“We Saw It. We Passed”: Blue Owl Fails To Secure Third Party Funding For $4 Billion Data Center

As we discussed extensively yesterday, Blue Owl already has huge headaches with its software exposure, being forced to dump a substantial amount of its SaaS-linked loans (to related parties among others) as it gates retail investors in its private credit fund amid a tsunami of redemption requests. We now learn that the massive private credit asset manager is also facing major hardware challenges too.

According to Insider, Blue Owl – which is also a leading investor in the data center boom funding countless projects with private loans – was unable to arrange financing for a $4 billion data center it is co-developing in Pennsylvania after pitching lenders to help bankroll the project in recent months.

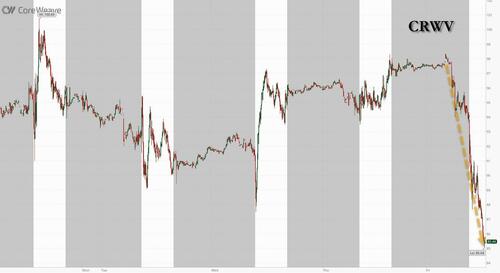

The facility, located in Lancaster county 80 miles west of Philadelphia, will be occupied by CoreWeave, a junk-rated provider of cloud computing services that has become a closely watched name in the AI race for its rapid expansion due to the massive debt load it took on to fund that expansion which has sent its credit default swaps to record wides.

An executive who arranges debt for major data center deals told Insider that the lack of interest in the Lancaster project was due to growing caution among lenders and investors about taking on sizable exposures to AI players with less-than-sterling credit. CoreWeave has a junk rating of B1/B+, according to S&P and Moodys

“We saw it. We passed,” a senior executive at a large specialty lender told Insider.

A Blue Owl spokesman said that the company had “considered” third-party financing for the Lancaster project “as we would with any transaction as we explore alternatives before choosing the most attractive path forward.” This suggests that not only was Blue Owl unwilling to fund the project internally, but when it tried to syndicate the private loan, the phone calls went straight to voicemail.

Understandably, already sweating under the spotlight of the market which has sent its stock price crashing in recent weeks, the Blue Owl spokesman added that the project, which he said is already under construction, “is fully funded, on time, and on budget.” It wasn’t immediately clear who had “funded” the project is, as Insider reports, 3rd party lenders had balked while Blue Owl itself was aggressively dumping its own software exposure.

To that point, Insider notes that it is unclear whether Blue Owl has been funding construction entirely from its own capital. If Blue Owl is unable to raise debt for the Lancaster development, the company – already facing massive redemption requests across its various funds – would be on the hook for a potentially huge outlay of cash to pay for the data center’s construction.

The situation shows the complications and risks involved in financing the massive buildout of infrastructure for AI computing. Brennan Hawken, an equity analyst at BMO Capital Markets who covers Blue Owl, said that difficulties to raise debt for the Lancaster project would raise concern.

“I’m not familiar with this deal, but if there is a struggle to find the debt financing, that’s a bit of a red flag that I would want to drill into,” Hawken said.

How we got here

Last summer, CoreWeave announced it would lease 100 megawatts of initial capacity at the Lancaster data center and potentially expand its commitment to 300 megawatts. The company said it would pour up to $6 billion into the project to equip it with chips and other cloud infrastructure. A month later, in August, Chirisa Technology Parks announced it would partner with Blue Owl and Machine Investment Group to develop the project. The partnership said it would provide $4 billion of funding, an amount separate from CoreWeave’s investment, to support the construction of the project’s data center facilities.

In the fall, Blue Owl began shopping the development to potential lenders, a person familiar with that effort told Insider.

Blue Owl has been one of the more “creative” financial architects of the data center building boom. Last year, it structured an off-balance sheet deal to partner with Meta in the ownership of a large data center campus that Meta will build and operate in Louisiana.

As a reminder, META is already neck deep in off-balance sheet debt. Here is a schematic of its $27.3 billion SPV with Blue Owl “Project Beignet” for the Hyperion data center. None of this touches META’s balance sheet.

Expect hundreds of billions of these in 2026 https://t.co/794EgSiiZ9 pic.twitter.com/7hMyVW6Lno

— zerohedge (@zerohedge) January 29, 2026

Blue Owl piggybacked on Meta’s strong credit to raise $27.3 billion of investment-grade corporate bonds against its share of the project’s equity, proceeds that will be used to help pay for construction.

Blue Owl could arrange a similar type of vehicle that could attempt to tap the credit of an investment-grade customer of CoreWeave’s who might use the Lancaster facility or Nvidia, the chipmaker that has purchased large stakes in CoreWeave. It could also potentially raise cash for construction debt by tapping large institutional investor clients to pool together a loan, Hawken said.

Much of the development of hyperscale data center campuses has sought to utilize the strong credit ratings and deep pockets of big-tech partners.

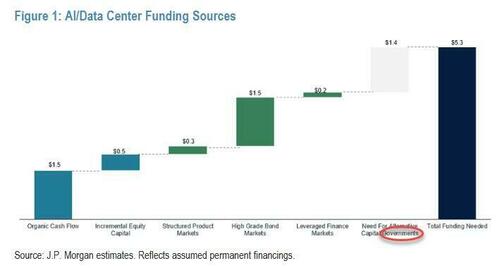

Coreweave’s data center challenges are only the latest hurdle that the AI supercycle is facing now that the market has realized the trillions in future funding needs will have to be largely filled with debt, including government funding (See “It Will Take $5 Trillion To Fund The AI Cycle, And The US Government Is On The Hook For Over $1 Trillion“)

Insider previously reported that major banks had recent difficulty selling off pieces of $38 billion of debt to finance the construction of two data center campuses that will be anchored by Oracle. Banks often sell pieces of such large commitments to other lenders to spread risk and also reap a quick profit.

The slowdown in interest in participating in that financing was due to worries about Oracle’s enormous AI spending and whether the tech company’s credit rating could be impacted by those outlays. Oracle has since sought to calm the lending market, announcing that it would raise up to $50 billion of cash from stock and bond offerings in order to “maintain a solid investment-grade balance sheet.”

Blue Owl stocks tumbled at the open to a fresh multi-year low, although it wasn’t clear if that was due to the Coreweave news or because of its mutiple other issues. Coreweave’s dump today, on the other hand, can likely be attributed largely to the data center news which, unless it manages to find a generous partner, will only be the start of its headaches.

Tyler Durden

Fri, 02/20/2026 – 13:00

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]