Rabobank: Gold Confirms The World Has Passed The Fiscal Event Horizon

By Benjamin Picton, Senior Market Strategist at Rabobank

France is once again engulfed in political crisis following the resignation of Prime Minister Lecornu just hours after his cabinet was sworn in. Lecornu lasted less than a month in the job, a tenure that makes Liz Truss look like Lord Liverpool. Jordan Bardella, President of the right-wing National Rally, has urged President Macron to dissolve the National Assembly and call fresh elections.

Lecornu’s is the third French government to collapse in the last 12 months. Former EU Brexit negotiator Michel Barnier lost the Premiership in December following failed attempts to pass budget measures and Francois Bayrou similarly lost a no-confidence vote last month after his attempts to rein in France’s runaway deficit were rejected by parties on the left and right.

French 10y OAT yields rose 6bps to 3.57% while 10y Bunds were comparative outperformers with yields rising just 2bps to 2.72%. The 10y OAT spread of 85bps is now 2bps wider than the spread between 10y Italian bonds and the equivalent Bund, highlighting Italy’s newfound status as an island of (comparative) political stability on the continent.

Equity markets took a similarly dim view of the latest evidence that France lacks the political capacity to pull the country out of its fiscal nosedive. The Euro Stoxx 50 fell by 0.41% to underperform all of the major American indices as well as the Nikkei, KOSPI, CSI300, ASX200 and TAIEX. The picture was even gloomier when drilling down into the performance of the CAC 40, which recorded a 1.36% fall on the day while the German DAX closed flat.

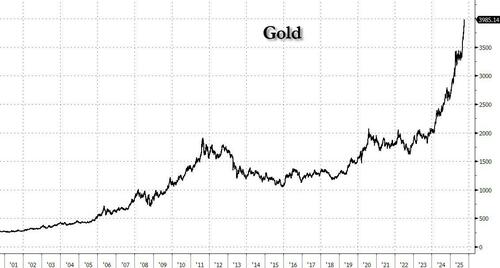

The Euro fell by 0.26% to 1.1711 while Sterling – presumably operating on the ‘least dirty shirt’ theory of comparative value (though, the British public finances and political apparatus are little better than the French) – rose slightly to close at 1.3485. The Dollar and gold were the big winners on Monday. The DXY index gained 0.39%, while gold rose another 1.92% to close at (another) all-time high of $3,960/oz and USDJPY gapped higher following news that Abe-acolyte Sanae Takaichi had won the LDP leadership race in Japan.

The S&P 500 also hit a fresh all-time high to close at 6,740 as chipmaker AMD surged 24% on news that it had struck a multibillion-dollar partnership with OpenAI to build AI data centers with AMD chips. The deal involves OpenAI purchasing 6 gigawatts worth of chips and also receiving warrants for up to 160 million AMD shares if certain milestones for chip deployment are reached. This kind of circularity is becoming a feature of the AI frenzy, with NVIDIA (the market leader in AI chips and AMD’s main competitor) recently announcing a $100bn investment in OpenAI, the proceeds of which would be used to buy – you guessed it – NVIDIA chips.

Given the confluence of events and price action in gold and equities on Monday, perhaps some European investors have been reading Bloomberg and are now adopting the ‘Turkish portfolio’ of 50% gold, 50% equities as their formerly developed markets behave more and more like an emerging market?

AI sceptics (including yours truly) have regularly made comparisons to the ‘irrational exuberance’ that characterized the dotcom boom and subsequent bust. There are many similarities, whether it be the classic ‘new era thinking’ (usually a harbinger of impending doom), the techno-optimism or the eyewatering P/E levels. But there are differences, too. This time around the companies driving the boom do actually have earnings, and perhaps it makes sense to pay very high valuations to get a slice of those earnings if you are afraid that your country has passed the fiscal event horizon and the only way out is a general inflation via debasement of the currency that will obliterate the value of your wages and savings.

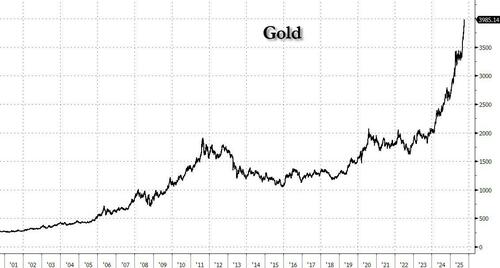

The gold price (and arguably stock prices, and arguably house prices in many markets) is sending a signal that such a general inflation is already underway. Some might quibble with that characterization, pointing to EM central bank buying as a the main driver of the gold price rally, but why are those central banks buying gold in the first place? Does the breakdown of the liberal globalized trading system that drove inflation lower and lower for decades presage lower, or higher, inflation in the future? Perhaps the answer to that question explains why the 10y Treasury yield busted through the top of a 40-year trend channel in 2022 and has stayed up there ever since?

Signs of breakdown of the globalized trading system are not hard to find. Fears have been stoked in Australia after China’s state-owned China Mineral Resources Group placed a ban on Dollar-denominated purchases of iron ore from Australia’s BHP. Australian politicians have sought to downplay the action as a “commercial matter” related to pricing, but the real tell is that iron ore shipments denominated in Chinese Yuan continue to flow.

The international market for iron ore is monopsonistic – China is the only buyer of scale because China produces ~54% of global steel output. The market has also, historically, been oligopolistic, with Australia and Brazil being the two suppliers of scale who could feed China’s insatiable demand for the raw material. However, that is changing as Chinese demand moderates and supply sources are diversified by Belt and Road-backed (not a coincidence) Simandou mine in West Africa coming online. Those factors have seen China gain market power over Australia, and it appears that China is now using that market power to pressure Australia to receive payment for what is (by far) it’s most important export in CNY, rather than USD.

This episode is likely to be much larger than a commercial disagreement between a mining company and an importing company (whose state-backed nature should not be forgotten). Xi Jinping was clear at last month’s Shanghai Cooperation Organisation summit that he wanted to increase the global role of the CNY, and thereby chip away at the USD’s position as the world reserve currency. That would weaken the US’s ability to use the Dollar as a weapon by applying sanctions, increasing the cost of Dollar-denominated borrowing or cutting other countries out of the SWIFT payments system.

A logical next step could be for Chinese exporters to require Australian importers to pay for manufactured goods in CNY, rather than Dollars. Using China’s market power as a major exporter of goods would create demand for the currency that they are offering in exchange for Australia’s exports, and pry Australia further away from the Dollar. Of course, the United States does not want this to happen and neither does Australia, because it wants Dollars to pay for its imports from every other country and also to pay for the AUKUS submarines that it has committed to buy from the United States.

Is China about to tell the Land Down Under that it is time to choose? We’ve been warning of those sorts of risks in this missive for years now. Economic statecraft (not collaborative free trade policed by the WTO) is the law of the jungle, and it’s eat or be eaten.

Tyler Durden

Tue, 10/07/2025 – 11:45

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]