The crypto market remains steady but cautious ahead of the September 16–17 Federal Reserve meeting. Investors are closely watching for signals on monetary policy, with many asking the same question: what is the best crypto to buy in this environment?

Bitcoin BTC ▼-0.29% is trading around $115,700 after briefly dipping under $115,000. On the daily chart, BTC has reclaimed the $112K support and now faces resistance near $120,000. A breakout above this level could open the path back toward $124,000, while failure to hold $112,000 risks a retest of $108,000.

Ethereum ETH ▼-2.13% is hovering above $4,600 after a small dip, while altcoins remain under pressure.

Sector-wide losses have been led by GameFi (-3.03%), DeFi (-2.21%), and meme coins (-2.85%).

DISCOVER: Did Dogecoin ETF Just Change Everything For Meme Coins?

Best Crypto To Buy Right Now: Bitcoin Holds $116K, Altcoins Wait for ETF Catalysts

Beyond price action, several upcoming macro and regulatory events could shape crypto’s next big move. From the Federal Reserve’s September meeting to critical ETF deadlines and stablecoin policy shifts, these decisions will determine whether capital flows back into Bitcoin and altcoins, or stays on the sidelines:

- FOMC Meeting (Sep 16–17): Markets price in an 88% chance of a 25 bps rate cut. This cut could boost Bitcoin and risk assets.

- October ETF Deadlines: SEC decisions on

XRP ▼-1.34%,

SOL ▼-2.68%,

LTC ▼-1.49%, and

ADA ▼-2.90% ETFs may validate altcoins as commodities, potentially sparking inflows similar to Bitcoin’s ETF boom.

- Stablecoin & Regulatory Shifts: Circle’s trust bank application and Spain’s early MiCA rollout could reshape liquidity and compliance across crypto markets.

The FOMC meeting remains the near-term spark that could set the tone for the next leg of the market.

MetaMask Launches Stablecoin mUSD on Linea

MetaMask has introduced its own stablecoin, MetaMask USD (mUSD), built on the Linea blockchain. The new token is designed to integrate seamlessly into MetaMask’s ecosystem, offering users strong liquidity, low-cost fiat onramps, and native support for transactions via MetaMask Swap and Bridge.

In addition, mUSD can be used with the MetaMask Card, enabling payments at more than 150 million merchants worldwide. By combining stable value, ease of access, and broad usability, mUSD aims to strengthen MetaMask’s role as a key player in digital finance and expand adoption of decentralized applications.

MetaMask USD ($mUSD) is now live.

The best way in and out of crypto is here. pic.twitter.com/h6zSUao7Ka

— MetaMask.eth

(@MetaMask) September 15, 2025

Base May Explore Network Token, While Bitcoin Hyper Revolutionizes BTC with Layer-2

Jesse Pollak, head of the Base ecosystem, recently revealed at BaseCamp that the Ethereum Layer-2 network is exploring the possibility of issuing its own token. While Coinbase and Base have repeatedly denied plans to launch a token, the new approach signals a shift in philosophy. Pollak emphasized that a Base network token could accelerate decentralization and expand opportunities for developers and creators in the ecosystem. “There are no definitive plans yet, but we’re exploring it,” he said, highlighting the potential for broader adoption and innovation on Base.

We’re exploring a Base network token.

It could be a great tool for accelerating decentralization and expanding creator and developer growth in the ecosystem.

To be clear, there are no definitive plans. We’re just updating our philosophy. As of now, we’re exploring it. https://t.co/BK3asbMpar

— Brian Armstrong (@brian_armstrong) September 15, 2025

Meanwhile, Bitcoin is facing its long-standing limitations: slow transaction speeds and high fees during peak periods. For this reason, Bitcoin Hyper (HYPER), is introduced as a new Layer-2 solution designed to supercharge BTC.

By bundling transactions off-chain and settling summaries back on Bitcoin, Hyper dramatically increases speed and reduces fees. Using Solana Virtual Machine (SVM) technology, it also introduces smart contract functionality, enabling DeFi apps, NFTs, and games on Bitcoin.

HYPER’s Canonical Bridge ensures wrapped BTC is fully redeemable 1:1, allowing fast and cheap transactions without compromising security.

The presale has already raised over $16M, with staking rewards up to 71%, drawing significant whale interest. With Bitcoin Hyper, BTC could finally move from a store-of-value to a high-utility, programmable financial asset, opening new possibilities for developers, investors, and the broader crypto ecosystem.

As Base considers its own network token and Bitcoin gets a Layer-2 upgrade, 2025 could mark a pivotal year for blockchain innovation.

Morgan Stanley Tips XRP as Next Crypto to Explode: XRP Price Prediction Amid $3 Break

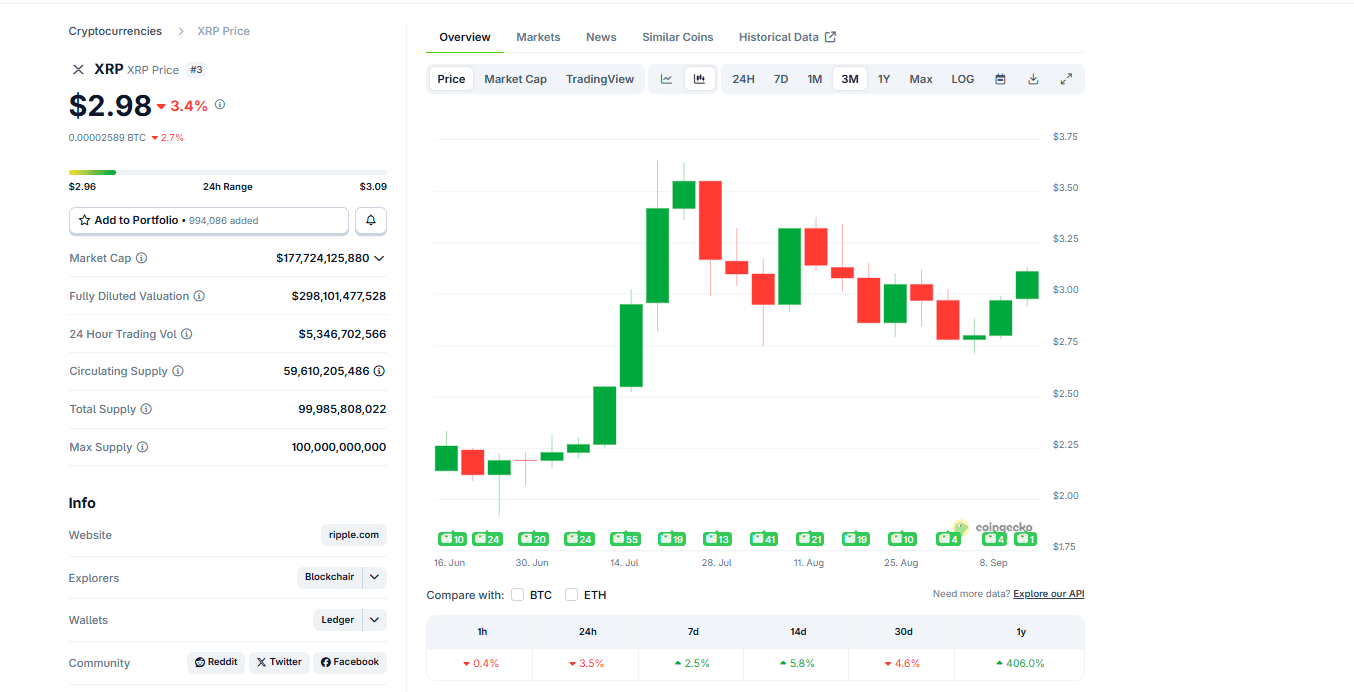

The total crypto market is steady above the $4T mark. While Bitcoin and Ethereum are (obviously) leaders dominating crypto discourse, many fail to mention that XRP crypto is now the third most valuable coin, flipping USDT. As XRP USD weaves around the $3 level, there is high confidence that the XRP token will be the next crypto to explode.

From Coingecko, XRP crypto is up +400% year-to-date. While the momentum slowed after peaking at over $3.5, printing fresh all-time highs, buyers appear to be stepping back. Over the past few trading weeks, XRP/USDT found a solid base at $2.75. From the series of higher highs over the first two weeks of September, XRP bulls have reduced losses. It is now down -4% in the past month, adding nearly +3% in the past week.

(Source: Coingecko)

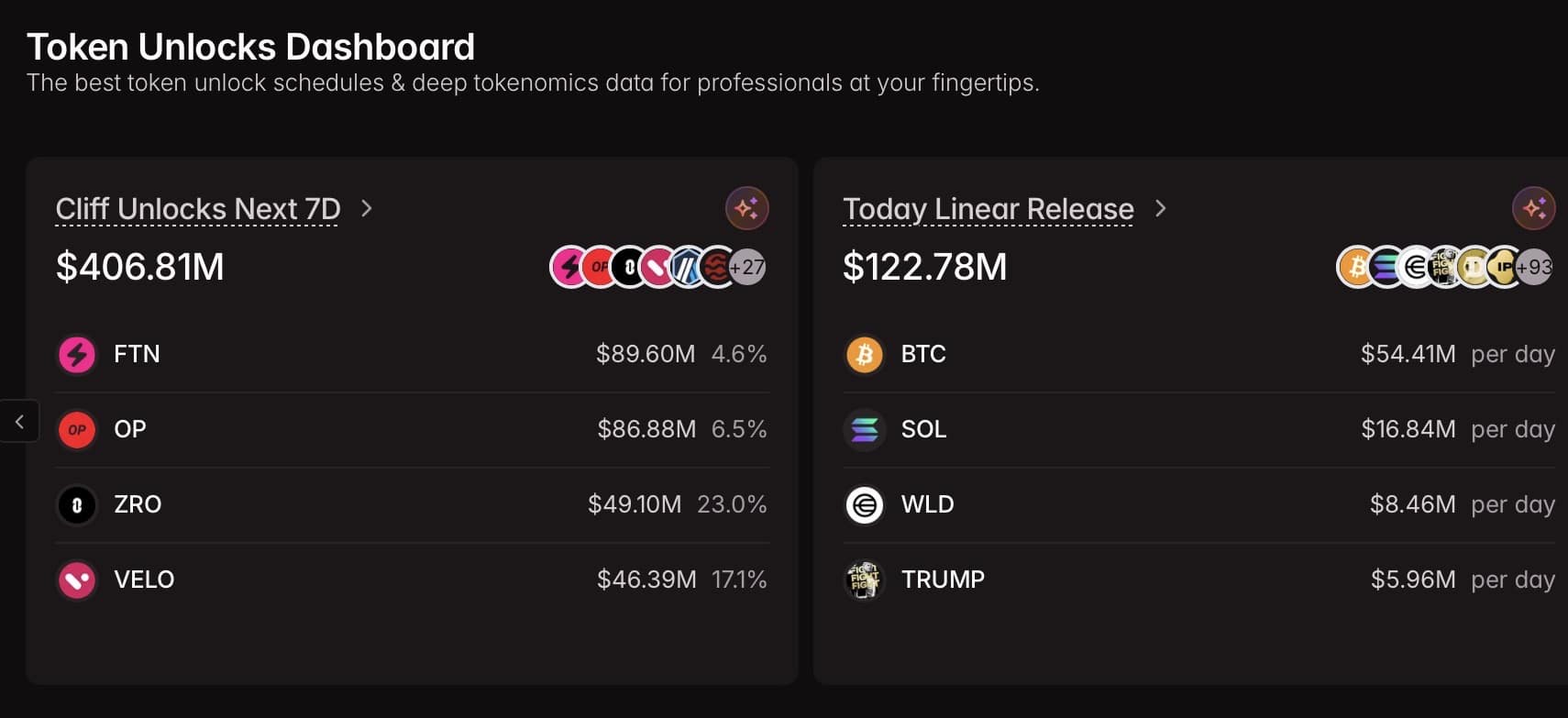

Token Unlocks Worth Over $790M Set for Release This Week

According to Tokenomist, more than $790 million in token unlocks are scheduled over the next seven days, posing potential volatility for the crypto market. Major cliff unlocks exceeding $5 million include OP, FTN, ZRO, VELO, ARB, SEI, ID, ZK, KAITO, AP, LISTA, and MELANIA.

Meanwhile, significant linear unlocks surpassing $1 million per day involve SOL, WLD, TIA, DOGE, TAO, AVAX, SUI, DOT, IP, MORPHO, ETHFI, JTO, NEAR, and ENS.

Arthur Hayes: Bitcoin Could Break $200K, Dismissing Four-Year Cycle

Arthur Hayes, co-founder of BitMEX, says Bitcoin’s trajectory will be shaped more by global liquidity than the traditional four-year cycle. In an interview with Kyle Chasse, Hayes argued that central banks and governments worldwide will keep printing money and buying bonds, fueling risk assets like Bitcoin over equities such as the S&P 500.

He believes the market underestimates this liquidity effect, which could drive BTC to $150K, $175K, or even $200K by the end of the 2020s.

While risks exist later in the cycle, Hayes insists the real upside has not yet arrived.

EXPLORE: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x in 2025

The post Crypto News Today, September 15 – Why Is Crypto Going Down? Bitcoin Loses $116K As Altcoins Lag Ahead of FOMC: Best Crypto To Buy? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]