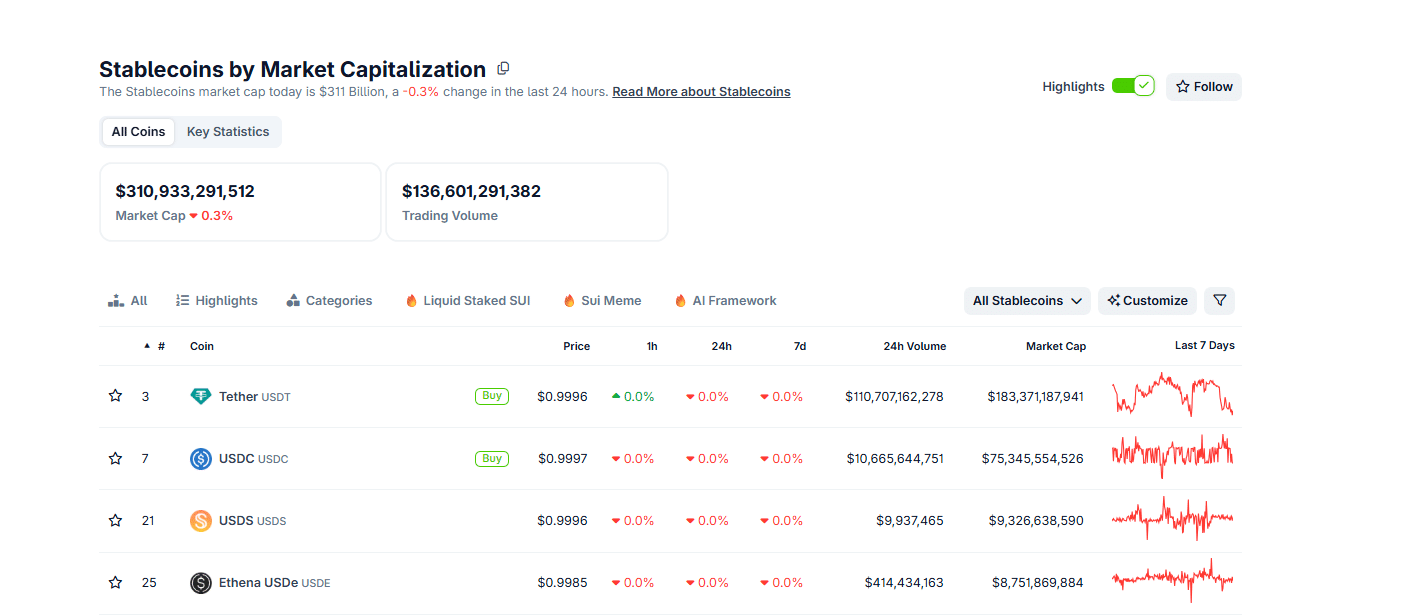

Tether is the lynchpin of crypto. Yes, there are many controversies, specifically those questioning its reserves. Still, time and time again, even during extreme market volatility, including the destruction that happened on October 10, USDT stood firm. Not so much can be said about new entrants, mainly USDe, which temporarily depegged.

As of November 7, USDT is still the largest stablecoin by market cap and trading volume. With over $183Bn of USDT in circulation, it is easy to say Tether, which is the issuer, determines the pulse of crypto.

(Source: Coingecko)

Backing this top stablecoin are multiple assets, mostly US Treasuries, at over 74%, when writing. With over $135Bn worth of treasuries in its balance sheet, Tether ranks as the 17th largest holder globally, ahead of some nation states, including South Korea. Their massive holding of US Treasuries also generates most of their profits via yields.

DISCOVER: 10+ Next Crypto to 100X In 2025

Tether is Gold-Hungry

Besides US Treasuries, Tether is also an investor in gold. When writing, and looking at their monthly attestations, last released on September 30, the stablecoin issuer holds nearly $13Bn of gold, representing roughly +7.1% of its reserves.

If Tether continues to buy more gold, it may also rise in the rankings as one of the largest gold holders, surpassing some sovereign nations. Part of this stash goes toward backing xAUT, its gold-backed tokens.

Tether is gold-hungry, and it shows. They already own over +50% of Elemental Altus Royalties and hold another +4.6% of Metalla Royalty.

Both of these companies are gold royalty companies. Owning their shares provides immediate exposure to mining production but without the dirt of operational risks. Every time miners deliver pure gold, they earn royalties on output.

DISCOVER: 9+ Best High-Risk, High-Reward Crypto to Buy in 2025

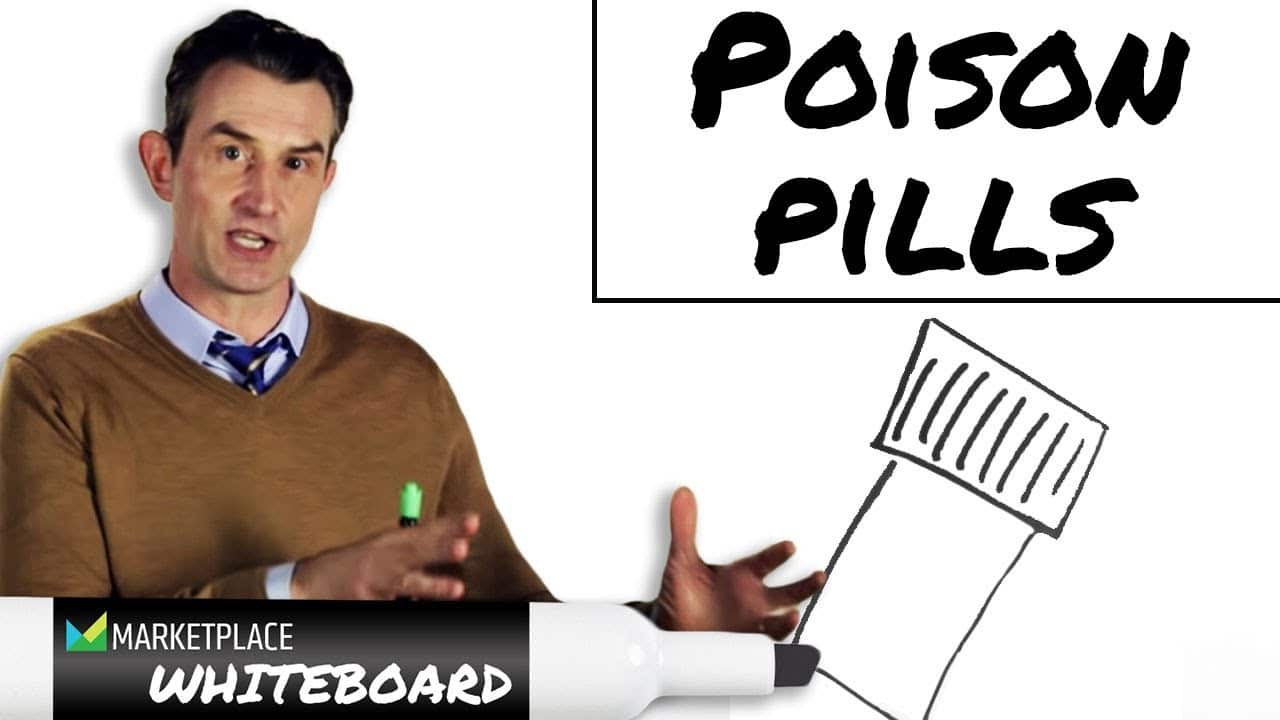

GROY Gold Royalty Company Offers The Poison Pill, Will Tether Take It?

Tether’s attempt to increase its share of Gold Royalty Corp is, however, facing a roadblock.

Yesterday, the Vancouver-based precious metals royalty company, boasting a portfolio of over 200 royalties and streams, all of them focused on gold, is aware of Tether’s increasing need for gold.

Tether disclosed an initial +8.1% stake in GROY shares, bought via open-market purchases, in late October 2025. Earlier this month, the stablecoin issuer pushed its holdings above +10%, triggering regulatory disclosure requirements. Subsequently, their aggressive buying of GROY shares raised eyebrows about possible control ambitions.

The rapid accumulation of shares, evidently, points to a potential takeover.

Possibly aware of their plan, GROY’s board acted.

On November 5, the days after Tether bought +10% of the company, they adopted the Shareholder Rights Plan, or the poison pill, aimed to “protect investors.

THE TABLES HAVE TURNED

Just days after Tether lifts its stake in Gold Royalty Corp ($GROY, ~$600M mkt cap) above 10%, the company fires back & adopts poison pill (“shareholder rights plan”) that would dilute everyone by roughly 50% if any investor (read: Tether) crosses the 15%… pic.twitter.com/jrrisuKSXJ

— matthew sigel, recovering CFA (@matthew_sigel) November 6, 2025

The plan took effect immediately and will remain in effect for three years, unless extended or redeemed earlier by the board.

With this pill, Tether can increase its holdings to +15% but any attempt to push past this limit will require board approval.

If Tether pushes forward and buys GROY shares nonetheless, increasing its ownership beyond 15%, then other shareholders will have the right to buy additional GROY shares at a steep 50% discount to market value, effectively flooding the market with new shares. This dilution will halve Tether’s voting power and economic interest.

Tether has not, officially, signaled a full buyout. Still, considering its investment in other gold royalty companies, they could be interested in consolidating what’s otherwise a fragmented sector.

DISCOVER: 9+ Best Memecoin to Buy in 2025

Tether USDT Wants More Gold But GROY Is Offering The Poison Pill

- Over $183Bn of USDT in circulation

- Tether backs USDT mainly with US Treasuries and a small percentage in gold

- Tether owns a controlling stake in Elemental Altus

- Will they take over GROY?

The post Tether USDT Wants More Gold But GROY Is Offering The Poison Pill appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Gold, groy, Tether, USDT

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]