Job Openings Unexpectedly Soar Even As Number Of Quits Plunges To 5 Year Low

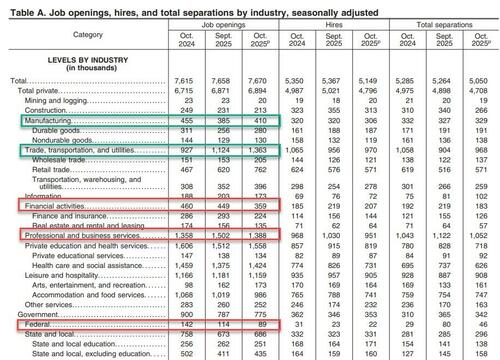

After a two month data hiatus, moments ago the BLS published the first jobs-linked report when it released the October JOLTS job openings and labor turnover survey. And following the last published JOLTS, which hit a little over two months ago on Sept 30, covering the month of August and which reported just 7.227 million job openings, the October report was unexpectedly strong, but not for what it showed for October but rather for the previously unreported September data, which came at a whopping 7.658MM, the highest since May, and the biggest one-month increase (+431K), since October 2024.

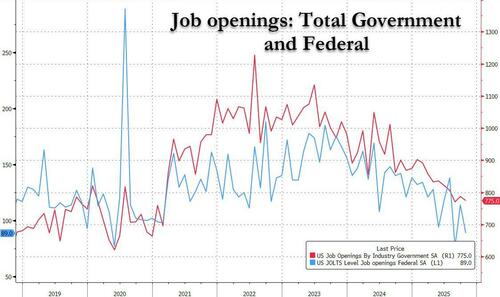

According to the BLS, there were no material monthly changes in October, expect for a notable plunge in the number of job openings in federal government (-25,000). And while that was accurate, a quick skim of the data

To be sure, as noted above, the best news about today’s report is that roughly around the time of the government shutdown the number of government job openings was already the lowest since Feb 2021, while the number of Federal job openings continues to be in freefall.

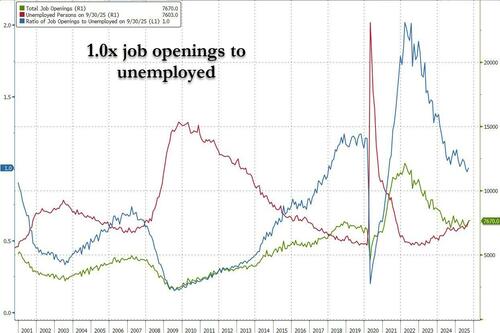

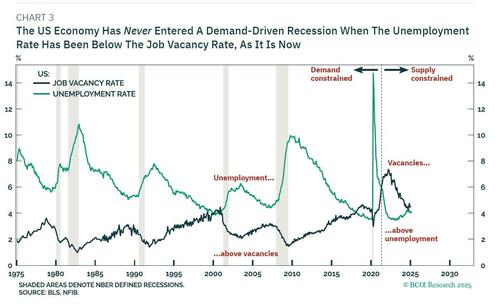

What is just as interesting is that after four years of the US labor market dodging the bullet, its luck has finally run out because whereas every month since May 2021, the labor market had been supply-constrained, with more openings than jobs in the US, in July and August we finally returned to a demand constrained baseline, with fewer job openings than unemployed workers, the first negative print this series since April 2021. That said, in October, this series reversed again, with 55L more job openings than unemployed workers. Expect this to reverse again in the coming months.

Said otherwise, in October the number of job openings to unemployed was just a fraction above 1.0x, having spent the previous two months below, which in turn was a reversal of the previous 4 years.

Why does this matter? Because as we discussed recently, the US never entered a recession in a period when there were more job openings than unemployed workers (i.e. the job market was supply constrained). After the previous two months, that is no longer the case.

Moving away from job openings, we find that both hires and quits dropped. Hiring slowed down in October, when 5.149 million workers were hired, down over 200K from 5.350 million in September. But this drop was modest compared to the plunge in the quits which slumped from 3.128 million to 2.941 million, the lowest since August 2020. The number of quits decreased in accommodation and food services (-136,000), health care and social assistance (-114,000), and federal government (-25,000). Curiously, quits in federal government in September saw a series high of 46,000. In October, quits increased in arts, entertainment, and recreation (+38,000) and in information (+21,000)

How to make sense of this data? On the surface, the JOLTS report suggests that the jobs market is much stronger than some had feared, and certainly the bottom is not falling out. It also suggests that anyone expecting an aggressive easing cycle in the immediate future will be disappointed. At the same time, the report is too close to the FOMC decision tomorrow, so it won’t change anything, and if it does impact the market, it will be odds of a January or subsequent rate cut (which will drop). At the same time, the continued collapse in both hires and quits is concerning and indicates that we can now add low quits to the “low fire, low hire” economy, which is rapidly finding a new equilibrium now that millions of illegal aliens aren’t polling the statistics, or artificially depressing wages. Neither of which makes the Fed’s role any easier…

Tyler Durden

Tue, 12/09/2025 – 10:38

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]