EU crypto trading volumes spiked after new MiCA rules, and euro-backed stablecoins now dominate the region’s on-chain cash rails. Yet most of that trading flows through a small cluster of exchanges, which quietly decides how fair your

1.98%

Bitcoin

BTC

Price

$94,140.46

1.98% /24h

Volume in 24h

$42.21B

<!–

?

–>

Price 7d

or

0.90%

Ethereum

ETH

Price

$3,240.95

0.90% /24h

Volume in 24h

$21.67B

<!–

?

–>

Price 7d

price really is. If you trade in euros and ignore where your order goes, you may donate extra basis points on every fill without realising it.

MiCA-compliant euro stablecoins such as EURC, EURCV, and EURI now control around 91% of the EU’s euro stablecoin market, and BTC-EUR’s share of global BTC-fiat trading jumped from 3.6% to roughly 10% in 2024. That sounds like a win for European traders, but the real story lives in spreads, depth, and a growing gap between “good” and “bad” venues.

In a world where every 0.1% added to your trading cost compounds over time, this venue gap could matter more than the headline that “volume is up.”

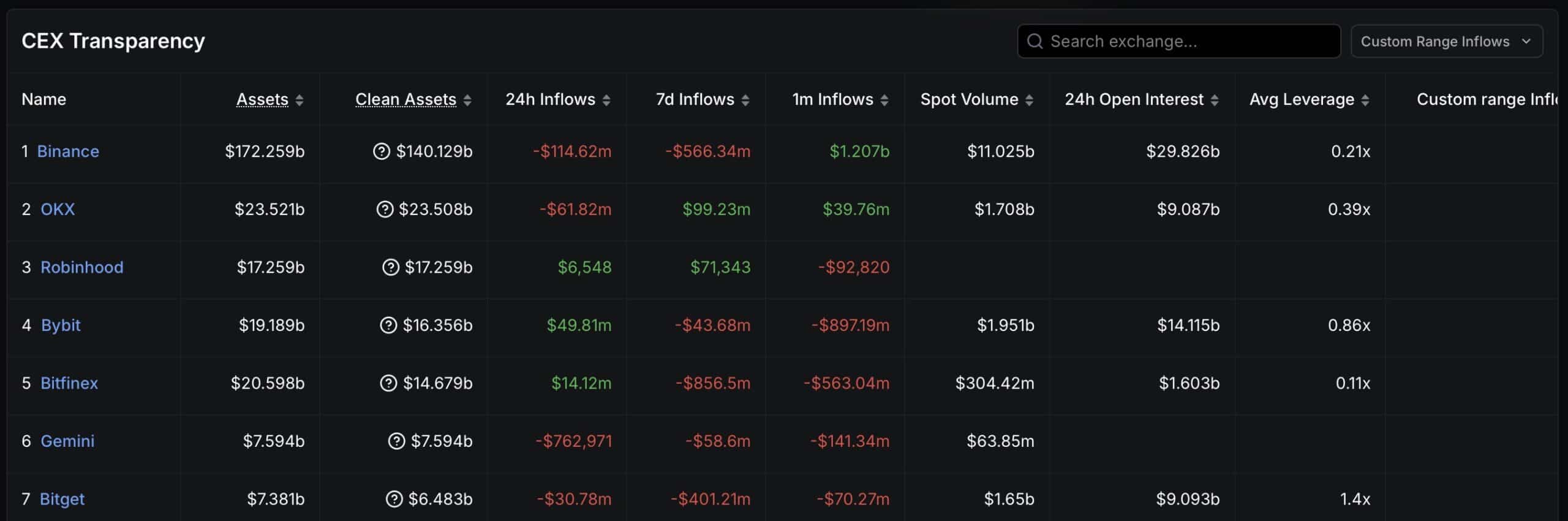

At the same time, the EU’s markets watchdog ESMA warns about heavy global crypto concentration, with Binance alone handling more than half of trading volume worldwide, which adds another layer of venue risk for ordinary users.

Just four exchanges (Bitvavo, Kraken, Coinbase, and Binance) account for about 85% of euro-denominated volume. Basically the majority of EU crypto volumes.

When that much power sits with so few venues, your execution quality starts to depend less on the token you buy and more on the exchange you pick.

DISCOVER: MYX Finance Crypto Touched $7 in a New Year Rally: The Perp DEX Breaks Out After 3 Months Resistance

What Is the EU ‘Venue Gap’ and Why Should Small Traders Care?

Think of each crypto exchange as a supermarket. The token is the same “product,” but some supermarkets stock big quantities and compete on price, while others keep a few items on the shelf and mark them up. The “venue gap” is this difference between exchanges with deep, tight order books and those where every trade moves the price.

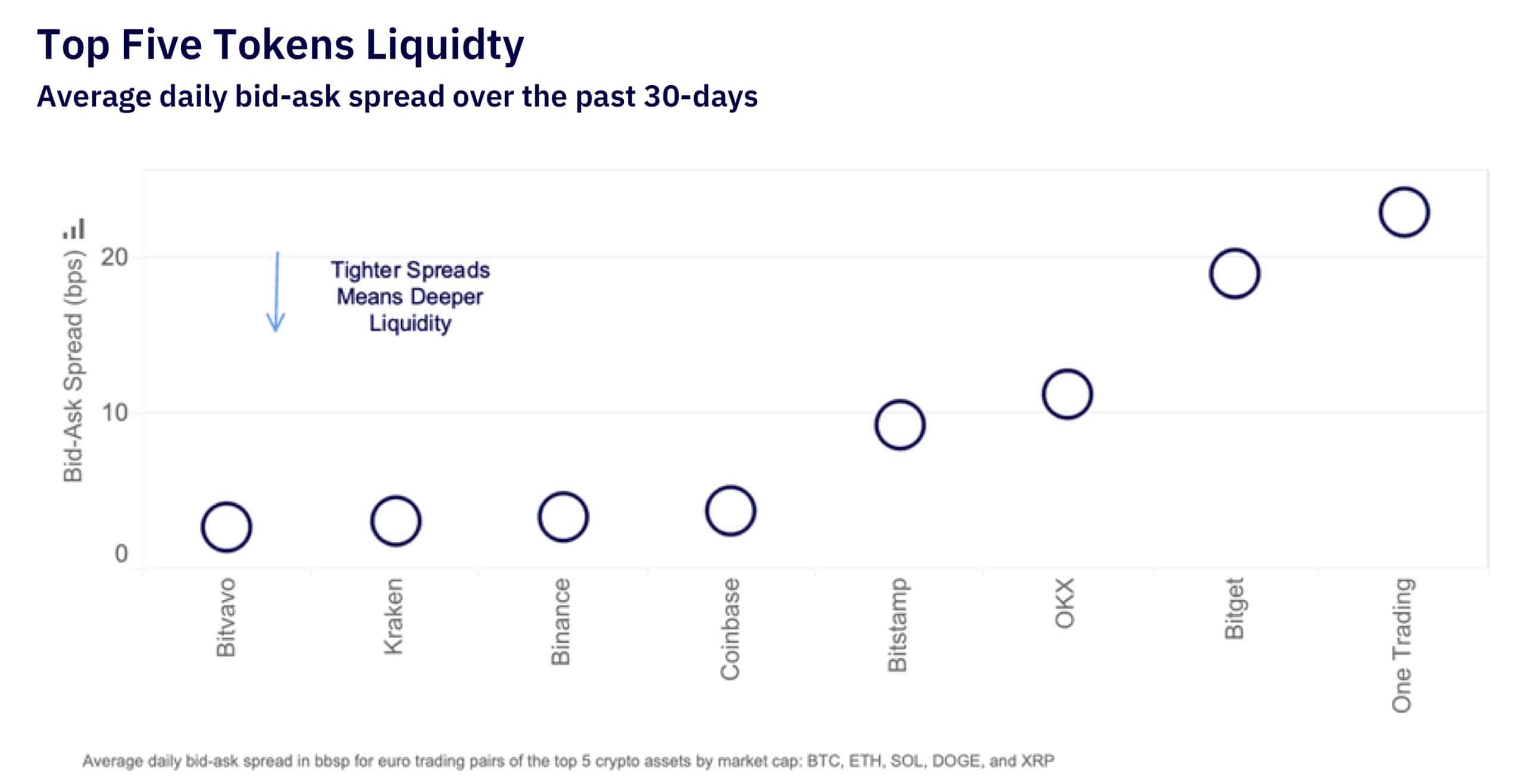

In crypto, the order book is just the list of buy and sell orders at each price. The bid-ask spread is the gap between the best buy and best sell. Tight spread and thick depth mean cheaper, smoother execution. The 30‑day average spreads on top tokens ranged from more than 20 basis points on One Trading down to about 2.6–3 basis points on Bitvavo and Kraken.

Same coins, different liquidity.

That gap shows up in depth too. BTC‑EUR now ranks as the second‑deepest BTC‑fiat market in Kaiko’s sample with around 758 BTC of depth within 1% of the mid‑price, more than double BTC‑GBP. If you are trading size, this decides whether you get filled calmly or chop your order into tiny pieces and still move the market. For beginners, it decides whether market orders on payday cost you a little or a lot.

MiCA and euro stablecoins did help. They gave Europe cleaner categories for “e‑money tokens,” forced exchanges to align with new rules, and helped compliant stablecoins grow. MiCA‑aligned coins like EURC, EURCV, and EURI now dominate the euro stablecoin space. But rails are only half the story. If those stablecoins sit on thin books or on exchanges with wide spreads, your execution price does not improve.

How Does This Liquidity Split Change Your Trading Strategy?

For everyday EU users, the big lesson is simple: what you trade matters less than where you trade it. Some exchanges now behave like “liquidity hubs” for the euro, while others look more like expensive neighbourhood kiosks. Bitvavo, Kraken, Coinbase, and Binance dominate EU crypto volumes, but Kaiko’s numbers show the best spreads and depth sit on only part of that list, especially Bitvavo and Kraken.

This isn’t just a pro‑trader issue. If you stack sats every month in BTC‑EUR, a 0.20% worse spread is like paying a silent extra fee on every purchase. Over years, that drag can rival the fees you worry about on brokers and banks. Our guide on crypto liquidations and how to avoid them shows how fast small structural edges add up when markets move hard.

Venue quality also shapes risk in a crunch. During fast drops, thin venues can see wild wicks and forced liquidations, while deeper venues stay more orderly. That dynamic mirrors what we saw when Solana DEX trading outpaced Binance for a moment: liquidity did not vanish, it just concentrated in new places. If your exchange sits on the wrong side of that shift, your stop losses and market orders take the hit. And we would like to avoid that.

DISCOVER: Is GameFi Crypto Finally Going Big in 2026? Here’s One Project Designed To Win Next Cycle

What Should EU Crypto Investors Actually Do Now?

First, treat exchange choice like broker choice in stocks. Check spreads and depth on your key pairs (BTC‑EUR, ETH‑EUR, and the euro stablecoin you use) instead of just following the biggest brand. Compare screenshots or pull data from public dashboards before you move serious size.

Second, keep your venue risk diversified. ESMA’s warning that Binance handles more than half of global volume shows how concentrated this market is. Split your holdings across at least two regulated exchanges with strong euro books, and always custody long‑term coins in your own wallet when possible, especially if you experiment with size or margin as described in our piece on ETH trading risks.

Finally, remember that MiCA and euro stablecoins make the rails safer, not your trading choices smarter. Euro markets matter more in Bitcoin now but the edge goes to the investor who treats spreads, depth, and venue quality as part of their cost basis.

If Europe’s year two under MiCA spreads liquidity beyond today’s winners, the traders who already pay attention to where their orders land will be in the best position to benefit.

DISCOVER: 10+ Next Crypto to 100X In 2026

Follow 99Bitcoins on X For the Latest Market Updates and Subscribe on YouTube For Daily Expert Market Analysis.

The post EU Crypto Volumes Jump, But a Hidden ‘Venue Gap’ Is Taxing Your Trades appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]