Congress is working to make owning a suppressor more affordable than ever—here’s how to prepare before demand explodes.

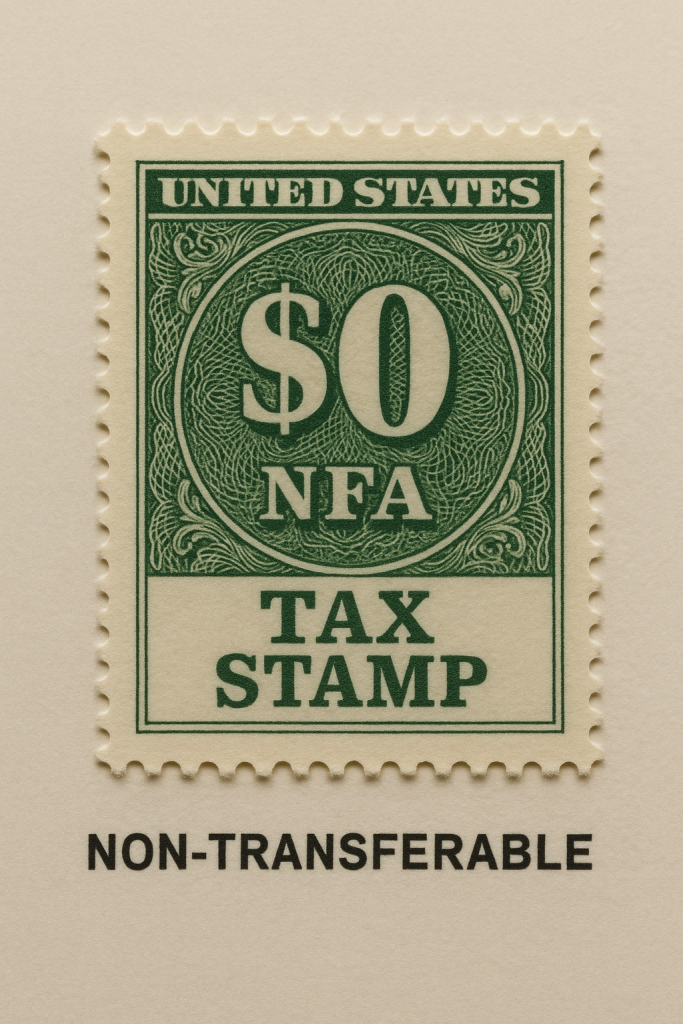

Big news for gun owners: the $200 federal tax on suppressors could soon disappear. Under the latest House Reconciliation Bill, lawmakers are proposing to slash the National Firearms Act (NFA) tax on suppressors from $200 to $0. While suppressors would still technically remain under the NFA (for now), this massive cost reduction is poised to open the floodgates for new suppressor purchases across the country.

At Walker & Taylor, we believe every lawful gun owner should be prepared to take full advantage of this shift—and that starts with a Texas NFA Gun Trust

What’s Happening With the Suppressor Tax?

Buried in the recently released House Reconciliation Bill is a small but powerful provision: eliminating the $200 NFA tax stamp for suppressors. While suppressors would still be regulated under the NFA (meaning background checks and ATF approval would still be required), removing the tax stamp could save buyers hundreds of dollars on each purchase.

Translation: if you’ve ever considered buying a suppressor, this could be your moment. We are closely monitoring the situation—because there’s still time for lawmakers to amend the bill and remove suppressors from the NFA entirely.

Why Suppressor Demand Is About to Surge

Suppressors aren’t just a “cool” accessory—they protect your hearing, reduce recoil, and improve your shooting experience. But the $200 tax stamp and complicated ownership rules have made suppressor ownership a hassle for many Americans.

With the tax removed, millions of gun owners could flood the market overnight. That means longer wait times, inventory shortages, and new bottlenecks in the NFA transfer process.

Setting up your Texas NFA Gun Trust now—might be the right option.

How a Texas NFA Gun Trust Gives You the Advantage

An NFA Gun Trust is a legal tool that allows you (and trusted family members or friends) to jointly own NFA items like suppressors, short-barreled rifles, and machine guns.

Here’s why it’s a game-changer—especially if the tax is eliminated:

No Solo Ownership Hassles

Only the person listed on an individual tax stamp can legally possess the NFA item. With a trust, all listed trustees can legally own, store, and use the items—no additional tax stamps required for each co-owner.

No Probate Nightmares

Unlike individual ownership, your NFA items pass smoothly to your chosen beneficiaries outside of probate—saving time, cost, and legal headaches for your loved ones.

Unlimited Trustees, Unlimited Items

Add as many trustees and items as you like. Our trusts are fully customizable and attorney-backed—not generic, fill-in-the-blank forms.

Future-Proof Your Firearms Ownership

Even if the law changes, your trust gives you greater control, flexibility, and privacy over how you store, share, and transfer your NFA items.

Get Started With Your Texas NFA Gun Trust

We have helped thousands of individuals establish their NFA Trusts.

By: Walker & Taylor PLLC

DISCLAIMER: The information on this website does not contain legal advice or create an attorney-client relationship. Every case is different. This material is not a substitute for, and does not replace the advice or representation of, a licensed attorney.

The post Suppressor Tax Stamp May Drop to $0 – Here’s Why Now Might be the Right Time to Set Up Your Texas NFA Gun Trust appeared first on Walker & Taylor Law.

Uncategorized

Walker & Taylor Law

Bitcoin

Ethereum

Monero

Donate Bitcoin to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Bitcoin to The Bitstream

Donate Ethereum to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Ethereum to The Bitstream

Donate Monero to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Monero to The Bitstream

Donate Via Wallets

Select a wallet to accept donation in ETH BNB BUSD etc..