In the end, Trump finally said something that made the market surge. The rally came after U.S. President Donald Trump signed an executive order allowing 401(k) retirement funds to invest in digital assets — a move that could unlock up to $9 trillion in long-term capital for the crypto market. Could this be the spark for the next bull run? Now might be the time to find the next crypto ready to explode.

BlackRock applauds Trump’s move to let 401(k)s be invested in crypto, private equity, and real estate. pic.twitter.com/UQXBvIv3vA

— More Perfect Union (@MorePerfectUS) August 7, 2025

While Trump’s move excites investors, some experts warn crypto in 401(k)s carries big risks: extreme volatility, possible fraud, unclear regulations, and high fees. Retirement savers could face intense losses if markets turn. Advisors suggest limiting crypto to a small share of a diversified portfolio.

EXPLORE: Best New Cryptocurrencies to Invest in 2025

Anyway, the market sentiment was also boosted by growing optimism over potential progress toward easing tensions in the Russia-Ukraine conflict. Ethereum led the rally, climbing 5.67% to briefly surpass $3,900. Bitcoin gained 2%, trading close to $117,000.

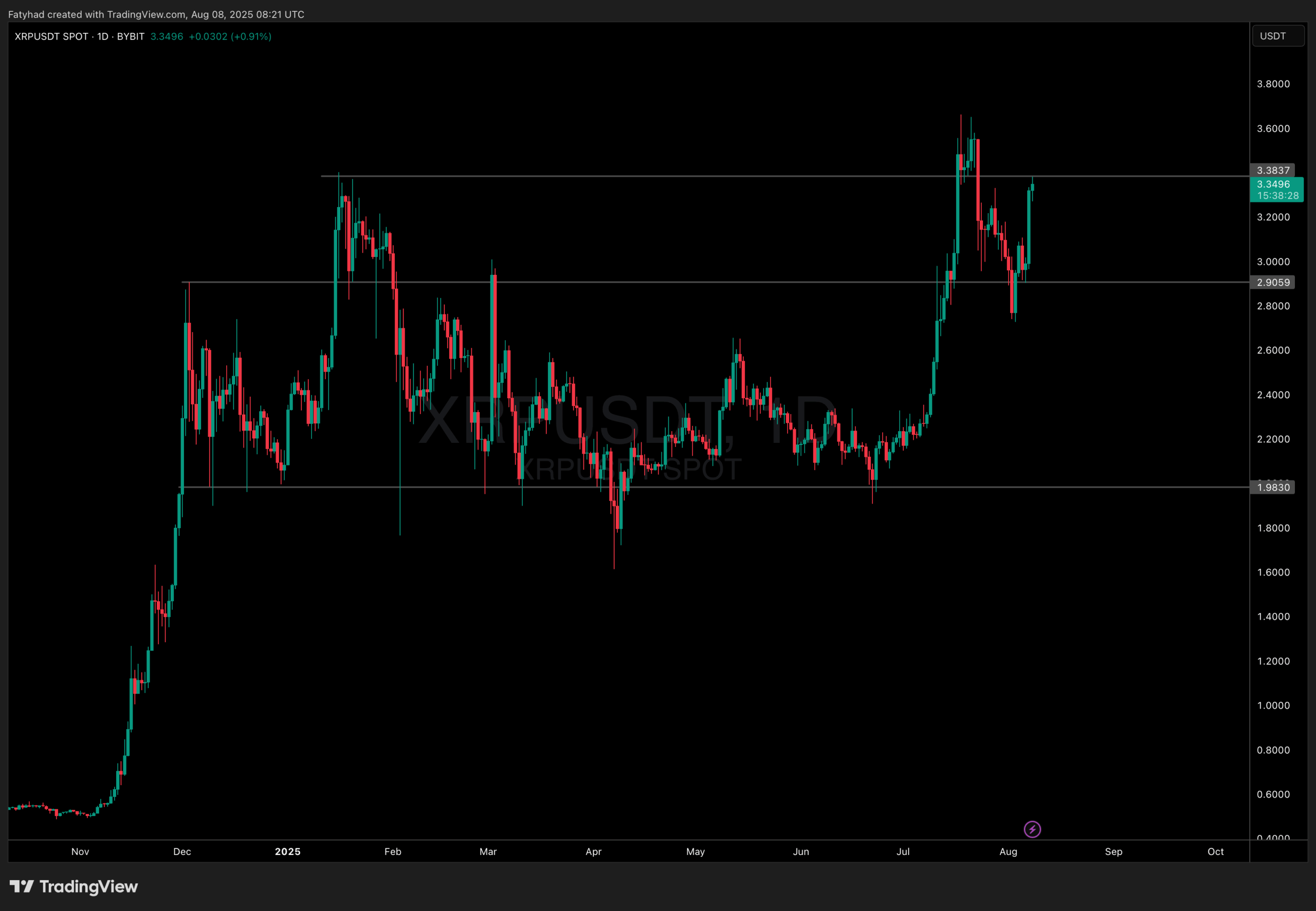

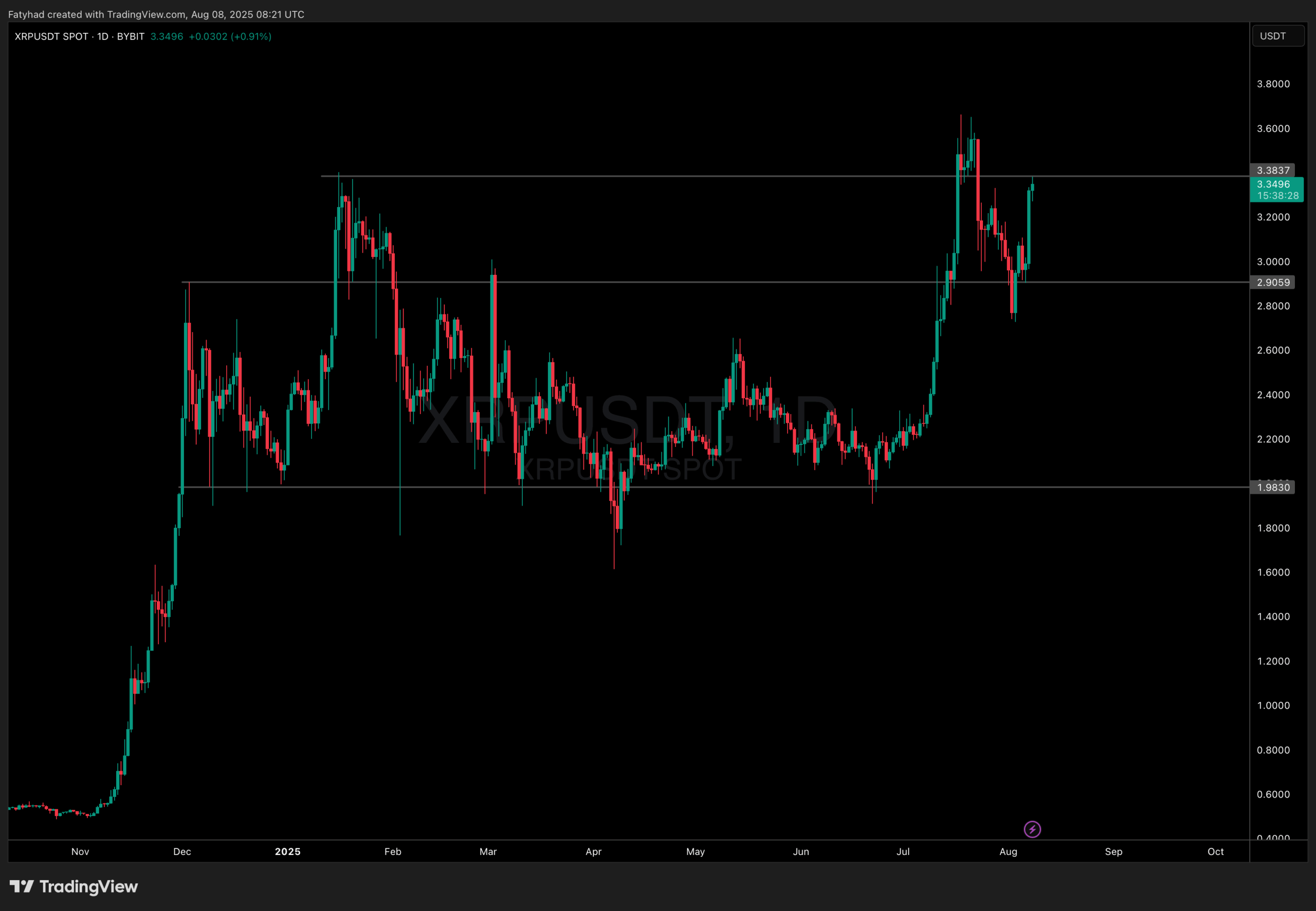

XRP delivered one of the standout performances of the day, soaring 12.8% after concluding its four-year SEC dispute. Gains were also seen across PayFi, DeFi, meme, and RWA tokens, adding to the day’s strong momentum.

(XRPUSDT)

Stay tuned for live updates on the latest developments shaping the crypto market.

Coinbase to Add DEX Trading: A Bullish Shift for the Exchange

Coinbase has announced it will integrate DEX trading directly into its app, allowing users to swap millions of on-chain assets on Base, Coinbase’s Layer-2 network. By connecting to trusted DEX aggregators like Uniswap and Aerodrome, the app will deliver competitive on-chain prices while keeping the familiar Coinbase interface.

This move is bullish for Coinbase as it massively expands asset availability beyond the few hundred tokens listed on its centralized exchange, giving users faster access to emerging projects without waiting for listings. It also positions Coinbase as a hybrid platform: combining the simplicity of a CEX with the flexibility of DeFi.

ETH Breaks $4,000 as Whale Executes $11 Million Leveraged Play

According to Binance data, ETH has surpassed $4,000, hitting a 24-hour peak of $4,012. For context, Ethereum’s all-time high was $4,878 in October 2021.

As price momentum picked up, whale 0xaf6c immediately exploited this opportunity to make a leveraged move. They purchased 1,390 WETH (worth $5.56M) at $4,000, deposited it into Aave, then borrowed 52.83 WBTC (valued at $6.17M). The whale quickly swapped the borrowed Bitcoin for 1,539 WETH ($6.17M), effectively increasing their ETH exposure without selling the original position.

The move signals confidence that ETH could extend gains, with traders watching if the $4,000 level can flip into support — potentially setting the stage for a run toward its historical high and why not, a new ATH.

Bitcoin ETFs See $281M Inflows — Could Bitcoin Hyper Be the Next Stop for New Capital

On August 7, U.S. spot Bitcoin ETFs recorded $281 million in net inflows, marking another sign that institutional and retail appetite for BTC is alive and growing. BlackRock’s IBIT led with $157 million, while Fidelity and other issuers also posted solid gains. This latest wave builds on a summer trend where Bitcoin ETFs have quietly absorbed selling pressure, funnelling fresh liquidity into the market.

With Bitcoin now trading roughly 5% below its all-time high of $122,838, many analysts see ETF inflows as a potential spark for the next leg up. Historically, large-scale ETF demand doesn’t just lift BTC’s price, it also draws new participants deeper into the crypto ecosystem. And here is where Bitcoin Hyper could shine.

HYPER is a Layer-2 network for Bitcoin built with the Solana Virtual Machine (SVM), enabling near-instant transactions, low fees, and direct integration with DeFi, gaming, and tokenized assets: all secured by Bitcoin itself. By bridging BTC into this high-speed environment, HYPER makes meme coin trading, flexible payments, and advanced dApps accessible to Bitcoin holders without leaving the Bitcoin security umbrella.

With $7.4 million already raised in presale and whales dropping nearly six figures on it, early demand is strong. The project’s bridge mechanism locks BTC, mints a wrapped version, and deploys it into the ecosystem — trimming supply and expanding utility at the same time.

As ETF inflows accelerate and Bitcoin edges closer to new highs, HYPER could become a key gateway for the next wave of BTC-focused investors looking for yield, utility, and speed in the same package.

For ETH, $4K Is The Next Target as SharpLink Steps Up Accumulation

Ethereum has shaken off its recent slump, climbing over 7% in the past 24 hours to trade above $3,900. The rally comes as whales and institutions step up accumulation, with SharpLink Gaming leading the charge. The ETH-focused treasury company purchased 21,959 ETH, valued at roughly $85.5 million, bringing its total holdings to 543,898 ETH, worth about $2.12 billion.

This latest acquisition follows SharpLink’s $200 million stock offering aimed at expanding its Ethereum reserves.

Upbit to List IP Trading Pairs, Token Surges 12%

South Korea’s largest cryptocurrency exchange, Upbit, has announced it will list Story (IP) with trading pairs against KRW, BTC, and USDT. Story is a Layer 1 blockchain network built specifically for intellectual property, aiming to streamline the creation, ownership, and monetization of IP assets on-chain.

The listing news sparked a strong market reaction. IP jumped 12% today, pushing its market capitalization to $6.67 billion. Trading activity also exploded, with 24-hour volume surging 789% to $354 million, reflecting heightened investor interest ahead of the listing.

With Upbit’s large Korean user base and strong local liquidity, the move could further boost IP’s adoption and cement its position as a leading blockchain for the IP sector.

Is Hyperliquid HYPE Crypto Undervalued? DEX Generates Record Revenue

HYPE crypto may be undervalued. With record-breaking $90M monthly revenue, a $13.1 billion market cap, and an aggressive buyback program, Hyperliquid dominates the DeFi perpetual DEX space.

In DeFi, Hyperliquid stands out due to its innovation. Coingecko data shows that HYPE, its governance token, is the most valuable DEX coin, with a market cap more than twice that of Uniswap (UNI). Currently, Hyperliquid has a market cap of $13.4 billion, and HYPE trading generated over $244 million in volume in the past 24 hours. While volume fluctuates, interest in the HYPE token suggests that Hyperliquid is closely monitored and may become one of the next cryptos to explode if it continues gaining market share.

The post Latest Crypto News, August 8 – Rally as Trump Approves 401(k) Crypto Investments, ETH Breaks $3,900: Next Crypto To Explode? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]