Trump Unveils Mercantilism 101

By Benjamin Picton, Senior Market Strategist at Rabobank

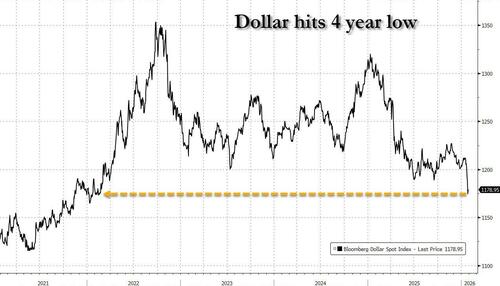

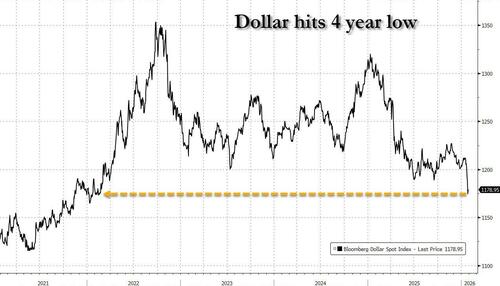

The de-Dollarisation meme rolled on yesterday as the Bloomberg Dollar spot index sank to its lowest reading since February of 2022. The fall became precipitous after Donald Trump was given an opportunity by journalists to talk up the Dollar, but instead replied “no, I think it’s great” when asked whether he was concerned about its recent drop. It would seem that there is no rage against the dying of the strong Dollar from the President.

Trump’s Treasury Secretary Scott Bessent had repeatedly assured financial markets last year that the administration still supports the strong Dollar policy. Trump himself has been a little more circumspect over the years, and implied yesterday that a weaker Dollar was good for US trade competitiveness. “Look at the business we are doing. The Dollar’s doing great.” Trump also pointed out that China and Japan have historically intervened to weaken their own currencies – thereby boosting trade competitiveness at the expense of trading partners. This is Mercantilism 101, as regular readers of this Daily would have been aware of for years.

On Monday we wrote about the Triffin Dilemma, and particularly the necessity of reserve currency issuers running trade deficits. The Triffin Dilemma also describes why the global reserve currency might be artificially strong as there is always a bid to hold it as a reserve asset and it is always demanded by other countries to conduct trade – even trade that does not involve the country issuing the reserve currency.

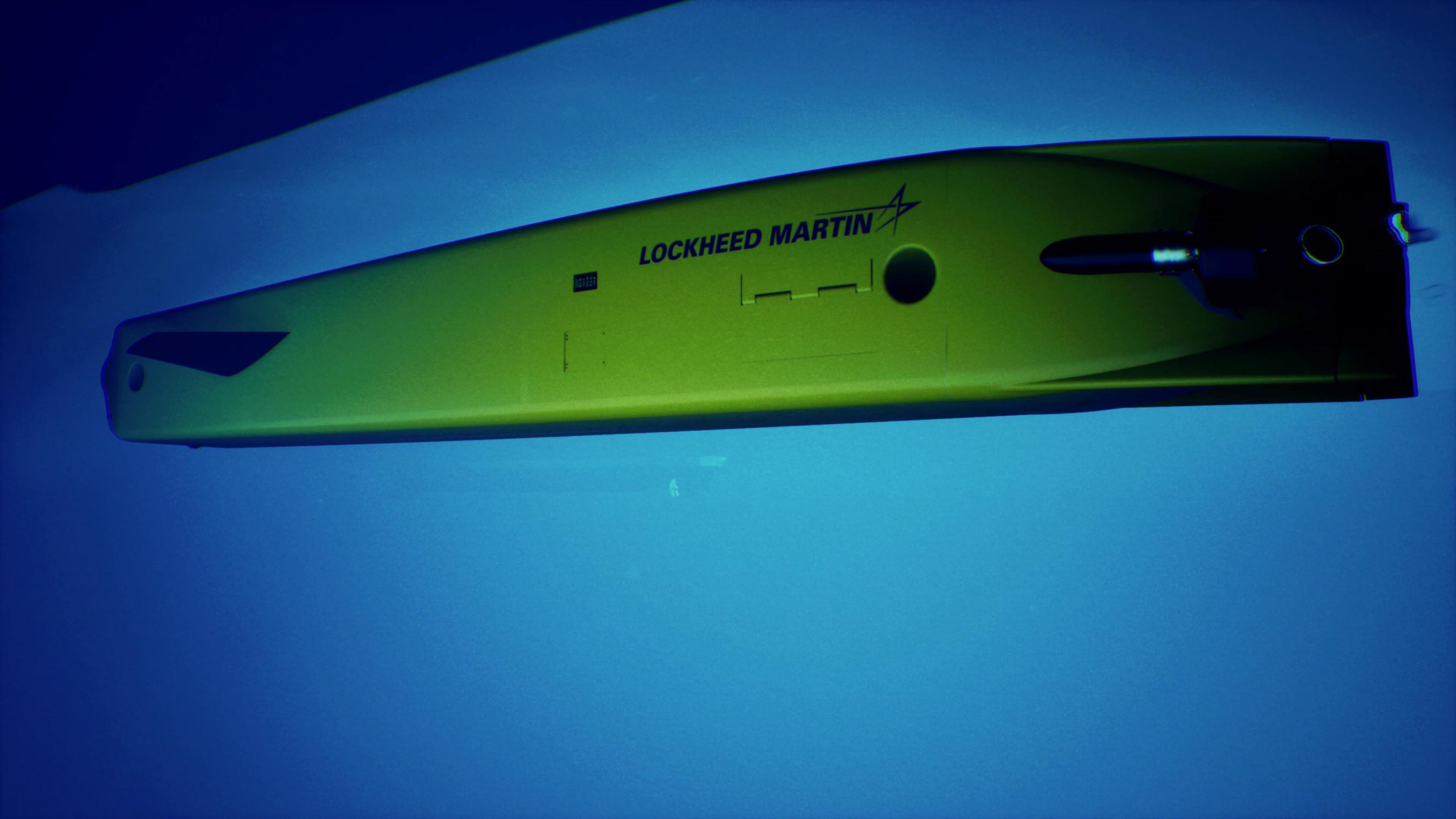

Along with the US Navy’s policing of global sea lanes at no cost to other countries (who benefit from absence of piracy, etc), the provision of the Dollar as a global medium of exchange is one of two public goods that Council of Economic Advisors Chair and now Fed Governor Stephen Miran (and author of the Mar-A-Lago accord) argues the US provides to other countries an substantial cost to itself. Under that framing, if the Dollar can be weakened without losing its status as the reserve currency, the Trump administration may consider that a welcome development.

Equity markets certainly considered it a welcome development. The S&P500 gained 0.41% yesterday and the NASDAQ was up 0.91%, but the Dow Jones finished well in the red. US equities are in the black for the year-to-date, and are performing similarly to European stocks, but the standout markets for the year so far appear to be in South America, where US intervention in Venezuela under the revamped Monroe Doctrine and a shift toward pro-US right wing government seems to be helping market sentiment. Indices in Peru, Chile, Colombia and Brazil are all well into double-digit growth YTD. Year-to-date growth in Mexican and Argentinian indices remains in the single-digits, but is still outperforming Asian, European and US markets.

Another excuse to sell Dollars was provided by the Conference Board’s latest consumer confidence report, which showed overall confidence falling to the lowest levels since 2014 (i.e. lower than during the pandemic) and undershooting the estimate of every analyst on the Bloomberg survey. The present conditions index fell to a five year low and the expectations index fell 9.5 points to 65.1 – its lowest reading since the immediate aftermath of Liberation Day and well below levels typically consistent with impending recession!

The weak confidence reading provides an interesting backdrop for today’s FOMC rate decision. There is virtually no chance of a change in the Fed Funds rate today, but Fed-dated OIS has slithered a little closer to a cut being fully priced for June and two more cuts fully priced for the year. The Conference Board report’s emphasis of labor market conditions may be of particular interest as last week’s more consumer spending-oriented University of Michigan confidence index rose to even stronger levels while inflation expectations fell. Personal spending reported earlier in the week was also reasonably strong.

Of course, a weaker US Dollar is providing an endogenous easing in financial conditions that – taken together with core PCE running at 2.8% YoY and the apparent feud between the FOMC and the White House – may cause the Fed to resist further monetary easing. Jerome Powell seemingly made it clear in his sensational press conference following the Department of Justice’s issuance of grand jury subpoenas that he will not go gently into that good night.

There are others raging against the dying of the light, too. Mark Carney is the most Davos of Davos men and in his well-publicized speech pronouncing the death of the liberal world order he unpacked what he thought that would mean for global prosperity: “a world of fortresses will be poorer, more fragile and less sustainable… Allies will diversify to hedge against uncertainty… They’ll buy insurance… to rebuild sovereignty.” He then said that “…the cost of strategic autonomy can be shared. Collective investments in resilience are cheaper than everyone building their own.”

Herein lies the rub, Carney recognises that strategic autonomy is desirable, but then immediately makes the mistake of trying to achieve strategic autonomy through multilateral coordination. That is a re-run of liberal globalism, but on a smaller scale. True strategic autonomy would logically require greater autonomy, not continued integration. To suggest otherwise is to forget Lord Palmerston’s dictum “we have no permanent friends, only permanent interests.”

The European Union is similarly raging against the change in the world order. The EU just pushed back against the protectionism trend by announcing that it has concluded “the mother of all trade deals” with India, forming what Ursula von der Leyen calls a free trade zone of 2 billion people. This follows a similar deal with the South American Mercosur bloc after years of drawn out negotiations. Of course, the India deal isn’t actually for “free” trade, but for preferential trade. Tariffs will be eliminated or cut on 96% of EU exports to India, while the EU will do the same for 99% of India’s exports to the EU.

Europe will be granted improved market access for many agricultural products, but India’s dairy sector will see no reduction in protection. Similarly, European beef and poultry producers will remain shielded by protectionist measures and Europe’s strict regulatory regime may pose hurdles for Indian products that, in theory, are now granted greater access to the European market but may be waylaid by Europe’s powerful bureaucracy.

Alongside the trade deal, Europe and India have signed a new pact for security and defense partnership. India’s defense minister on Tuesday said that India’s defence industry can play a meaningful role in the EU’s ReArm Initiative and that the partnership will “become a force multiplier by integrating supply chains for building trusted defence ecosystems”.

This talk of integrating supply chains and trusted defense ecosystems sounds a lot like the arrangement the EU has (had?) with the United States. It also sounds a lot like Mark Carney’s prescription of integration on a somewhat-less-than-global scale. What it does not sound like is strategic autonomy – or supply chain sovereignty, and it is likely to cause some consternation in Paris, where Emmanuel Macron has been vocal about the need for Europe to prioritize indigenous industry in arms procurement.

Perhaps Europe still isn’t ready to admit that the light of the liberal international order really is dying.

Tyler Durden

Wed, 01/28/2026 – 10:15

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]