Who Exactly Is Going To Be Earning More With AI?

By Michael Every of Rabobank

May The Warsh Be With You

After having written about AI for two days in a row, it wasn’t the intention to do so again today. However, developments on the ground are accelerating while those responsible for dealing with the fallout are failing to understand what the immediate implications are.

Two short movies were just made with AI for pennies, in hours, both more entertaining than anything Hollywood has splurged onto our screens in some time. (The latest trailer for ‘The Mandalorian and Grogu’ underlines Hollywood no longer understands movie- and myth-making, or even The Force behind fonts.) Indeed, Warner Brothers, Paramount, and Netflix are standing in a circle like the gunfighters at the end of The Good, The Bad, and The Ugly (which IS a great movie),… as a giant T-Rex in sunglasses parachutes in to a heavy metal soundtrack to eat them.

Another video showed Chinese robots doing acrobatic kung fu, when their Russian equivalent fell off the stage at its launch as if after too much vodka. Robots like that can do almost any job, 24/7, faster and better than humans. That includes soldiery. With AI, they can learn from us then teach themselves. That’s as serious as a giant T-Rex in sunglasses is trivial.

The Fed’s Barr and Daley addressed AI yesterday. The headline, written by Bloomberg AI, is that neither think this potential revolution makes the case for lower rates. That places them in stark opposition to Fed Chair nominee Warsh even before he gets appointed, and even before other areas of controversy arise within the FOMC, which they will.

Barr’s main argument is that AI means the demand for capital would rise because of strong business investment, while “household savings could fall due to expectations of stronger real wage growth and thus higher lifetime earnings.” Daley noted higher growth would dictate a higher neutral rate in “the standard model” because “the demand for investment would rise relative to the supply of savings.” Yet that analysis –which may well be copied and pasted around other institutions as if by AI agents– lacks sufficient human, let alone artificial intelligence.

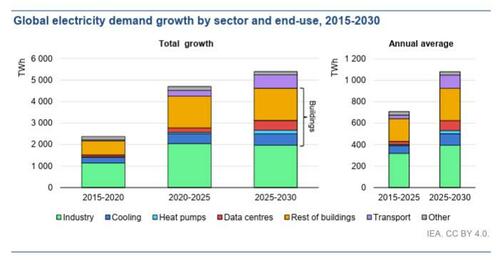

Obviously, AI is going to be inflationary in some areas – it already is. However, it’s got nothing to do with constraints on CAPITAL in a fiat credit based system with an equity market where ludicrous P/E ratios are normal – indeed, US 10-year yields have been trending down even as AI action has heated up. The real world AI constraints are PHYSICAL: electricity, copper, memory chips, rare earths, etc.

Equally obviously, AI is going to be deflationary for many other areas. Barr echoes the gibberish early AIs spat out in predicting “expectations of strong wage growth and higher lifetime earnings.” Who is going to be earning more with AI? Hollywood types about to be replaced? The swathe of white collar workers going the same way? The blue collar workers who face competition from robots who can do back flips to the building site they labour away at 24/7?

Setting rates high vs AI would mean deeper disaster for those hit by it. Setting rates too low to help those hit by AI would inflame inflation in the areas boosted by it. In short, how the Fed works logically needs to change. However, at least two of the current members of the FOMC are instead producing the monetary policy equivalent of ‘The Mandalorian and Grogu’ – reheated nonsense that undermines its own mythic power and collapses its fanbase. Or, maybe, they just don’t want to say ‘May The Warsh Be With You’(?) That could also be the way.

The RBNZ left rates on hold today and said it expects them to stay there – but said nothing about AI.

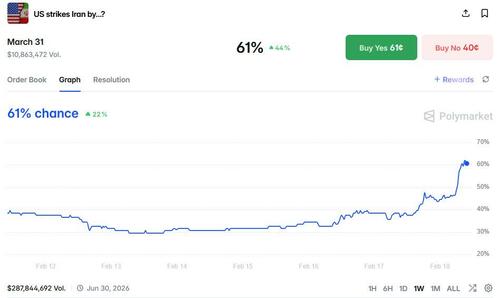

Meanwhile, the second round of US-Iran talks ended with the Iranians smiling and talking about deals within reach, and a third round pencilled in for two weeks from now to close gaps. Markets liked that. However, the US is still surging military equipment to the region; Iran also insulted and threatened the US yesterday, partially closing the Strait of Hormuz for the first time since the 1980s; and both regional reports and Vice President Vance underlined that Tehran is playing for time while it tries to regain control of its restless population, and is ignoring core US demands. Recall in 2025, Iran offered the US the same deal it’s offering now – and got bombed.

On which note, India and France just upgraded their ties to a strategic partnership – which is a win for France but complicates the EU moving as one on foreign policy as we move towards a possible multi-tier Europe. It also has interesting implications given India’s closeness to Russia, and steely relations with Pakistan, which is in turn close to Saudi and Turkey. That’s as the UK PM, who gave a pugnacious speech in Munich and returned to push for 3% of GDP defense spending by 2029, suffered his latest of blow as Chancellor Reeves blocked that move.

The US also hardened its allegations that China just conducted a secret nuclear test, speaking to our tense geopolitical backdrop. In Peru, Congress ousted President Jeri after just four months in office because of China-linked meetings: another win for the Donroe Doctrine, it seems.

In geoeconomics, the US announced the first three projects under Japan’s $550bn trade deal, which will include around $33bn for an LNG-powered plant, a crude oil facility and a synthetic industrial diamonds plant. This is much more significant than it looks: it’s proof of concept that the US can tell trade and security partners where to place their capital back into the US, rather than them just pushing it into US stocks or bonds. Some may knock this in the same way they do US non-FTA trade deals – but they are still paying those tariffs, so will likely invest as asked.

The recent Trump-Milei trade pact is placing pressure on the EU to act on its Mercosur FTA, now only being applied provisionally. The Trump deal with Argentina overrides it in some places, underlining the argument that Donroe Doctrine > technocratic FTA when push comes to shove.

The EU is stating it could move ahead with a Russian oil services ban without G7 support, but Malta and Greece won’t back the measure unless the US also gets on board – so how does the EU ignore their lack of support?

In terms of key political developments, New York Mayor Mamdani just warned of a nearly 10% property-tax increase if he can’t soak the wealthy instead; Sergey Brin is backing a group trying to undercut California’s proposed billionaire tax; and the UK’s HMRC has hired 1,000 valuation officials ahead of its imposition of a ‘mansion tax’.

Also telling given AI hasn’t started to wreak havoc yet, Politico reports that ‘1 in 5 Europeans say dictatorship might be preferable’ – with the caveat that many don’t dislike it in principle, just how it works in practice. That’s OK then. The same media talks of ‘Macron’s mission: Le Pen-proof France before the 2027 election’, while warning that this undermines the neutrality of the institutions that will need to be seen as such if current political polarisation continues to grow.

Finally, the ‘rules-based order’ cheerleader Financial Times also has an op-ed arguing ‘Perhaps we should all be banned from social media’ because “Focusing only on under-16s obscures the lack of internet safeguards for everyone else”. One can start to pick up a certain Luddite-ism in the zeitgeist. That’s both understandable, and predictable. Yet it surely won’t apply globally, which will only increase the growing differences within and between our societies and economies.

Markets should prepare for far greater volatility – and not just because two people at the Fed don’t buy the Warsh case for lower rates.

Tyler Durden

Wed, 02/18/2026 – 10:10

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]

![M5 iPad Pro Hits New Record Low Prices on Amazon, Starting at $799.99 [Updated]](https://images.macrumors.com/article-new/2025/10/m5-ipad-pro.jpeg)