China’s DeepSeek Using Banned Nvidia Chips To Develop Next Major Model

Chinese AI startup DeepSeek has been using ‘several thousand’ banned Nvidia Blackwell chips to develop its next major model, The Information reports, citing six people with knowledge of the matter.

The chips in question were smuggled into China through a complex scheme that involves sending them to data centers in countries that are allowed to purchase them – then dismantling the servers and importing the components to China.

Doing so allowed DeepSeek to remain competitive in the AI race, as Chinese AI chips are still not sufficient to train AI models – a process in which the models ‘learn’ from mountains of data. While Beijing has pushed for domestic companies to use homegrown alternatives, the Nvidia chips are currently the only ones that can get the job done.

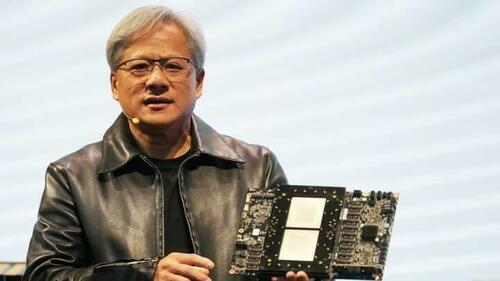

Nvidia’s Blackwell, which shipped in the fourth quarter of 2024, have been used by companies including xAI, Google, Microsoft and OpenAI – which all use hundreds of thousands of B200 chips, along with the prior “hopper” generation H100 / H200 models – to train and operate.

DeepSeek made headlines in January, when its R1 deep-reasoning model displayed high performance vs. what the company claimed was very minimal cost to train it. Since then, the startup has only made incremental upgrades to their model – which uses a method called ‘sparse attention’ in which only certain parts of the model are used to answer questions vs. the entire model, according to the report. This technique could significantly reduce the costs of ‘inference’ (when AI models send your power bills higher to create cat videos) – which lowers the overall cost to adopt AI.

Blackwell chips are perfect for this approach, as they include specialized hardware designed to silo various processes and accelerate sparse computing, which can run such calculations nearly twice as fast as traditional methods.

DeepSeek’s focus on the sparse attention technique has made its model development more challenging and time-consuming, according to the person. The company in September released the V3.2-Exp, which it described as an experimental model serving as “an intermediate step” toward its next-generation model. But applying sparse attention to bigger models is proving to be more complicated, the person said.

Some DeepSeek employees are hoping to roll out the next-generation model by the Lunar New Year holiday in mid-February, according to the person. However, DeepSeek founder Liang Wenfeng, who prioritizes performance over the timeline, hasn’t set a hard deadline for the new model, the person said. –The Information

DeepSeek originally trained its models with older Nvidia A100 chips which launched in 2020 – 10,000 of which were stockpiled by its hedge fund parent, High-Flyer Capital Management before US export restrictions kicked in in 2022. The A100 is two generations older than Blackwell. DeepSeek also used Hopper chips, the generation just before Blackwell, according to company research papers from 2024.

When Blackwell was unveiled, Nvidia released a design that combines 72 chips in connected server racks weighing 3,000 pounds (1.5 tons) each when fully assembled – taller than the average household refrigerator. While this has been the go-to option for US companies, it’s impossible for smugglers to move it around in suitcases. Instead, they smuggle Blackwell hardware into China in eight-chip servers that are much lighter (about the size of a large suitcase), which are easier to install and repair.

On Monday, President Trump announced that he would allow the sale of Hopper (H200) chips to China, while Beijing is still deliberating over whether to permit companies to use them. Doing so could reduce demand for smuggled Blackwell chips.

As The Information notes, DeepSeek’s models are custom-tailored to work with Nvidia hardware and software, making the use of Chinese chips less than ideal. After US export controls kicked in, DeepSeek followed Beijing’s policy priorities and began using Huawei Technologies’ chips instead to train smaller models – while continuing to rely on Nvidia processors for larger and more powerful models.

In April, the House Select Committee on the Chinese Communist Party called DeepSeek a “profound threat” to US national security – and accused the company of circumventing export controls and potentially stealing intellectual property from US companies. In February, legislation was introduced to prohibit DeepSeek’s chatbot app on federal devices.

(Is the ‘profound threat’ that the US government can’t control what DeepSeek tells people?)

How They’re Smuggled

In this instance:

First, chip dealers usually line up non-Chinese data center companies, typically in Southeast Asia, to procure Nvidia chips through authorized sellers. After the chips and accompanying servers are installed in those data centers outside China, Nvidia or its distributors, such as Dell Technologies and Super Micro Computer, dispatch personnel to inspect the equipment on location and make sure it complies with technical standards and export regulations, the people said.

Once the inspection is completed, dealers dismantle the servers and ship them into China. After passing Chinese customs, usually under a false declaration, the chips and servers are installed in data centers that already have leasing agreements with Chinese AI companies, the people added.

The elaborate scheme means the chips can only be ordered and delivered in batches, but it also ensures no paperwork can be traced to the end user.

Last month we noted a WSJ investigation which detailed a different method that keeps the chips physically out of China, but under Chinese control:

-

Nvidia sells chips to a U.S. partner partly owned by a Chinese firm: Nvidia supplies advanced AI chips to Aivres, a Silicon Valley server builder whose parent company is one-third owned by Inspur—a Chinese tech firm placed on a U.S. national-security blacklist in 2023. While Nvidia is barred from dealing with Inspur or its blacklisted subsidiaries, the restrictions don’t extend to U.S.-based entities like Aivres, allowing the business relationship to continue.

-

Aivres finds an overseas buyer for high-end Nvidia servers: In mid-2024, Aivres negotiated a $100 million deal to sell 32 Nvidia GB200 server racks – containing roughly 2,300 Blackwell-generation chips – to Indosat Ooredoo Hutchison’s cloud-computing division in Indonesia. Indosat is jointly owned by Qatar’s Ooredoo and Hong Kong’s CK Hutchison.

-

The Indonesian buyer lines up a Chinese AI startup as the end user: Indosat agreed to purchase the servers only after securing a major client facilitated by Aivres: Shanghai-based AI startup INF Tech. Negotiations also included representatives from Fudan University, where INF’s founder, Qi Yuan, directs an AI institute.

-

The Chinese startup intends to use the chips for finance and medical AI: By October, the servers had arrived in Indonesia and were being set up. INF plans to use the computing power to train AI models for financial analytics and scientific research, including drug-discovery applications.

According to attorneys familiar with export-control rules, as long as the Chinese company isn’t directly using the chips to help China with military intelligence or weapons of mass destruction, the arrangement doesn’t violate any laws set by the Trump administration.

Nvidia has responded to The Information, telling the outlet in a written statement: “We haven’t seen any substantiation or received tips of ‘phantom data centers’ constructed to deceive us and our [server manufacturing] partners, then deconstructed, smuggled and reconstructed somewhere else. While such smuggling seems farfetched, we pursue any tip we receive.“

Meanwhile, the company has developed a software feature to track the location of its chips – which could help the company combat chip smuggling, Reuters reported Wednesday. If this feature becomes live, it could ‘severely cripple’ the use of smuggled chips in China.

Tyler Durden

Wed, 12/10/2025 – 10:00

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]