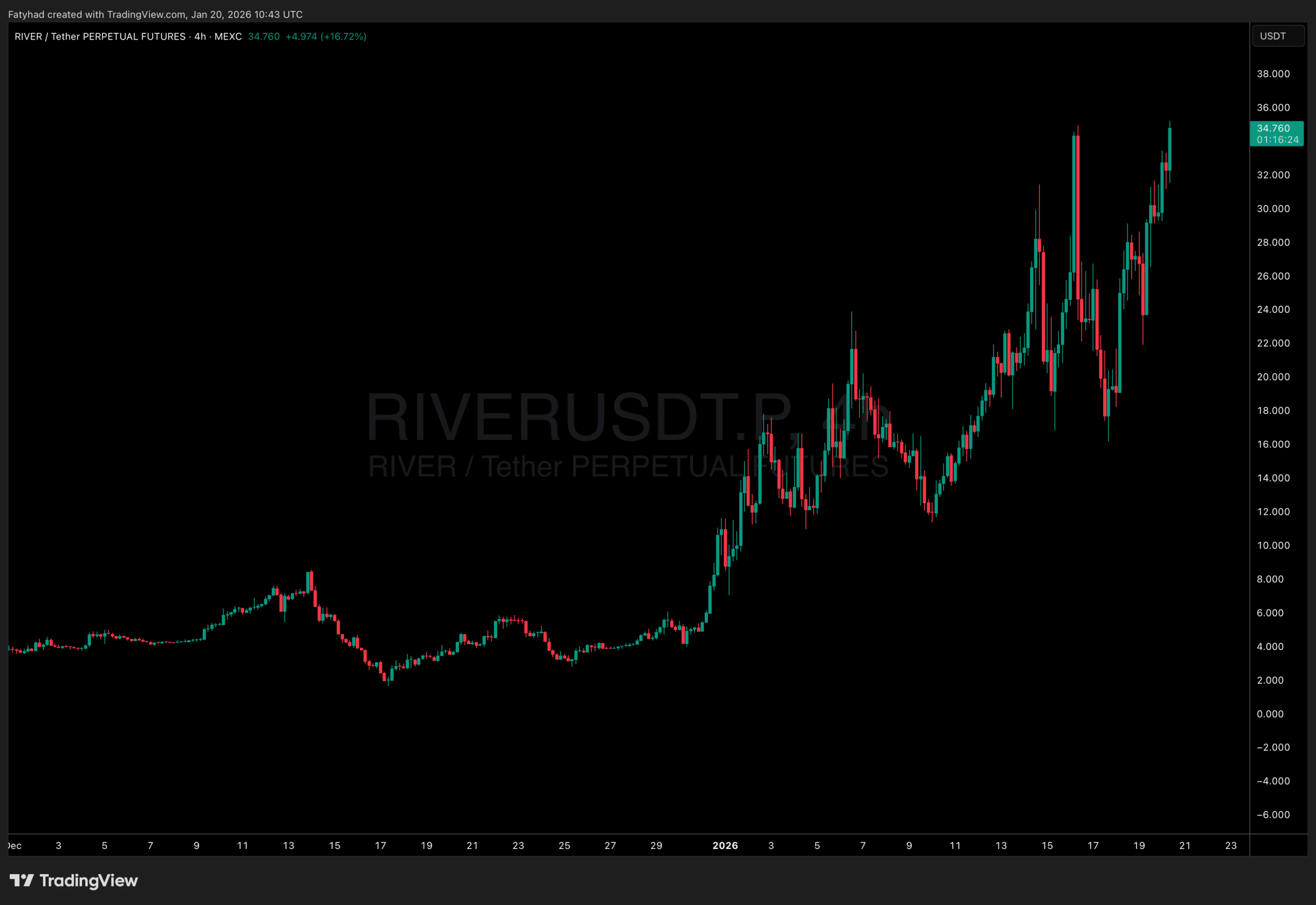

River Crypto Keeps Pumping Despite Token Unlock in 2 Days: Best Crypto to Buy?

In today’s crypto market, risk-off flows dominate as macro headwinds push capital toward safe-havens.

2.26%

Bitcoin

BTC

Price

$89,349.30

2.26% /24h

Volume in 24h

$41.26B

<!–

?

–>

Price 7d

has dipped toward the $90k–$92k zone amid fresh geopolitical drama: Trump’s escalating tariff threats against Europe over Greenland, potential trade war escalation, reactions to Nobel developments, and heavy rotation into gold (pushing new ATHs near $4,700) plus silver (surging past $95).

This broader dump has triggered liquidations and cooled altcoin momentum, yet

16.03%

River

RIVER

Price

$35.18

16.03% /24h

Volume in 24h

$35.91M

<!–

?

–>

Price 7d

keeps grinding higher, posting strong pumps even with a major token unlock just 2 days out. This kind of decoupling draws eyes to resilient plays like River alongside high-conviction presales such as Bitcoin Hyper (HYPER), a Bitcoin-tied Layer 2 built to ride BTC volatility waves. For degens hunting the best crypto to buy in this chop, could these two offer solid Bitcoin-beta exposure with upside in a potential recovery setup?

(Source: TradingView)

Read the full story here.

For crypto investors, the worst thing they can do is “trust” a founder to deliver. Whenever millions are raised in an ICO or from private investors, what happens within the next few weeks or months can define how the project evolves. While some raise millions and actually solve a problem, quickly posting a 100X ROI, most don’t.

Some of the best cryptos to buy, including Bitcoin, Ethereum, and Polygon, for example, have already rewarded early believers. Meanwhile, in Solana, less than 1% of all meme coins launched on top launchpads like Pump.fun die as soon as they are launched. The +99% of meme coin projects that die are often rug pulls. To put in the numbers, over $6Bn was lost to rug pulls in 2025 alone. A big chunk of this loss was due to the collapse of Mantra (OM) in April 2025.

🚨BREAKING 🚨

Mantra $OM has plummeted 92% in the last 24 hours

Erasing $6 billion in market value

Traders speculate this could be one of the biggest “rug pulls” in recent history$OM yikes…. pic.twitter.com/K2cuCDouEU

— Lego (brick by brick) (@onchainlego) April 13, 2025

And earlier today, Trove, a project that raised millions on Hyperliquid, rugged investors, forcing the TROVE crypto to plummet by -95%.

Read the full story here.

How Much XRP to Hold? XRP Drops Below $2 While Long-Term Holders Do the Math

This is one of the classiest questions in crypto: how much is enough? What is the magic number that will guarantee the financial freedom many investors are chasing? XRP holders are asking the same thing again as XRP price recently reached a new all-time high for the first time in… eight years? XRPL developer Bird asked a straightforward question on X: how much XRP to hold?

The engineer on the XRP Ledger stepped into this debate not long ago and pushed back on the idea that one fixed number can change everyone’s life. There is no universal target because people live very different lives. Crazy, right?

It’s a simple answer but perhaps some people need to hear it. The right amount depends on income, monthly expenses, and long-term goals. A portfolio that feels transformative in one country might only cover a few years of living costs in another. Bird also warned beginners not to copy figures they see online, where numbers often circulate without context.

Still, one number keeps appearing among XRP holders: 10,000 XRP. That leads to the next obvious question.

Read our full coverage here.

Axie Infinity AXS Crypto 120% in 7 Days: No More Frog Memes?

The start of 2026 is mixed. Top 10 coins like Solana and Cardano are stuck within tight ranges, struggling to shake off the weakness of Q4 2025. As is clear, buyers need to prove that they have what it takes to break out strongly, re-injecting momentum into what is otherwise boring price action.

For those who are looking beyond Ethereum, Polkadot, and some of the best cryptos to buy, there is an opportunity in promising altcoins. One of them is Axie Infinity, one of the first play-to-earn (P2E) games that commanded billions in market cap during the last bull cycle.

At press time, Axie Infinity is undoubtedly one of the top performers. In the last week alone, AXS, the native governance token of the P2E game, surged by +120% before cooling off to spot rates. Still, despite the slowdown, the uptrend remains, and buyers are upbeat, targeting Q3 2025 highs of around $3.

Read the full story here.

Ethereum Targets ‘Trust Me’ Wallets: Here’s What Changes in 2026

All public chains are by default “decentralized,” but the level of decentralization varies. How decentralized a chain like Ethereum, Bitcoin, or Solana always remains a topic of discussion. Nearly all debates center on node distribution but fewer on how wallets connect and “talk” with the underlying mainnet.

This is about to change. Starting with Ethereum, which hosts some of the best cryptos to buy, it will soon be possible for wallets to talk directly with the mainnet without relying on third parties.

According to Vitalik Buterin, one of the six co-founders of Ethereum, developers will soon phase out so‑called “trust me” wallets by 2026. Following this comment, the Ethereum price didn’t shift higher. Instead, sellers are still in control, but the second most valuable coin is soaking in selling pressure, maintaining ETH USDT above $3,100.

Read our full coverage here.

Tom Lee’s BitMine Causes $8Bn Ethereum Staking Traffic Jam

Ethereum staking system just hit a huge traffic jam thanks to the Tom Lee-backed Ethereum treasury firm, BitMine. The company has staked so much ETH

over the past few weeks that more than $8Bn now sits in line to be staked.

Since the beginning of 2026, Bitmine, which trades on the New York Stock Exchange, has locked up over 1.7M ETH, totaling more than $5.56Bn at current prices.

In total, BitMine owns 4.167M ETH, worth $12.99Bn, meaning it has locked up nearly 50% of the Ethereum it currently owns, effectively taking nearly 2M ETH out of circulation, per <a class=”general-link” href=”https://intel.arkm.com/explorer/entity/bitmine” target=”_blank” rel=”noopener”>Arkham Intelligence data</a>.

ETH is currently trading around $3,150, down -2.4% on the day, as the queue has stretched past 44 days. This is a sharp shift from late 2025, when exits, not entries, caused delays. This move fits a wider trend. Big institutions want Ethereum yield, not just price exposure, and nobody is moving faster than BitMine.

Read the full story here.

The post Crypto Market News Today, January 20: Federal Reserve Injects $8.3 Billion Liquidity as Gold Records Another ATH | Bitcoin USD Next? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Federal Reserve, Gold, Live Updates, Silver

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]