BTC and ETH both opened the day with a clear uptrend sentiment against USD, just before the expected 25bps rate cut, and the strength showed up early in the Bitcoin to Ethereum price relationship as well. With Bitcoin price inflows turning green and ETH USD bouncing sharply, the market finally looks like it’s regaining clear direction.

(source – Trending, X)

Fidelity and Grayscale reportedly recorded more than $250 million in Bitcoin inflows, which immediately improved confidence around their BTC USD positioning. ETH USD price followed the same momentum as Ether broke its three-month downtrend against BTC, a perfect sign for altcoin season.

BREAKING:

Fidelity and Grayscale have bought $250.1 million worth of Bitcoin.

Whales are loading up! pic.twitter.com/adrY6CjOZ7

— Ash Crypto (@AshCrypto) December 10, 2025

DISCOVER: 15+ Upcoming Coinbase Listings to Watch in 2025

BTC USD Inflows, Bitcoin Price Cycles, and the Path Toward a Supercycle: What to expect?

The latest institutional activity, for sure, helped lift the entire market, as CZ recently said crypto could enter a supercycle by 2026 during Bitcoinmena, pointing to US political shifts, Federal Reserve easing, and continued institutional adoption as the main catalysts.

BINANCE FOUNDER CZ JUST SAID #BITCOIN 4 YEAR CYCLE IS NOW DEAD AND WE ARE IN A SUPERCYCLE

HERE WE GO!! pic.twitter.com/Cxp58Dwc6I

— Vivek Sen (@Vivek4real_) December 9, 2025

The above comment landed at the same time Senator Cynthia Lummis confirmed she aims to release a draft of the long-awaited crypto market structure bill by week’s end so both parties and industry groups can review it before next week’s markup.

Senator Lummis on Crypto Market Structure Bill – draft by end of this week – let industry republicans and democrats vet it and go to markup week after.@SenLummis pic.twitter.com/ivWLDcud8I

— MartyParty (@martypartymusic) December 9, 2025

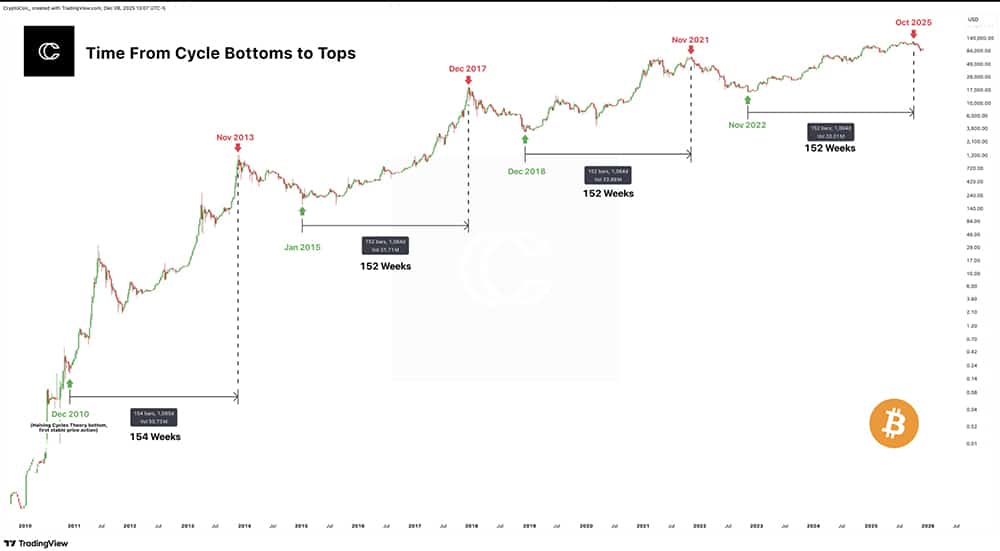

An analyst also highlighted that the stretch from Bitcoin’s November 2022 bottom to a projected October 2025 top sits at 152 weeks, almost identical to previous cycles. This also adds weight to halving-cycle theories.

(source – X)

These all while Argentina plans to allow banks to offer crypto services in 2026, 3 and a half years after Lionel Messi won the World Cup, and as soon as Bank of America recommended a 4% crypto allocation inside a balanced portfolio.

Seasonality is also giving us another bullish layer. Bitcoin and the market have shown positive performance eight times in the past ten Decembers, and the weeks heading into Christmas, often if not always, lean bullish. With less than 7% of the global population owning crypto, the long-term adoption curve still looks early enough to support additional major cycles.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

ETH USD Strength, BTC ETH Breakout: Altcoin Season Coming?

ETH broke out of its three-month downtrend against BTC, flipped resistance into support, and pushed higher, just an early sign for altcoin season. ETH USD gained more than 10% as about $150 billion was added to the total crypto market cap in a single day. Technical indicators on the BTC ETH pair showed RSI holding above 50 and a clean MACD positive cross on the daily chart.

(source – ETH BTC, TradingView)

DeFi ecosystem momentum is climbing, too, as total value locked climbed back to around $124 billion. And Coinglass data showed more than $300 million in short liquidations overnight, with the pumps creating most of the damage. This flush cooled leverage and gave long-term buyers more room to move the market without immediate resistance.

(source – Liquidation, Coinglass)

With Bitcoin price eyeing the $95,000 zone with building inflows numbers and ETH USD targeting $3,500, bulls is holding the advantage. Altcoins may rotate next as liquidity spreads. Holiday season strength, policy developments, and rising TVL all point to continuation. As long as resistance levels don’t trap newly rebuilt short positions.

We are bullish, we are happy!

DISCOVER: 10+ Next Crypto to 100X In 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

Michael Saylor’s Big Bitcoin Idea: Digital Credit Built Upon Digital Capital

Speaking at the Abu Dhabi Finance Week on 10 December 2025, Michael Saylor said that Bitcoin is indeed digital gold and that once everyone understands it for what it is, the global credit is will be built on it.

According to Saylor, Strategy is currently acquiring nearly $500 million to $1 billion worth of Bitcoin per week and has managed $60 billion worth of equities in the past 14 months, becoming the fifth largest treasury in the S&P universe, well on its way to becoming the largest in about four to eight years, given the same pace of accumulation continues.

According to him, the entire cabinet of the US, along with President Donald Trump, and financial as well as non-financial regulators, backs this idea. Moreover, major banks in America, including skeptics such as JPMorgan, Bank of America, etc., have started to warm up to the concept and are now extending credit on Bitcoin and Bitcoin derivatives.

JUST IN: Michael Saylor says he got approached by all the major banks recently to launch #Bitcoin products and services.

Banks are here

pic.twitter.com/AcHQRCaP7y

— Bitcoin Magazine (@BitcoinMagazine) December 9, 2025

With all these Bitcoins amassed, Saylor says that Strategy has created the world’s first credit vehicle, generating $800 million in dividends, paying about 10% dividend rates by either selling equity, Bitcoin commodity, or derivatives in the public markets.

Read the full story here.

What to Expect From FOMC Meeting Today: 3 Expert Predictions For Powell Speech and More

Here are three predictions to expect from the FOMC meeting today. First ask yourself: are they pumping

1.48%

Bitcoin

BTC

Price

$92,701.76

1.48% /24h

Volume in 24h

$44.10B

<!–

?

–>

Price 7d

today so they can dump it tomorrow after the FOMC meeting?

Almost all economists are expecting a 25 basis point cut, yet nobody’s confident it will feel bullish. Futures pricing via CME’s FedWatch tool shows roughly 85-90% odds of a quarter-point cut, the third of the year, with the fed funds range likely dropping again from the current 4.75–5.00% band.

The catch is the tone. This is shaping up as a classic “hawkish cut” moment:

(Source: Polymarket)

Inflation is cooling, but not enough for Jerome Powell to declare victory. Core PCE is still running above the Fed’s 2% target on a 12-month basis.

So the Fed can justify easing, but it will not want markets to party like 2021 again. Here are three predictions you need to know.

Tron Completes Revolut Link, As Justin Sun TUSD Drama Continues: TRX Price Prediction as Alt Season Beckons?

The Tron and Revolut setup goes live just as Justin Sun and his TUSD situation and drama heat up again, and we are left figuring out what it will be for the TRX price next.

The Revolut integration is, to be candid, straightforward enough; users can now stake Tron without messing with extra platforms. Revolut itself is reaching 65 million users across Europe, a massive funnel of everyday people who now get the ability of Tron staking, quick remittances, and easy swaps baked right into an app they already use for regular banking.

Something real just shifted in crypto infrastructure.

TRON has officially integrated with Revolut and that unlocks a new lane for adoption.

Starting now, Revolut users across Europe can stake TRX in-app with zero platform fees.

They can also send stablecoins and make… pic.twitter.com/H3BoXXmcze

— Maria (@MariaOnchainDev) December 10, 2025

0.82%

TRON

TRX

Price

$0.2803

0.82% /24h

Volume in 24h

$734.57M

<!–

?

–>

Price 7d

is known for being both cheap and fast, which also plays well here. Justin Sun has been cheering the launch, calling it a win for bringing crypto into “real” financial rails across 30 markets. The whole thing feels more practical, and that’s exactly what matters.

However, the headlines around court orders and frozen assets have added an unexpected layer of bedlam. Even if the early reaction we see from the Tron Revolut rollout is a positive step, especially with the altcoin season starting to form in the background.

🚫 Dubai court freezes $456M linked to TrueUSD reserves

The missing funds that forced Justin Sun to bail out TUSD have now been frozen by Dubai’s Digital Economy Court. Techteryx claims the reserves were illegally moved via First Digital Trust into illiquid investments in Dubai pic.twitter.com/HVnSLRIbaV

— Telbloggram (@Telbloggram) November 13, 2025

Read the full story here.

‘Not Our Job’ SEC Crypto BTFO ICOs: ??

SEC crypto guidance has finally shifted, and it could unleash the most significant ICO resurgence since 2017. After years of regulatory bottlenecks, lawsuits, and fear-driven fundraising environments, U.S. innovators now have a realistic path to launch tokens without SEC interference.

With markets preparing for the 2026 cycle and early-stage investors hunting for asymmetric upside, two standout presales are rising to the top. But first, here’s why the SEC’s new stance is igniting the revival.

Read the full story here.

PIPPIN Slams 77% Gain, WIF Price Fires Up Hopes: But is 10% FET Price Pump the Smart Money Move?

The market is moving once again as volatility returns and traders hunt for the next momentum play. With AI tokens surging, Solana memes rallying, and fresh liquidity entering the market ahead of the December FOMC catalyst, many investors are wondering where the next big move will pop up.

Today, all eyes are on PIPPIN, WIF, and FET – three very different tokens showing powerful performance. In this breakdown, we will explore the PIPPIN price explosion, rising confidence in WIF, and whether the FET crypto AI powerhouse rally is a genuine smart-money opportunity, before closing with a standout presale play.

Read the full story here.

The post Crypto Market News Today, December 10: Green BTC USD Inflows with ETH to Bitcoin Price Broke Downtrend with 12% Rally as Short Positions Wiped Out appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Crypto Liquidation, cz binance, Fidelity, Grayscale, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]