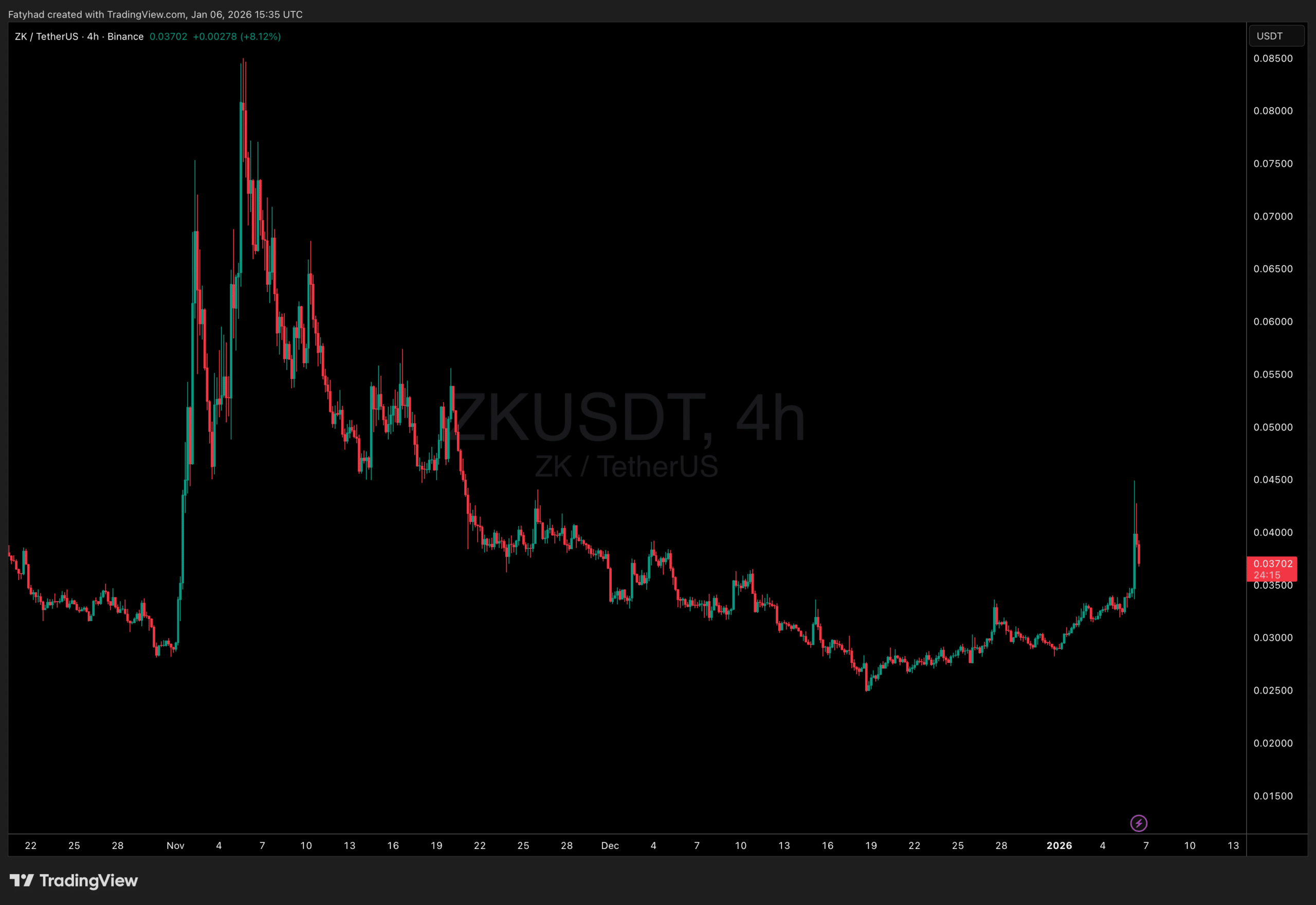

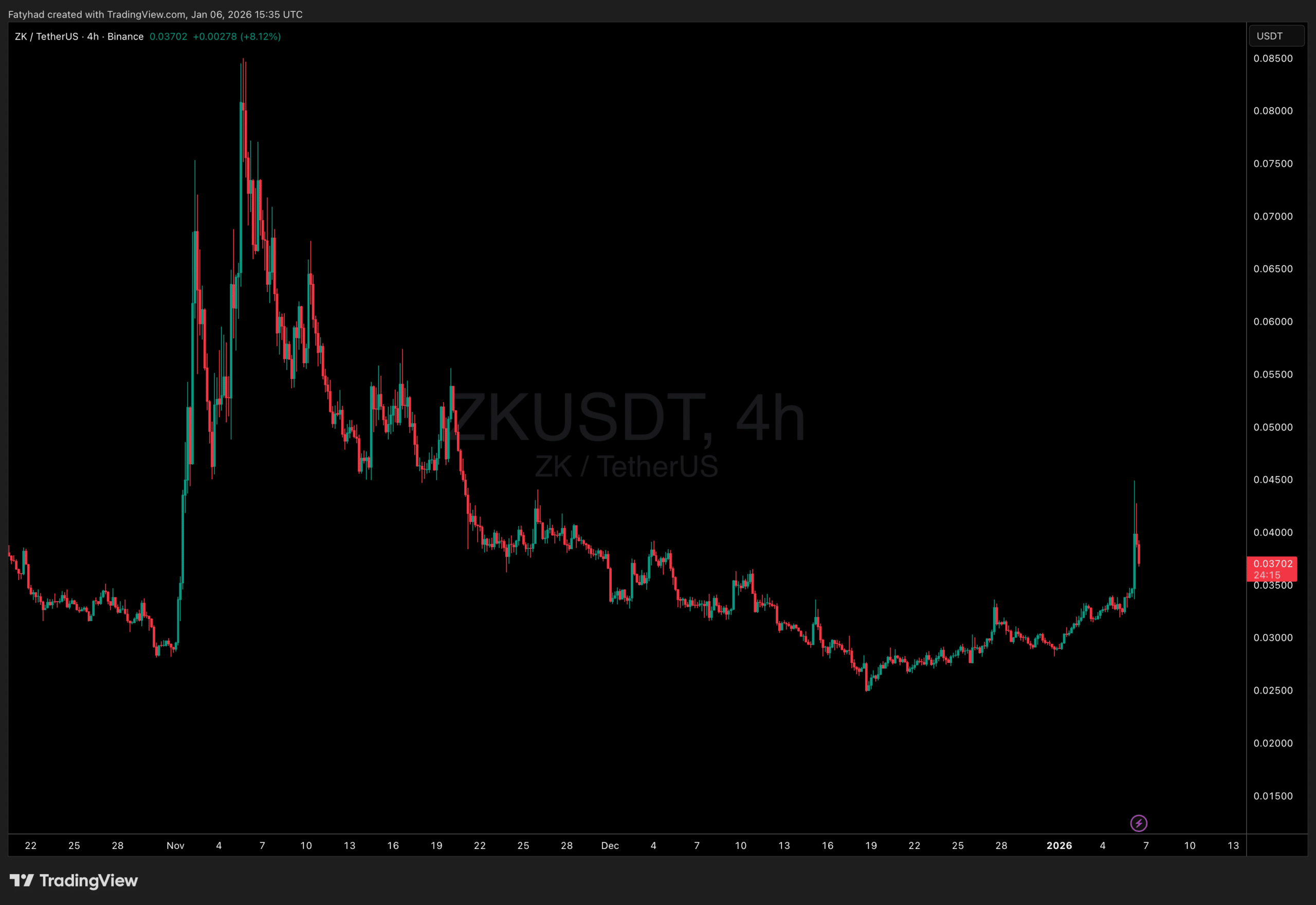

ZKsync’s ZK token hit a one-month high following the ZK Upbit listing, as the Korean exchange added new trading pairs. ZKsync is a Layer-2 scaling solution for Ethereum that uses zero-knowledge rollups to improve transaction speeds and lower costs on the network, with the ZK token serving as the ecosystem’s native utility and governance asset.

Korean won markets on Bithumb and now Upbit account for a growing slice of ZK’s trading, with one venue already handling more than 16% of volume. This fits a broader pattern in altcoins where fresh exchange listings, especially in Korea, trigger pumps that unfortunately don’t always last.

While the Upbit listing likely drove the short-lived pump, ZK’s updated tokenomics could play a more meaningful role in shaping longer-term price action.

(Source: Tradingview)

What Does the ZK Pump After Upbit Listing Actually Mean?

ZK is the token tied to ZKsync, a so‑called “Layer‑2” network that helps Ethereum handle more transactions cheaply and quickly.

Upbit is one of South Korea’s biggest crypto exchanges, so a listing there opens ZK to a large, very active trading crowd. Another ZK‑related token, zkPass (ZKP), also exploded when Upbit listed it, which shows how strongly Korean traders can move prices on new coins.

This pump doesn’t happen in a vacuum. ZKsync has been busy on the technical side, rolling out upgrades that pushed throughput up to around 15,000 transactions per second and attracted institutional users like tokenized funds and real‑world assets. So there is a real network behind the token, even if the listing hype steals the spotlight today.

ZKsync (#ZK) and Zcash (#ZEC) surged into the global top five for perps trading volume over the weekend, ranking fourth and fifth with volumes of $2.98 billion and $2.23 billion, respectively, just behind SOL, BTC, and ETH.

The spike followed a public endorsement from Ethereum… pic.twitter.com/XGSRecmaHD

— Laevitas (@laevitas1) November 2, 2025

At the same time, other Layer‑2s like Arbitrum and StarkNet also report rising fees and usage, which means more people pay to use these scaling networks.

EXPLORE: Asia’s Crypto Acceleration: What Korea Blockchain Week 2025 Reveals

ZK Token Surges as New Tokenomics Link Value to Network Fees

Even if the post-listing pump proved short-lived, recent changes to ZK’s tokenomics could introduce more sustained buy pressure, making the token more relevant from a longer-term perspective. A new proposal aims to link ZK’s value directly to network revenue through mechanisms such as buybacks, token burns, and staking rewards. In simple terms, holders and stakers could benefit more directly as network activity increases and fee revenue grows.

That model is closer to a company sharing profits with shareholders than a meme coin living only on hype. Earlier stages of this token utility overhaul already saw ZK post weekly gains above 87%. If the revenue link works as advertised, ZK behaves less like a random casino chip and more like a “network equity” token that tracks real usage.

A pure listing pump on a token with no clear use case usually fades once early traders take profits. A pump on a token where fees, staking, and burns connect to on‑chain activity can still be very risky, but at least you can point to something concrete that drives value over time.

If you want to understand how exchange access shapes altcoin momentum more broadly, check our coverage of altcoin ETF demand and exchange listings in 2026. Both stories show the same theme: when big venues open the door to a new asset, money tends to rush in, at least at first.

Risks of Chasing ZK After a Korean Exchange Pump

Now the hard truth: listing pumps are dangerous to chase, especially if you are new. Korean exchanges like Upbit and Bithumb helped send ZK and ZKP higher, but that same fast money can leave just as quickly. If you buy after several green candles in a row, you are often the exit liquidity for traders who got in earlier.

These markets move on emotion as much as fundamentals. Liquidity clusters on specific venues and local fiat pairs, so if Korean demand cools, volumes can drop and price support can vanish. Our piece on hidden venue gaps in crypto trading explains how trading on a few crowded platforms can amplify both gains and losses for regular users.

If you want to get exposure to Layer‑2s like ZKsync, a safer approach is to monitor the price action post-listing volatility. Decide how much of your portfolio you want in higher‑risk altcoins and stick to it. Never chase candles on news days, and especially never invest rent money.

ZK’s Upbit listing may mark another step in the rise of Layer‑2 tokens, but the real test comes after the hype cools and only actual network usage remains. If ZKsync keeps processing real transactions and its revenue‑sharing model delivers, price will have plenty of time to reflect that without you needing to gamble on day‑one spikes.

DISCOVER: 10+ Next Crypto to 100X In 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post ZK Skyrockets on Upbit Listing – How Long Can the Hype Last? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]