Oil Prices Drop As Geopolitical Risk Eases, Gasoline Stocks At Highest Since 2020

Oil prices are lower this morning after Ukrainian President Zelenskiy said that the US, Russia and Ukraine will meet in coming days for trilateral team meetings.

WTI dropped below $60 as Zelenskiy urged Russia to be “ready for compromises.”

Any breakthrough to end Moscow’s war in Ukraine could iron out supply disruptions and end sanctions on Russian crude in an already oversupplied global market, sapping a longstanding geopolitical risk premium.

Adding to pressure on prices, Kazakhstan is getting closer to ending a weeks-long export constraint as repairs at a key Black Sea oil-loading facility near completion. A backlog of cargoes at the Caspian Pipeline Consortium terminal is easing.

And supplies are also returning to the global market from Venezuela.

Easing tensions returned the focus to market fundamentals, as traders look to rising global inventories as supply runs well ahead of demand (seemingly confirmed by a large build in crude and product stocks reported overnight by API).

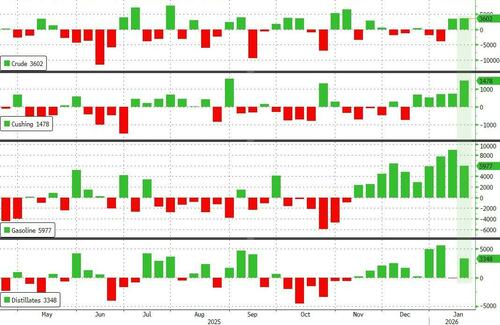

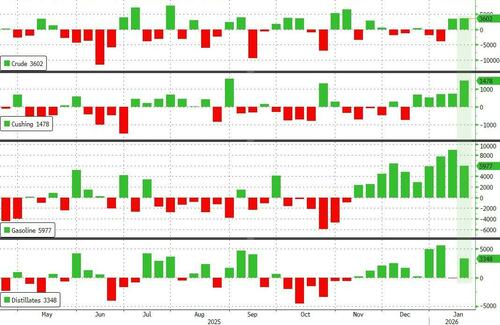

API

-

Crude +3.04mm

-

Cushing +1.2mm

-

Gasoline +6.2mm

-

Distillates -33k

DOE

-

Crude +3.6mm

-

Cushing +1.478mm – biggest build since Aug 2025

-

Gasoline +5.977mm

-

Distillates +3.348mm

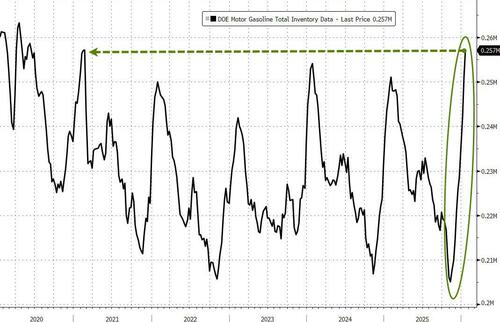

The official data showed inventory builds across the board with Cushing stocks jumping by the most since August and gasoline inventories up for the 10th week in a row

Source: Bloomberg

Gasoline inventories are now at the highest level since 2021 and the highest seasonal level since 2020. This comes as demand plummeted to the lowest weekly level since January 2023. East Coast gasoline stocks posted their largest weekly move since the end of 2021.

Source: Bloomberg

US Crude production dipped a little from record highs as rig counts continue to trend lower…

Source: Bloomberg

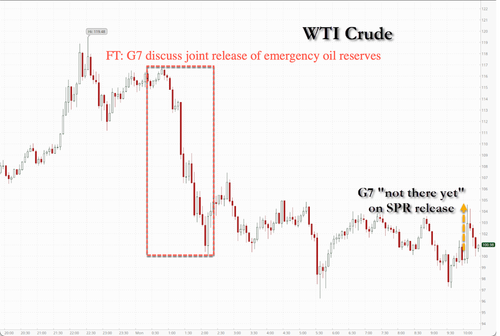

WTI extended losses after the across the board builds…

Source: Bloomberg

“The geopolitical temperature has eased a few degrees,” said Ole Sloth Hansen, a strategist at Saxo Bank A/S in Copenhagen.

But with a range of supply threats unresolved, and colder weather set to bolster US demand, prices will likely “hold firm.”

Tyler Durden

Thu, 01/22/2026 – 12:05

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]