Solana co-founder Anatoly Yakovenko started a heated debate after saying blockchains must keep changing or risk fading away. At the same time, RWAs (real-world assets) on Solana crossed $1 billion in value.

Yakovenko’s view contrasts with Ethereum co-founder Vitalik Buterin’s position. Buterin supports a “walkaway test,” where the network should function reliably for the long term even without constant core developer updates, focusing on stability and immutability once mature.

I actually think fairly differently on this. Solana needs to never stop iterating. It shouldn’t depend on any single group or individual to do so, but if it ever stops changing to fit the needs of its devs and users, it will die.

It needs to be so materially useful to humans… https://t.co/itqr1b5az4

— toly

(@toly) January 17, 2026

The debate highlights two directions: Solana prioritizes continuous upgrades for new features and real-world use, while Ethereum aims for a stable foundation that minimizes future changes.

This moment lands during a wider shift in crypto. More blockchains now chase real adoption, trying to break the crypto cycle. Tokenized versions of stocks and Treasuries sit at the center of that push.

That mix of philosophy and hard numbers raises a simple question: is Solana building something that lasts?

EXPLORE: How Much Money You Should Save in 2026 (Amount by Age)

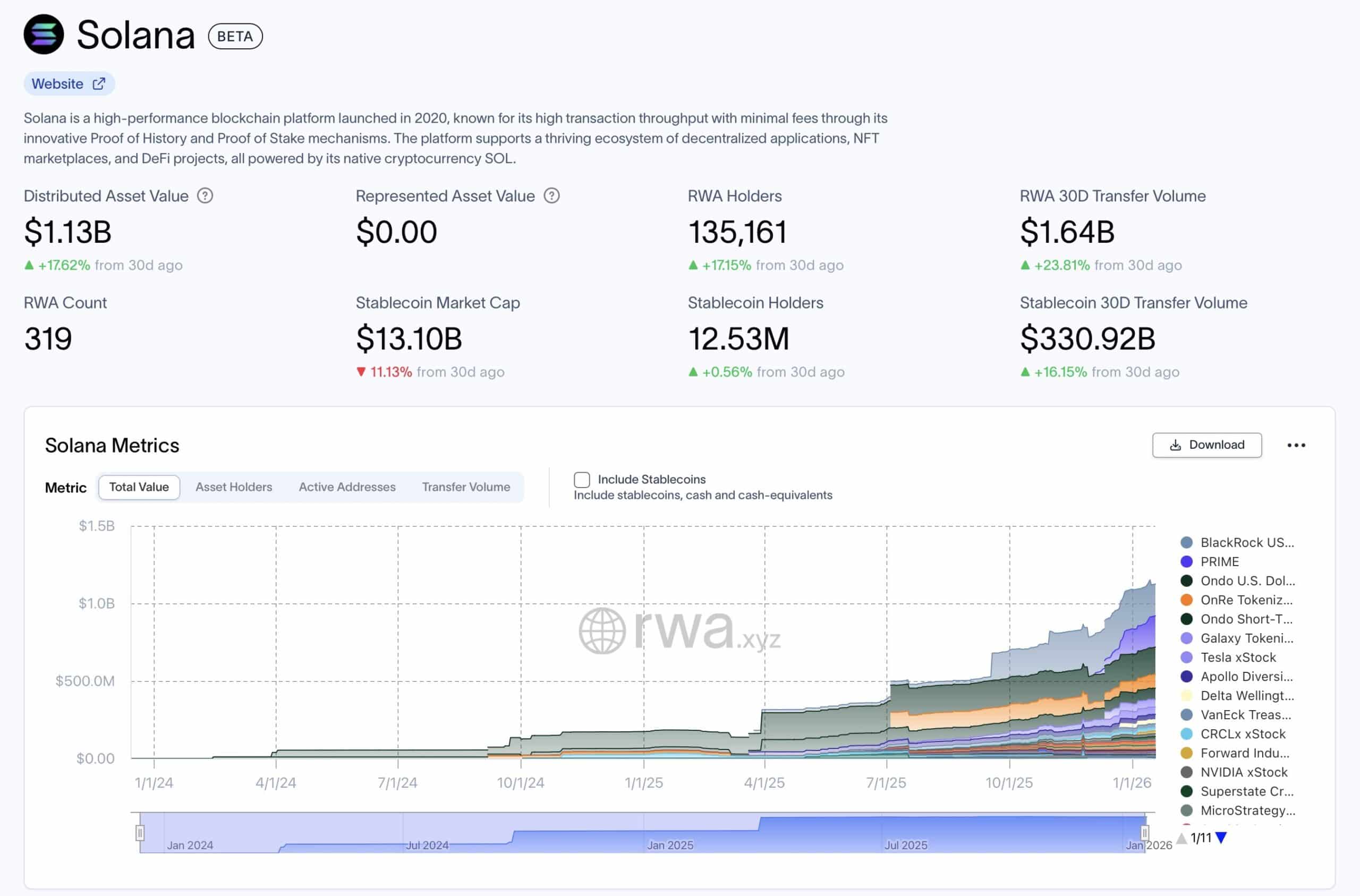

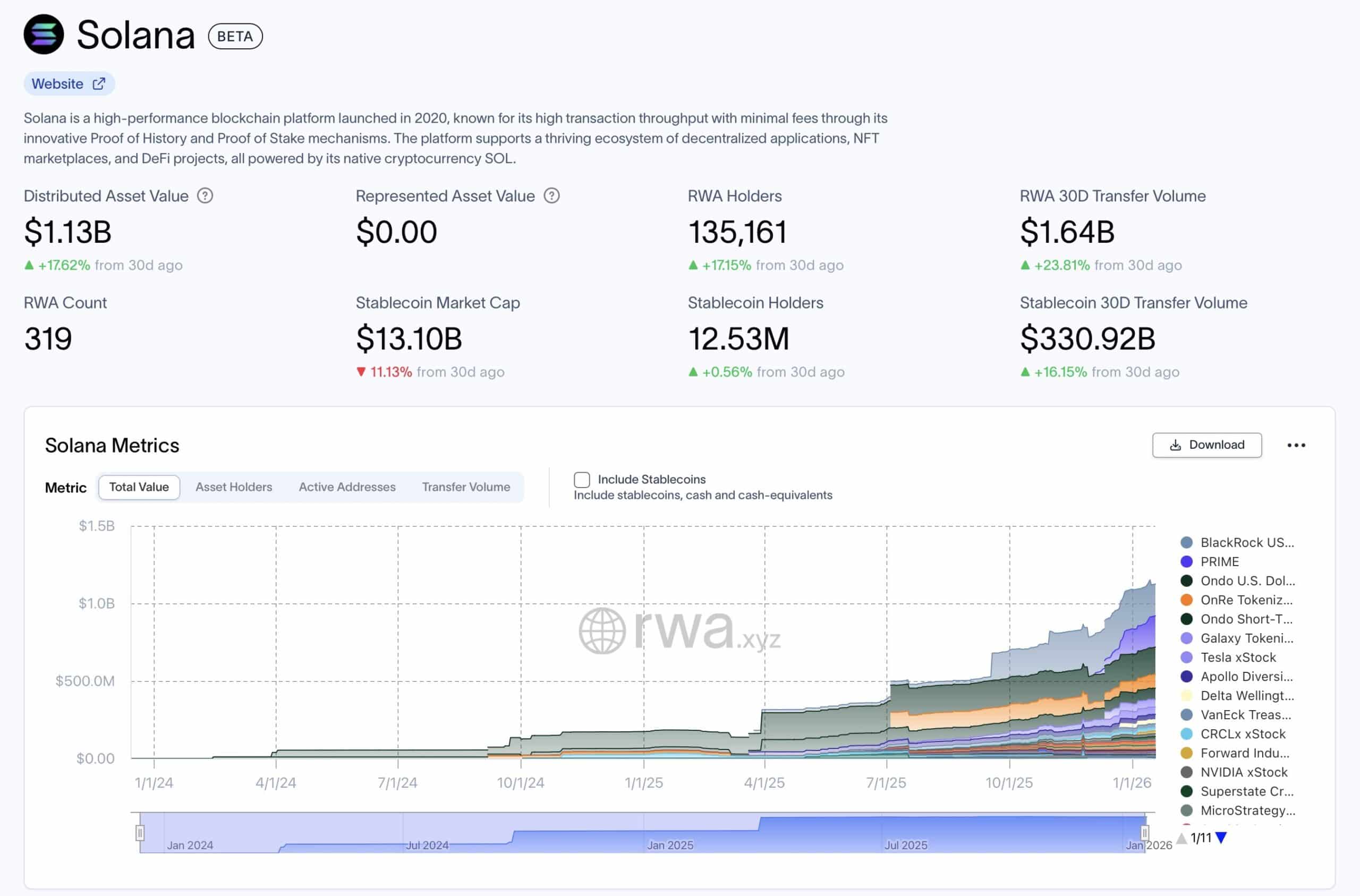

What Are Real-World Assets? A Sector In Rapid Expansion

RWAs are traditional assets like U.S. Treasuries, public company shares, and funds turned into blockchain tokens for easier trading and yield. Major players include BlackRock’s tokenized fund, Ondo’s yield products, and others, drawing institutional interest due to Solana’s speed and low costs

RWAs on Solana now exceed $1 billion. That places Solana as the third-largest blockchain for RWA tokenization, excluding stablecoins.

(Source: App RWA)

This builds on Solana’s institutional adoption trend that keeps pulling traditional finance closer.

EXPLORE: Pump.fun is Up 27%—But What Happens When Bitcoin Copies Its Blueprint?

Is Solana Building for the Long Term? $1 Billion RWAs Milestone

The combination of Yakovenko’s focus on evolution and the $1 billion RWA milestone shows Solana targeting lasting utility. Institutions are increasingly using the network for tokenized assets, which builds trust and brings in capital.

Solana’s RWA ecosystem has officially crossed $1 billion in TVL, a new ATH.

It’s time to accelerate. pic.twitter.com/wx2ycBHU13

— Solana (@solana) January 15, 2026

RWA holders on Solana grew to over 126,000 wallets, up 18% in the last 30 days. Investors now access yield products without a traditional brokerage.

Builders also benefit. More financial products mean more fees and activity. That supports validators and strengthens Solana staking infrastructure, which helps secure the network.

On the price side,

2.21%

Bitcoin

BTC

Price

$93,209.47

2.21% /24h

Volume in 24h

$34.37B

<!–

?

–>

Price 7d

is trading around $133–$134, down about 6% in the last 24 hours amid broader market pressure from trade tensions. This follows a drop below key moving averages, with $59 million in long liquidations adding to the sell-off. Support holds near $123–$130, while resistance sits at $140–$145.

Despite the dip, on-chain activity remains strong, and the recent RWA milestone provides underlying support for potential recovery if sentiment improves.

DISCOVER:

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Solana RWAs Hit $1B as Yakovenko Issues ‘Adapt or Die’ Warning appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]