At Korea Blockchain Week 2025, founders, traders, and regulators all pushed the same message: Asia now drives a huge share of global Bitcoin and Web3 activity. APAC crypto transactions reached about $2.36 trillion over the last year, the fastest growth of any region. For regular investors, this shift changes where liquidity flows, which rules matter, and where the next big opportunities may appear.

Japan led crypto growth in APAC, with on-chain activity up 120% year over year, driven by regulatory reforms, tax changes, and progress on yen-backed stablecoins, while other major markets grew from already higher adoption bases.

Korea Blockchain Week – Why Does Asia Suddenly Matter So Much for Bitcoin and Web3?

When we say “APAC” (Asia-Pacific), we mean a huge region that includes India, South Korea, Hong Kong, and more. Together they now form the fastest-growing crypto market worldwide, moving trillions in value every year. Think of it as the busiest new highway in global crypto traffic.

APAC processed about $2.36 trillion in crypto volume as of mid‑2025, up 69% year over year. That growth outpaces the U.S. and Europe. For us traders, that means more trading pairs, more liquidity, and often faster product experimentation coming out of Asia before it reaches Western platforms.

South Korea plays a special role here. Local exchanges often trade Bitcoin at a higher price than the rest of the world, nicknamed the “kimchi premium.” This premium tells you Korean retail demand stays strong, even when other markets cool off. At the same time, Korean platforms test new products with stablecoins: tokens like USDT and USDC that track fiat currencies and behave like on‑chain dollars.

India also tops the global

0.87%

Bitcoin

BTC

Price

$92,528.61

0.87% /24h

Volume in 24h

$42.82B

<!–

?

–>

Price 7d

adoption charts. India ranks number one for grassroots crypto use. That means everyday people, not just hedge funds, use Bitcoin and stablecoins for savings, trading, and payments.

What Does Asia’s Crypto Push Mean for Everyday Investors?

Asia’s rise improves overall liquidity, which is just a fancy word for how easy it is to buy and sell without moving the price too much. When $2.36 trillion in volume flows through APAC, big moves in Seoul or Mumbai can ripple into your Binance or Coinbase chart. Price action follows the money.

Hedge funds now chase this flow. Hedge fund exposure to Asian markets hit a five‑year high in mid‑2025. That matters because professional traders bring both liquidity and volatility. You get tighter spreads and deeper order books, but also sharper reactions to news.

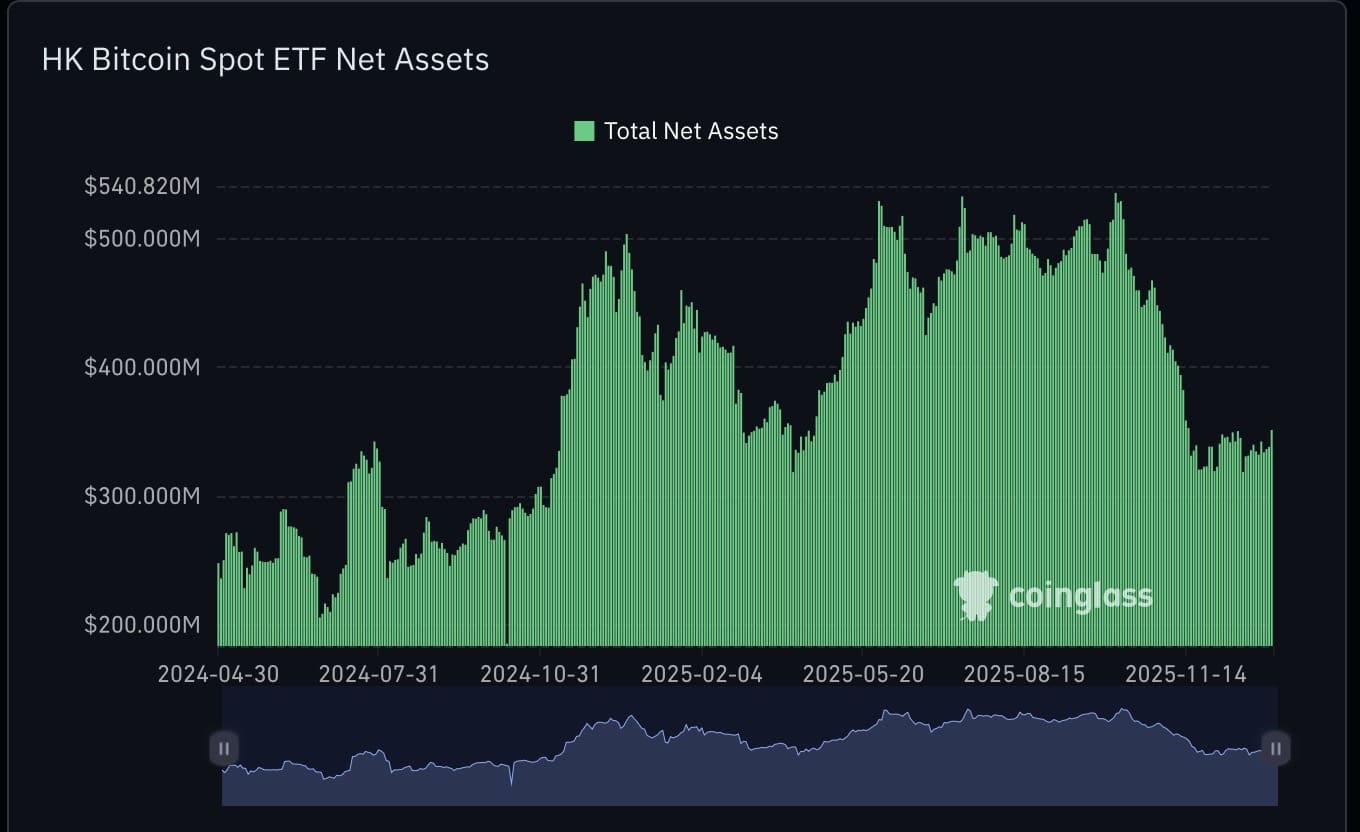

On the product side, Hong Kong approved spot Bitcoin and Ether ETFs in 2024. This move turned Hong Kong into a front‑runner for crypto ETFs in Asia. Spot ETFs act like regular stock‑market funds that hold Bitcoin directly, so traditional investors can get exposure without running a wallet.

(Source: Coinglass)

Asia tests new rails for stablecoins and regulated ETF products, then the rest of the world adapts.

How Should You Adjust Your Crypto Strategy Around Asia’s Rise?

When you track Bitcoin or altcoin prices, pay attention to Korean exchange premiums, India adoption news, and Hong Kong ETF flows. They often hint at demand before Western headlines pick it up.

Second, remember that fast growth also increases risk. Regulatory approaches across APAC differ a lot: some countries welcome crypto, others tighten rules overnight. That can affect exchange access, token listings, and even stablecoin usage. Never park money you cannot afford to lose on a single regional platform or token theme.

Third, use this information to build a calmer long‑term plan instead of chasing every hype wave. Focus on assets with clear use cases: Bitcoin as digital savings, major stablecoins for on‑chain dollars, and large, liquid projects that institutions already watch. Articles like our Bitcoin und Web3 Strategien piece can help you stress‑test your approach.

The takeaway from Korea Blockchain Week is that Asia’s crypto engine now powers a big part of the market’s future direction. If you learn to read those signals without overreacting, you give yourself an edge that most beginners never develop.

DISCOVER: 10+ Next Crypto to 100X In 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post Asia’s Crypto Acceleration: What Korea Blockchain Week 2025 Reveals appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]