The regulatory tug-of-war for crypto’s hottest sector just intensified. Nevada regulators ordered Coinbase to halt its prediction markets operations within the state. The Nevada Gaming Control Board ruled that, despite Coinbase’s federal strategy, its event contracts constitute unlicensed gambling under state law.

This ban arrives at a critical moment. Coinbase had just expanded its prediction market access to all 50 states in January, leveraging a partnership with CFTC-regulated Kalshi. By using Kalshi’s legal rails, Coinbase hoped to bypass the regulatory minefield that plagues competitors. Nevada’s aggressive intervention suggests that for state regulators, the technology (blockchain) matters less than the activity (betting).

“Nevada Gaming Control Board Files Civil Enforcement Action Against Coinbase”

Press release from NGCB: pic.twitter.com/mSSN6NlOZO

— Daniel Wallach (@WALLACHLEGAL) February 3, 2026

This mirrors earlier action against other platforms. Nevada has already moved to shut down Polymarket access.

This also explains why Coinbase spends so much time on compliance. While fighting for prediction markets, Coinbase is simultaneously defending its core revenue engine against the banking lobby.

This is just another battle that the Coinbase legal team is adding to its plate.

DISCOVER: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Coinbase Prediction Markets: A $20 Billion Race for Dominance

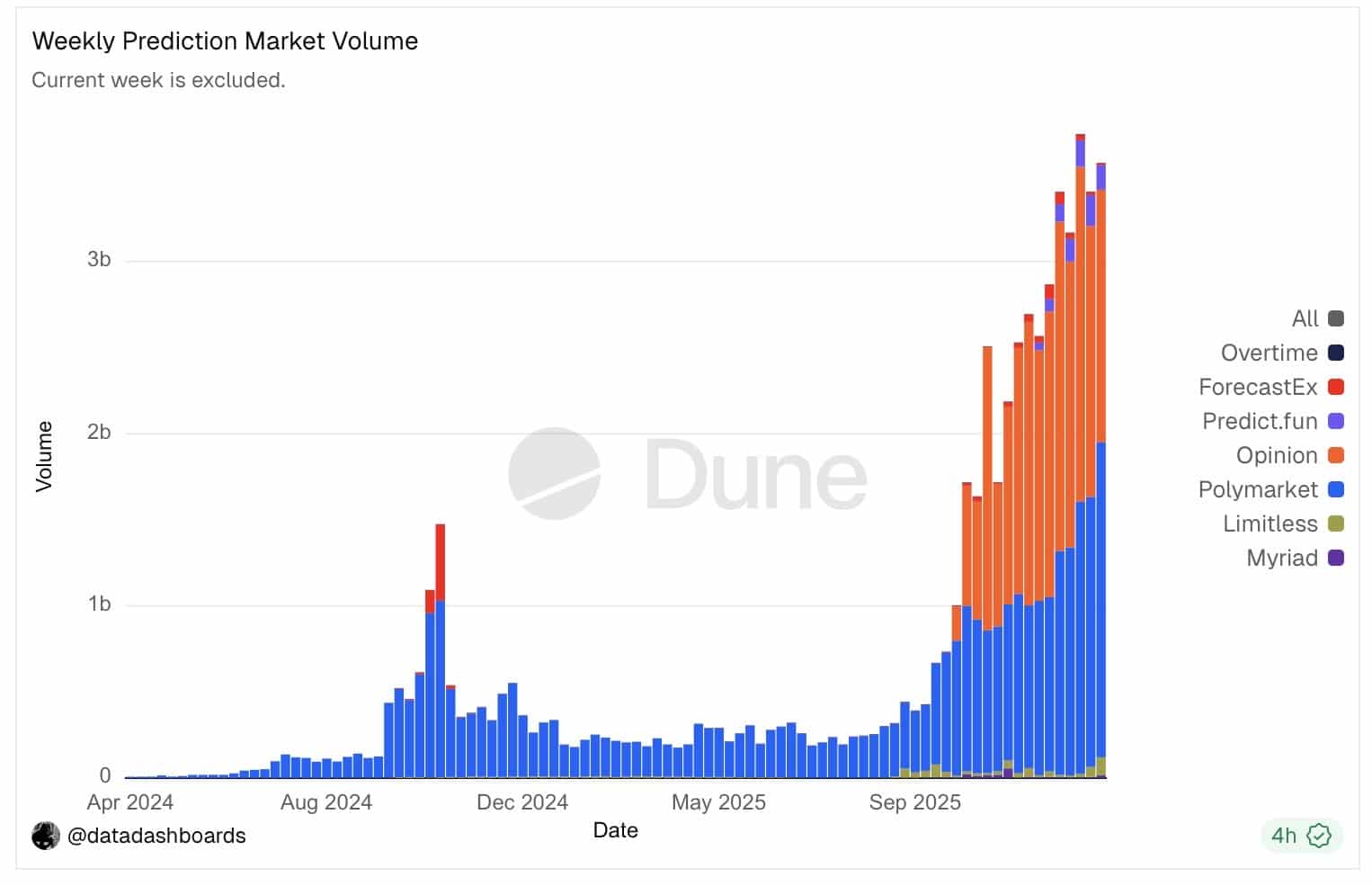

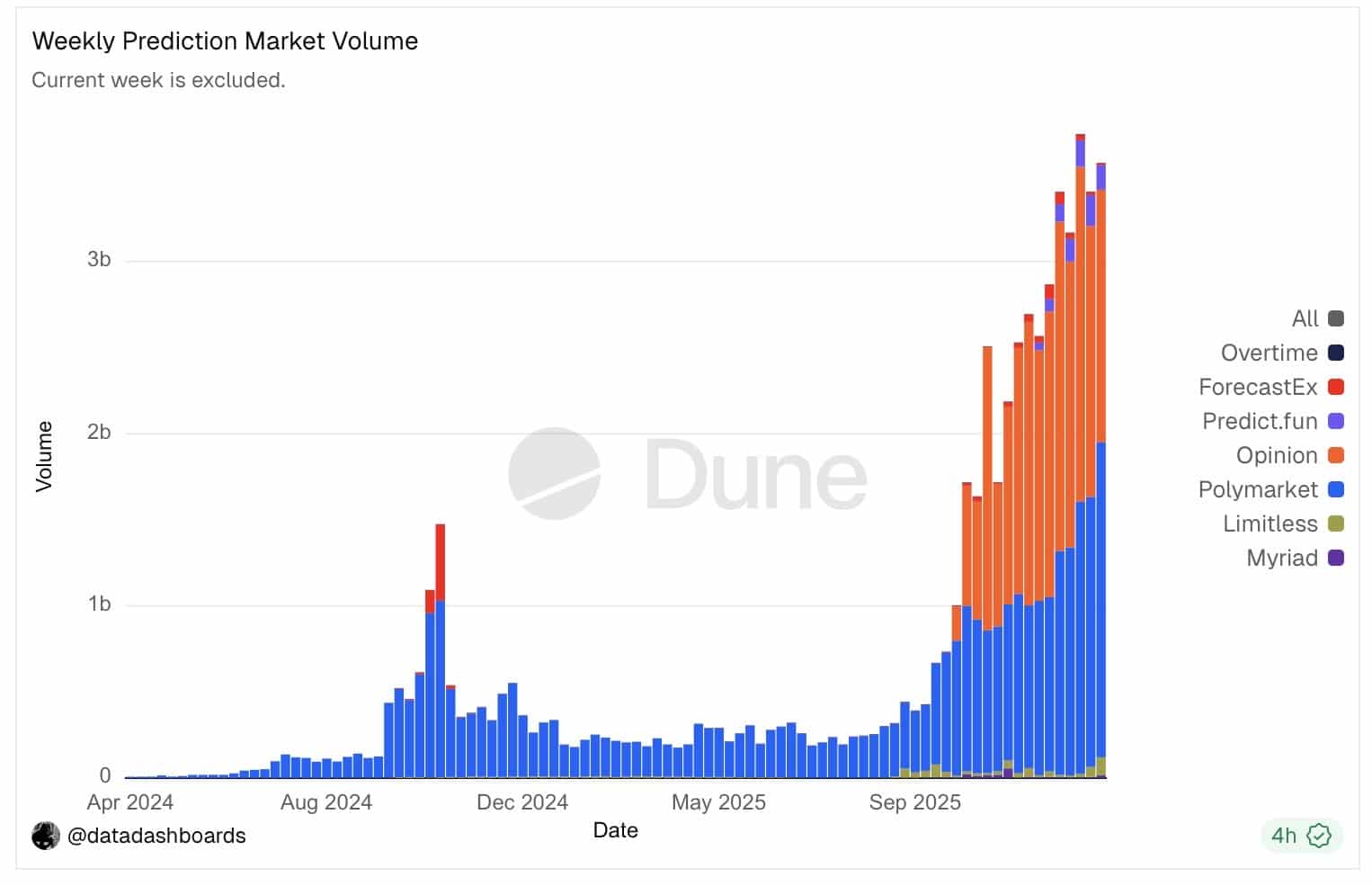

The stakes are high because the volume is undeniable. Prediction markets have evolved from a niche crypto experiment into a financial powerhouse.

- Sector Explosion: Total monthly trading volume for the sector rocketed from under $100 million in early 2024 to over $13 billion by the end of 2025.

- While Polymarket dominated 2024, Kalshi has surged in 2026. Data from January 2026 shows Kalshi processing $9.16 billion in monthly volume, edging out Polymarket’s $7.66 billion.

- Kalshi reported a staggering 1,100% year-over-year growth in 2025, driven largely by sports and political contracts that appeal to retail traders who previously used sportsbooks.

(Source: Dune)

Coinbase is attempting to capture this volume by becoming the “interface” layer: letting users trade these markets without leaving their main crypto wallet. However, the Nevada ban threatens to fracture this national rollout into a state-by-state legal battle.

EXPLORE: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

State Regulators Are Drawing a Line

U.S. regulators treat investing and betting very differently. Prediction markets blur that line, which makes states nervous. Nevada, a gambling hub, guards its licensing rules aggressively.

Coinbase’s Chief Legal Officer, Paul Grewal, has framed the Nevada suit as a “state power grab,” arguing that Congress granted the CFTC exclusive jurisdiction over these contracts. Coinbase is currently suing regulators in Michigan, Illinois, and Connecticut to establish federal preemption.

Federal agencies are also tightening definitions. The SEC now demands detailed disclosures for crypto exchange-traded products, including who runs them and how they reach users, as seen in its latest guidance on crypto ETPs.

The message is simple. If a crypto product looks like gambling, expect gambling rules.

Not all prediction markets sit in a gray zone. Kalshi operates under CFTC oversight, which gives it a clearer federal footing. That shows regulation is possible when rules are followed.

Coinbase may adjust its product or seek licenses state by state.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Nevada Moves to Block Coinbase Prediction Markets appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]