Articles

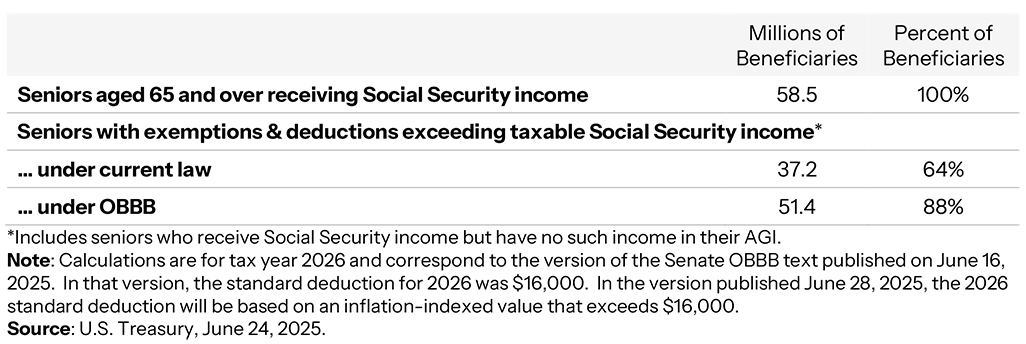

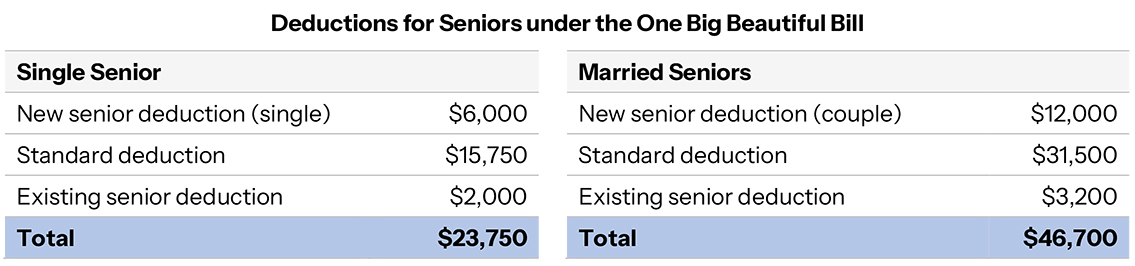

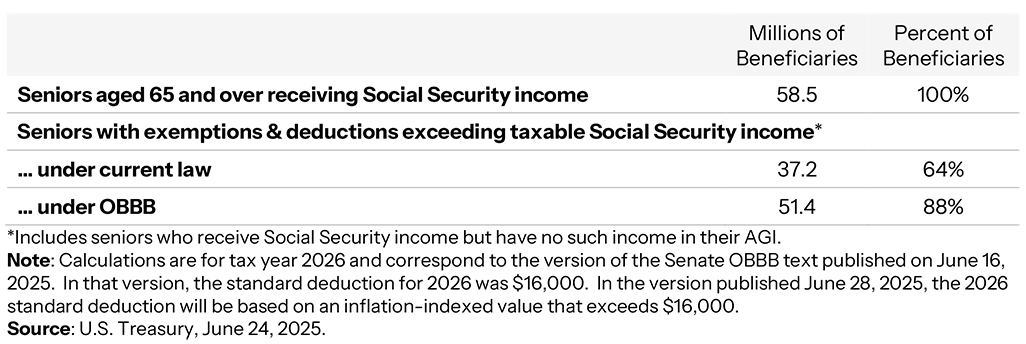

Under the One Big Beautiful Bill, the vast majority of senior citizens — 88% of all seniors who receive Social Security — will pay NO TAX on their Social Security benefits, according to a brand new analysis from the Council of Economic Advisers.

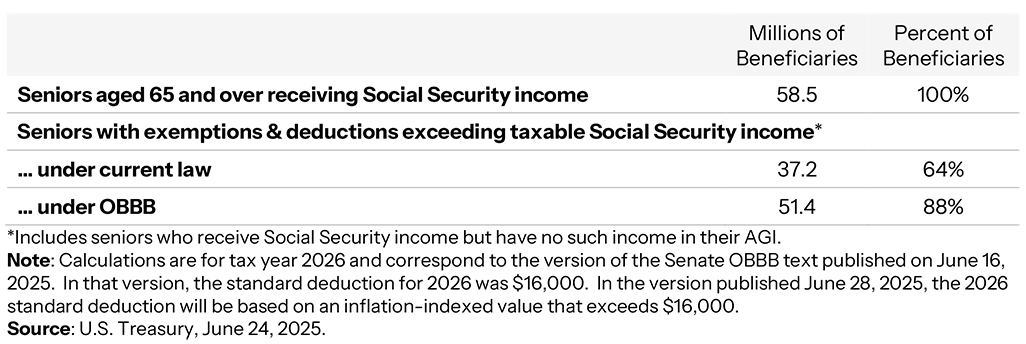

- A senior who files as a single taxpayer and receives the current average retirement benefit (approx. $24,000) will see deductions that exceed their taxable Social Security income.

- Married seniors who both receive the average $24,000 Social Security income — a total of $48,000 in annual income — will also see deductions that exceed their taxable Social Security income.

This amounts to the largest tax break in history for America’s seniors — and makes sure that after years of earning their Social Security, seniors can save more of their money.

Promises made, promises kept.

The post No Tax on Social Security is a Reality in the One Big Beautiful Bill appeared first on The White House.

Articles

Articles – The White House

[crypto-donation-box type=”tabular” show-coin=”all”]