Strong 7Y Treasury Sale Sends Yields To Session Low In Final 2025 Auction

After two poor, disappointing coupon auctions earlier this week, when global yields were surging thanks to the circus that is Japan, we have come to the final note auction of the year, and yes… this one was not quite as bad.

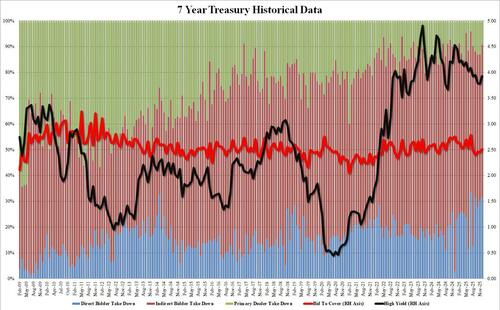

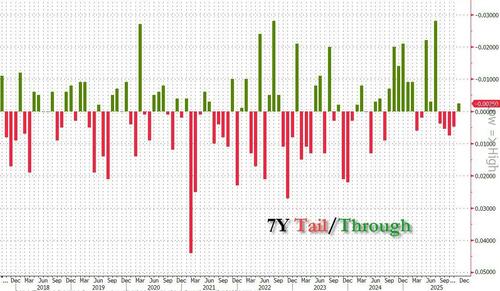

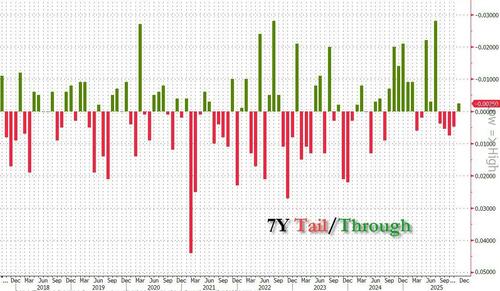

The sale of $44BN in 7Y notes priced at a high yield of 3.930%, up from 3.781% in November and the highest since July. That said, the auction stopped through the 3.933% When Issued by 0.3bps, and followed 4 consecutive tailing auctions.

The bid to cover was 2.509, up from 2.459 last month and the highest since July, if just below the six-auction average of 2.520.

Unlike the week’s previous coupon auctions, which saw a slide in foreign demand, the internals were stronger and Indirects took down 59.04%, up from 56.65% and the highest since August’s 77.5%. And with Directs rising to 31.6%, just shy of a record high, Dealers were left with just 9.34%, the lowest since July.

Overall, this was a stronger auction than the subpar fare observed earlier this week, which is handy since this was also the final auction of the year, helping push yields down to session lows. Of course, we now have an entirely new year to look forward to and with an onslaught of deficit-funding debt on deck, far more ugly auctions on deck.

Tyler Durden

Wed, 12/24/2025 – 11:57

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]