Grayscale’s Ethereum ETF (ETHE) just paid out its first batch of Ethereum

2.93%

Ethereum

ETH

Price

$3,240.91

2.93% /24h

Volume in 24h

$22.53B

<!–

?

–>

Price 7d

staking rewards to shareholders, a first for any US spot crypto product. ETH USD is hovering around $3,250 following the news, up +2.5% in the past 24 hours, as early strength across the broader crypto market in 2026 continues.

Traders are now weighing not just price moves but also on-chain yield from regulated products that track the ETH USD price. This step moves Ethereum ETFs from merely tracking the chart to earning passive income from the network itself, setting up a new race among issuers to offer yield.

HISTORY MADE: First ETH ETF Staking Payout.

Grayscale ($ETHE) just distributed the first-ever staking rewards to US shareholders.

* Crypto now pays you to hold

* Yield: ~3-4% (passed through)

* The “Internet Bond” thesis is realBlackRock to follow?#ETF #Grayscale #ETH pic.twitter.com/OpV3PJkc83

— Blockchain Hive (@_BlockchainHive) January 6, 2026

Why is Grayscale’s Ethereum ETF Staking Payout Important and Why Should New Investors Care?

When you stake Ethereum, you lock up your ETH to help secure the network and earn rewards, similar to interest on a savings account, but paid in ETH and tied to network security. To date, US spot crypto ETFs have only tracked price and have not supported staking, even though staking rewards are a significant part of how Ethereum rewards holders on-chain.

Grayscale switched that model on for its US Ethereum products in October 2025 and has now sent out the first batch of rewards. ETHE shareholders will receive $0.083178 per share, covering rewards earned from October 6 through year‑end, for investors on record as of January 5.

That means if you held ETHE in a regular brokerage account, you now get a share of real on-chain staking income without ever running a validator, using a DeFi app, or moving coins off your exchange, which is being lauded as a game-changer for the TradFi adoption of cryptocurrency.

Before Grayscale enabled Ethereum staking for its ETHE product, ETFs were purely for price exposure to an asset, and investors were required to ‘go on-chain’ to access DeFi tools and earn staking rewards.

The SEC previously forced issuers to remove staking, but 2025 guidance and a change in IRS rules opened the door for products that both track ETH and earn rewards. Now, yield is another factor to consider when comparing Ethereum ETF products.

If you want a broader overview of how these payouts began, we covered it in more detail in our earlier piece on ETH staking payouts. For context on Ethereum’s recent moves around the $3,200 mark and mainstream adoption, you can also check our coverage of Ethereum’s price action and new use cases.

DISCOVER: 16+ New and Upcoming Binance Listings in 2026

How Could Staking ETFs Reshape ETH USD Investing and Regulation?

On the industry side, this is not happening in a vacuum. Grayscale manages around $31Bn across its products and wants to stay ahead of rivals such as 21Shares and Bitwise, which are also pushing staking features for ETH USD and Solana products, according to Reuters. Think of it like banks suddenly offering interest on checking accounts again: once one does, others feel pressure to match or risk losing customers.

Regulation sits at the center of this shift. The Securities Act of 1933 focuses on clear disclosure so investors know what they are buying. Still, it doesn’t tell funds how to run their strategies day-to-day, which Grayscale is leveraging with its Ethereum staking offering.

For everyday investors, this may signal greater confidence from regulators in Ethereum staking overall. The US Treasury and IRS gave guidance last year that explicitly explained how ETFs can stake proof‑of‑stake assets like Ethereum and Solana

4.23%

Solana

SOL

Price

$137.46

4.23% /24h

Volume in 24h

$5.28B

<!–

?

–>

Price 7d

and pass rewards to investors, which Treasury Secretary Scott Bessent called a “clear path” for retail access.

That clarity is one reason we’re now seeing staking‑enabled products, not just Ethereum but a growing universe of yield‑focused crypto ETPs that sit alongside broader ETF trends we cover in our institutional ETF outlook.

It also tightens competition inside the Ethereum ETF category. Investors won’t just compare fees and tracking error anymore. They will look at “Who stakes? What yield do they pass through after fees? How often do they distribute?”

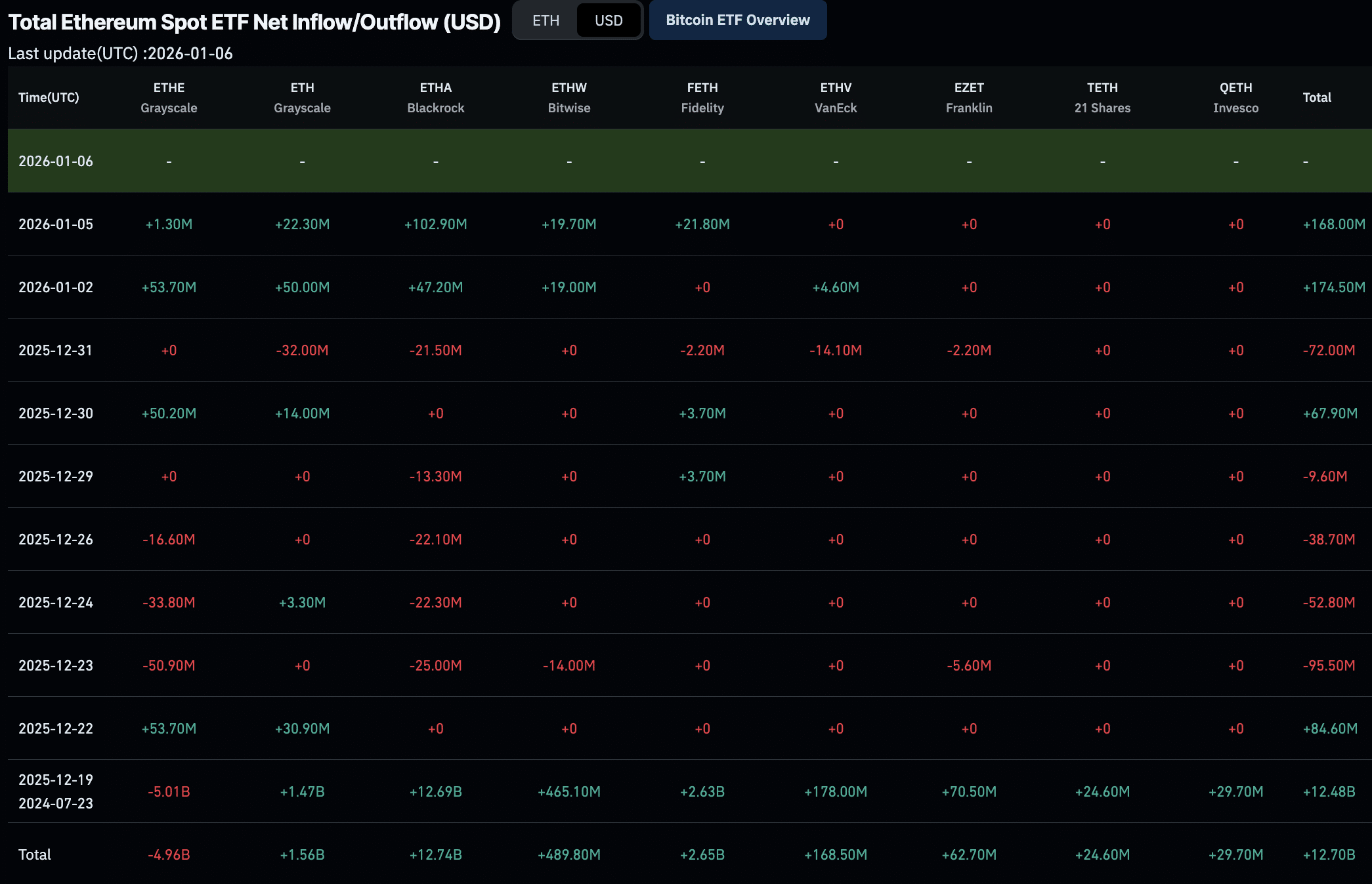

That shift may help ETH appear more attractive relative to zero‑yield assets in a world where crypto funds already compete for inflows, a dynamic we see across ETH USD and XRP products in our coverage of crypto ETF flows.

The official prospectus filing for ishares Staked Ethereum ETF, their fourth crypto filing. Spot btc, eth, btc income and now this. pic.twitter.com/M6vRxiGm78

— Eric Balchunas (@EricBalchunas) December 8, 2025

What are the Risks to Staking ETFs Like Grayscale’s ETHE?

Getting staking rewards through an ETF feels safer than navigating on-chain, which poses many risks and roadblocks for non-tech-savvy investors, but it doesn’t completely remove the crypto risk. You still carry Ethereum price risk; if ETH USD declines by -30%, a few percentage points of staking yield will not protect your portfolio from such a downturn.

On top of that, staking rewards are income in the eyes of the taxman. The new IRS rules aim to clarify when and how ETFs recognize and pass through staking rewards, but for you, that may appear as taxable income even if you reinvest it. This can lead to tax complications, and many investors are turning to a tax professional to assess their position, which comes at a cost.

New investors are cautioned to treat staking‑enabled ETFs as a convenience feature, not a reason to overexpose themselves to ETH USD. If you are already seeking Ethereum exposure and prefer a brokerage account over self‑custody, then a staking ETF might rank higher on your shortlist.

As more issuers roll out staking across Ethereum and Solana products, expect a steady drip of ‘yield wars’ in ETF marketing. Your edge won’t come from chasing the highest advertised APR; it will come from knowing what you own, how it earns those rewards, and how much risk you are really taking for that extra passive income.

EXPLORE: The 12+ Hottest Crypto Presales to Buy Right Now

Follow 99Bitcoins on X for the Latest Market Updates and Subscribe on YouTube for Daily Expert Market Analysis

The post Grayscale’s Ethereum ETF Starts Paying Staking Rewards: Huge News for ETH USD Price? appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]