EUR Flat As ECB Leaves Rates Unch; Cable Drops On BoE’s ‘Dovish Hold’

In a surprise to traders, The Bank of England came within a vote of cutting interest rates and predicted inflation will fall below its target, a closer-than-expected decision that revived hopes of a move next month.

As Bloomberg reports, Governor Bailey was once again the swing voter in a 5-4 decision to leave rates unchanged at 3.75%, choosing to hold policy having cut at the last meeting in December.

Bailey said in a statement that “there should be scope for some further reduction in bank rate this year.”

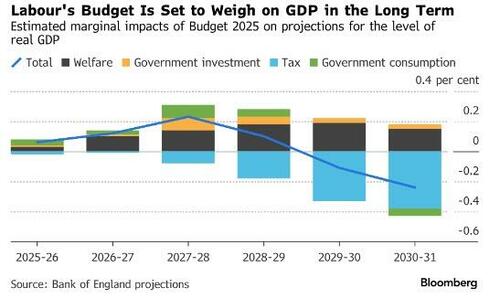

In the accompanying monetary policy report, we also got a bit more insight into how the Bank of England sees the measures announced at November’s budget impacting the economy.

The BOE delivered its verdict on Labour’s budget and growth: good in the short-run, bad in the long-run.

Measures announced in November will boost real GDP in the next three years. Beyond that, tax rises will take centre stage and weigh on the economy.

When asked if there is any scenario in which the BOE would need to hike rates, Bailey said that this was not under discussion at their meeting.

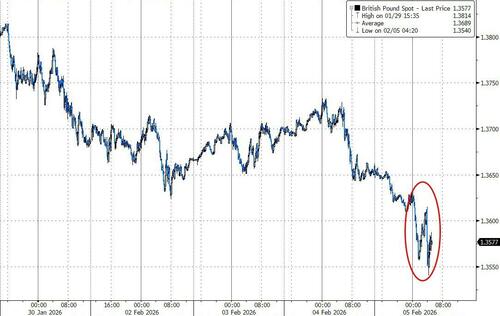

This surprisingly dovish hold pushed cable lower…

And gilt yields lower from overnight highs…

The commentary and closely split decision also pushed rate-cut odds higher for later in 2026.

Bailey says the rate-cut curve is in a “reasonable place” in a question about where the neutral rate lies, which the BOE made clear in its statement is highly uncertain.

Following the BoE’s ‘Dovish hold’, the ECB kept rates unchanged – as fully expected and reiterated its previous comments that it will follow a data-dependent and meeting-by-meeting approach to determining the appropriate monetary policy stance.

In particular, the Governing Council’s interest rate decisions will be based on its assessment of the inflation outlook and the risks surrounding it, in light of the incoming economic and financial data, as well as the dynamics of underlying inflation and the strength of monetary policy transmission.

ECB reiterates the Governing Council is not pre-committing to a particular rate path.

On growth, the ECB says the economy “remains resilient in a challenging global environment” and lists a number of factors underpinning growth:

-

low unemployment

-

solid private sector balance sheets

-

the gradual rollout of public spending on defense and infrastructure

-

the supportive effects of the past interest rate cuts

But it also repeats that “the outlook is still uncertain, owing particularly to ongoing global trade policy uncertainty and geopolitical tensions.”

EURUSD shrugged at the nothingburger from Lagarde…

In conclusion, while both central banks held rates unchanged (as expected), The ECB’s commentary was far more tame than the dovish BoE leaving traders with little incentive to push front-end Bunds around.

Tyler Durden

Thu, 02/05/2026 – 08:27

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]