Another day, another Trump’s new tariffs plan. The market is tired and it didn’t react to the news positively. U.S. President Donald Trump has signed an executive order reimposing ‘reciprocal tariffs’ of 10% to 41% on imports from 69 countries, along with higher duties on certain Canadian goods over drug-smuggling concerns. Canada’s tariffs take effect on August 1, with others following on August 7. Overall, the market is still holding up well, with major altcoins retesting key support levels. It could be interesting to identify what might be the next crypto to explode once the dust settles.

The tariff news hit just as global risk assets tumbled. Over $570 million in crypto long positions were liquidated in 24 hours, with Ethereum and Bitcoin taking the biggest blows. Fear of higher inflation and tighter trade flows drove a broad sell-off. Still, seasoned investors are looking past the headlines, scanning on-chain data for signs of a rebound.

EXPLORE: Top 20 Crypto to Buy in 2025

Next Crypto to Explode? Whales Accumulate ETH as XRP Retests Support

While spot prices slipped, whale wallets quietly scooped up more Ether. In the last week, 12 new large holders added roughly 790,000 ETH (about $2.9 billion) to their balances. Two of those fresh wallets alone bought 68,300 ETH ($252 million) just eight hours ago. This steady accumulation suggests big players see value in holding ETH through short-term turbulence.

Whales keep accumulating $ETH!

2 fresh wallets accumulated another 68,297 $ETH($252M) 8 hours ago.

Since July 9, a total of 12 fresh wallets have accumulated 790,449 $ETH($2.92B). pic.twitter.com/hcNiJTN9xz

— Lookonchain (@lookonchain) August 1, 2025

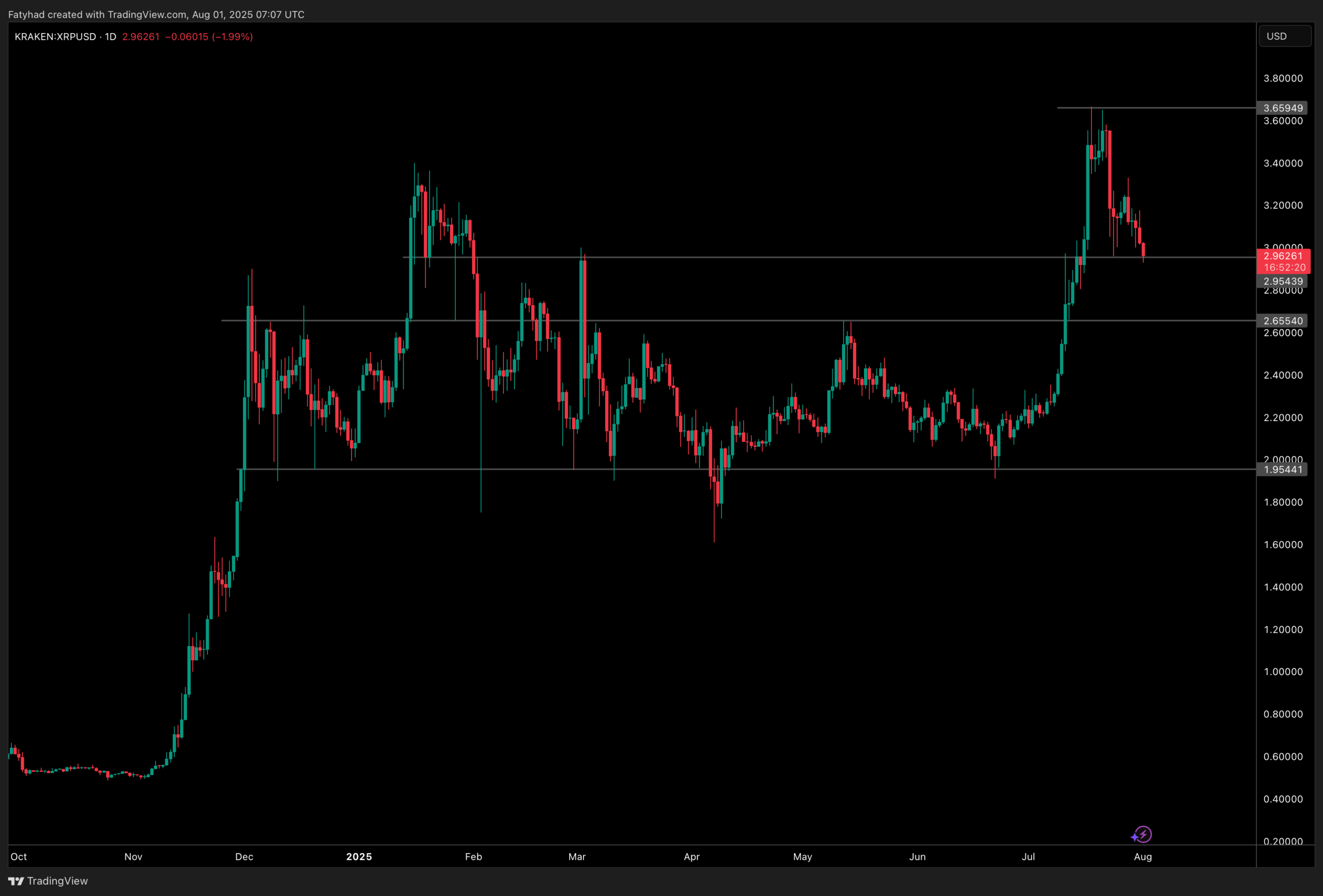

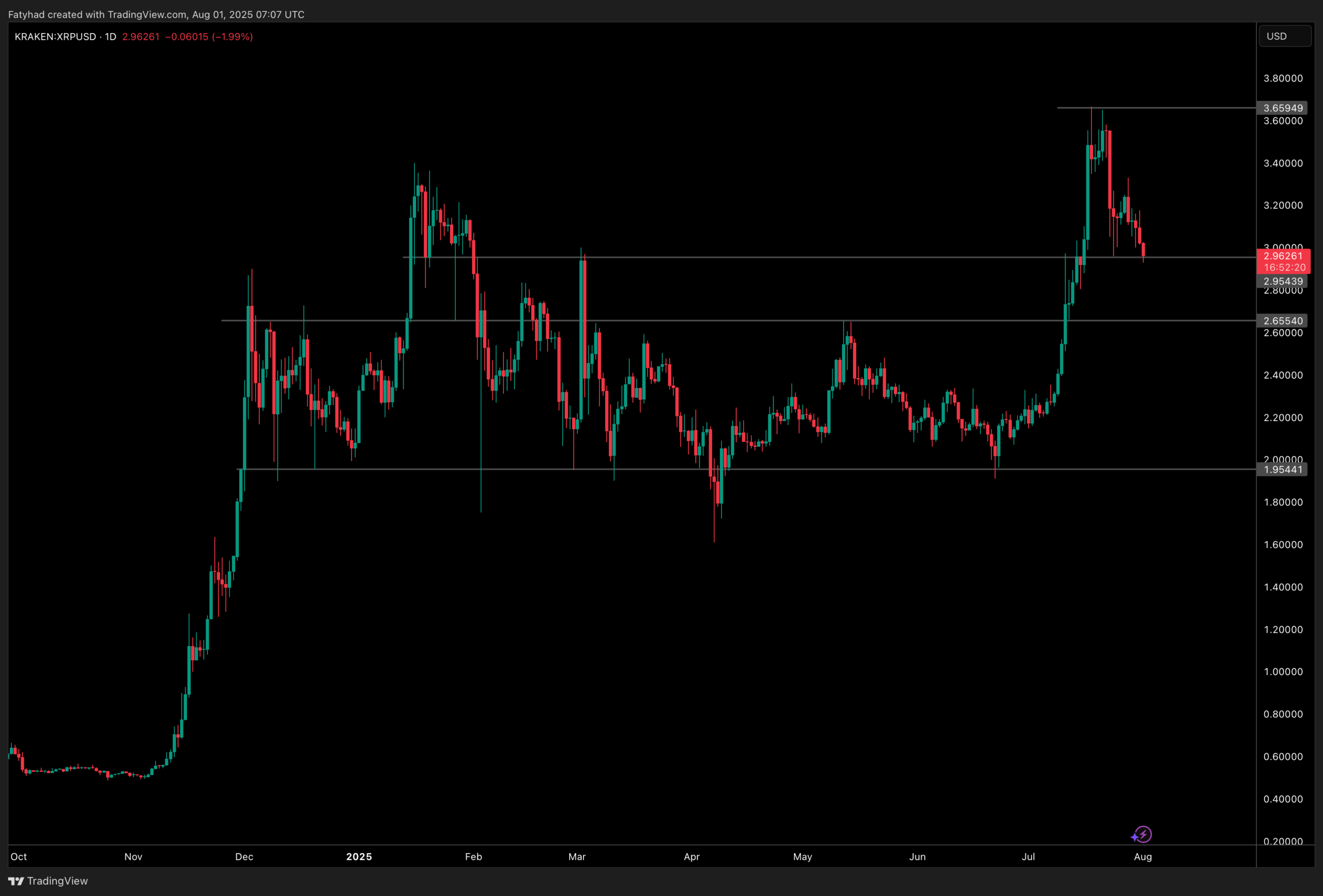

At the same time, XRP price is retesting a key support zone around $2.95. After peaking near $3.66, XRP has pulled back to this horizontal level first tested in March and May. If buyers defend $2.95, XRP could rally back toward $3.20 or higher. But a break below might send price down to the next floor near $2.65.

Between the tariff-driven dump and aggressive ETH buying, traders are split on which asset is truly set to explode next. Bulls point to whale activity and XRP’s support bounce as a recipe for a fast rebound. Skeptical traders warn that macro uncertainty and ongoing liquidations could keep pressure on prices.

For now, keep an eye on on-chain flows and chart levels. If ETH accumulation continues and XRP holds above $2.95, these could be the ingredients that spark the next crypto to explode once the market finds its footing.

Tether Surpasses South Korea in U.S. Treasury Holdings

Tether now holds more U.S. Treasury bonds than South Korea, Germany, and the UAE, with over $127 billion in total exposure. According to Messari, Tether’s Q2 2025 report shows $105.5 billion in direct holdings and $21.3 billion indirectly, marking an $8 billion increase from Q1. This makes it the only private company among the top global holders of U.S. debt.

The stablecoin issuer also reported a $4.9 billion net profit in Q2, backed by income from Treasuries, Bitcoin, and gold reserves. Tether’s total assets stand at $162.6 billion, exceeding liabilities by $5.5 billion. The firm’s strong equity buffer enhances its solvency and backs the USD₮ token with high liquidity and low risk.

Tether has reinvested $4 billion into strategic U.S. projects, including XXI Capital and Rumble Wallet, reinforcing its expanding role in both crypto and global finance.

Yes, Bitcoin Price Is Down Today — But It Just Closed Its Highest Monthly Candle Ever

Bitcoin (BTC) is down 3.02% today, trading at $114,902, but it just printed its highest monthly close ever, confirming strong bullish momentum. Despite the dip, 24-hour trading volume remains high at $83.63 billion, showing sustained interest.

Institutions are steadily accumulating BTC, and network hashrate continues to surge, reflecting growing confidence and participation from miners. This is likely a short-term pullback in a broader uptrend.

The Fear & Greed Index sits at 57, suggesting a neutral-to-positive sentiment. Meanwhile, the Altcoin Season Index is at 35, showing BTC dominance is intact.

In short, this dip looks more like a breather than a reversal. With strong fundamentals and rising adoption, Bitcoin could be setting up for its next big move.

Bitcoin Briefly Dips Below $115K – Is Bitcoin Hyper the Next Crypto to Explode?

Bitcoin (BTC) may be trading just under $115,000, but many see this as a healthy pullback: especially after it closed its highest monthly candle ever. With whale accumulation rising and institutional demand strong, analysts expect BTC to retest the $120K level soon.

In the shadow of this consolidation, Bitcoin Hyper (HYPER) is quickly gaining momentum. This Bitcoin Layer-2 project uses Solana’s Virtual Machine to bring low-cost, high-speed smart contracts to Bitcoin. Already, its presale has raised over $7 million, with over $5 million in July alone.

As Bitcoin prepares for its next breakout, early investors are watching Bitcoin Hyper as the next crypto to explode. Its bridge tech unlocks new use cases for BTC, like DeFi, payments, and gaming, without sacrificing Bitcoin’s security.

With the presale still open and momentum building, Bitcoin Hyper could ride the next BTC rally to new heights.

Bitcoin Crashes to 3-Week Low After Trump Tariff News Sparks $630M Liquidation

The Trump tariff news is wrecking the crypto and equities markets. Bitcoin’s floor gave way in Asia cracking to $114,250 and marking its lowest level since June 11.

Three weeks of sideways chop ended in one clean move south that went as low as $111,000.

According to CoinGlass, 158,000 traders were liquidated in the past 24 hours. Total liquidations hit $630 million, with the majority from long positions. My gains, nooo!!!

This liquidation trauma reflects pre-emptive risk reduction. Spot crypto holdings saw $110 billion withdrawn in the 12 hours preceding Trump’s tariff announcement, underscoring heightened market anxiety.

President Trump lit the fuse with a tariff blitz of 35% on Canada and up to 39% on non-allied economies. Countries without trade pacts got the worst of it; here’s how low btc logoBTC -2.82% can go.

Virtual Crypto On Downtrend: Can Virtuals Protocol Break $1 Billion Market Cap

Virtual protocol is spiraling, with its price at $1.24 and market cap at $812 million well below its former crypto highs. Down 46% from May’s peak, the token is struggling under pressure, declining demand, and bearish technicals.

Once seen as a promising AI x Metaverse project on Base, VIRTUAL -9.14% is now buckling under ecosystem slowdowns. Falling revenues, disinterested users, and smart money exiting paint a rough picture for short-term recovery. But maybe long-term things don’t sit that way, and we may witness a breaking of $1 billion market cap.

Bankrcoin (BNKR) Crypto Hit 100M Marketcap: How’d it happen?

Bankrcoin (BNKR) crypto has doubled in market cap since our initial coverage. After completing its Coinbase listing, the token soared over 100% and is now over a 100M market cap.

With Coinbase’s backing and full Baseapp integration, BNKR has captured a 14% market share. It now leads coins like Fartcoin, Rekt, Virtuals, OpenLedger, and Monad, according to CookieDAO. How did this happen?

The post Crypto News Today – Next Crypto To Explode? Crypto Market Is Down But Whales Keep Accumulating ETH As XRP Price Retests Support Level appeared first on 99Bitcoins.

Altcoins, Altcoin News Today, Live Updates

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]