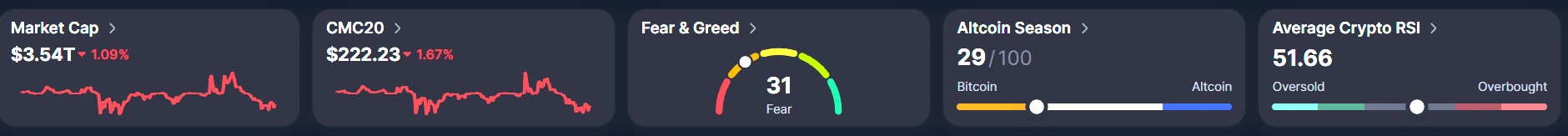

In crypto news today, the market is still in a downturn. The total market cap is down by 1.9% to $3.54 trillion, and the Fear and Greed Index is sitting at 31, signifying fear. Moreover, the average crypto Relative Strength Index (RSI) is sitting in the neutral grey zone, signifying that the market is currently unsure and is waiting for a signal to push price actions either way.

(Source: CoinMarketCap)

1.39%

Bitcoin

BTC

Price

$102,713.82

1.39% /24h

Volume in 24h

$52.96B

<!–

?

–>

Price 7d

retreated by 1.49% in the last 24 hours, despite positive news about the US Government ending the shutdown, and is currently trading at

.

While the news helped the overall market confidence, it did not help BTC regain its momentum. Instead, investors shifted their focus to tech stocks that saw a stronger rebound.

Even Strategy Inc. adding 487 more coins to its stash did not move the needle. The company now holds more than 641,000 BTC, but the market barely reacted.

It has retested the resistance at $107,060 and the neckline of a double-top pattern, meaning BTC’s price movement has formed a break-and-retest pattern, a common bearish pressure continuation sign.

On the weekly chart, BTC will likely continue to move down in the short term. If its price breaches the support at $105,000, the next level to watch will be $100,000.

A move below that will likely cause BTC to drop to $96,800.

EXPLORE: Next 1000X Crypto – Here’s 10+ Crypto Tokens That Can Hit 1000x This Year

Crypto News Today: ETH Holds Above $3,500, Market’s Confident

1.33%

Ethereum

ETH

Price

$3,422.47

1.33% /24h

Volume in 24h

$30.38B

<!–

?

–>

Price 7d

is showing signs of strength after a rough start to November, when its price dropped to just above the $3,100 level. Since then, it has bounced back modestly and has claimed the critical support level at $3,500.

Currently trading at

, it is signalling a renewed interest from buyers. A big part of this recovery comes from institutional investors, who recently added $1.37 billion worth of ETH to their holdings, suggesting confidence in ETH’s long-term potential.

$ETH still holding above the trendline that’s been support since April.

But the daily 20 EMA is pressing down as resistance.

Meanwhile, MACD is gearing up for a golden cross.

Support vs. resistance vs. momentum – something’s about to give.

Eyes on the triangle. pic.twitter.com/ounJA2FLCt

— Lark Davis (@TheCryptoLark) November 10, 2025

Technically, ETH is still holding up above the trendline support that was established in April this year. Its price action has captured the 20-day EMA and the 50-day EMA and is currently in the process of testing the 100-day EMA at $3,648

(Source: TradingView)

Meanwhile, market data shows strong liquidity between $3,500 and $5,000, meaning investors are ready to buy if prices keep rising.

$ETH upside liquidity is massive. pic.twitter.com/JwayLFeosV

— Ash Crypto (@AshCrypto) November 10, 2025

Market analysts are cautiously optimistic. Analyst Tom Lee believes that ETH could hit $10,000 to $12,000 by the end of the year, with a long-term goal of $60,000.

TOM LEE JUST BOUGHT ANOTHER $389M OF ETH

Bitmine added 110,288 ETH since the past week – currently worth $389.3M. Bitmine in total holds $12.4 BILLION of ETH.

Tom Lee bought the dip. pic.twitter.com/LkL9Y5tZUR

— Arkham (@arkham) November 10, 2025

However, there is a catch. If ETH falls below $3,425, it could lose its momentum and further slide down to lower support levels.

EXPLIORE: The 12+ Hottest Crypto Presales to Buy Right Now

Monad Dropped 160M Tokens: Five Market Makers Get First Dibs

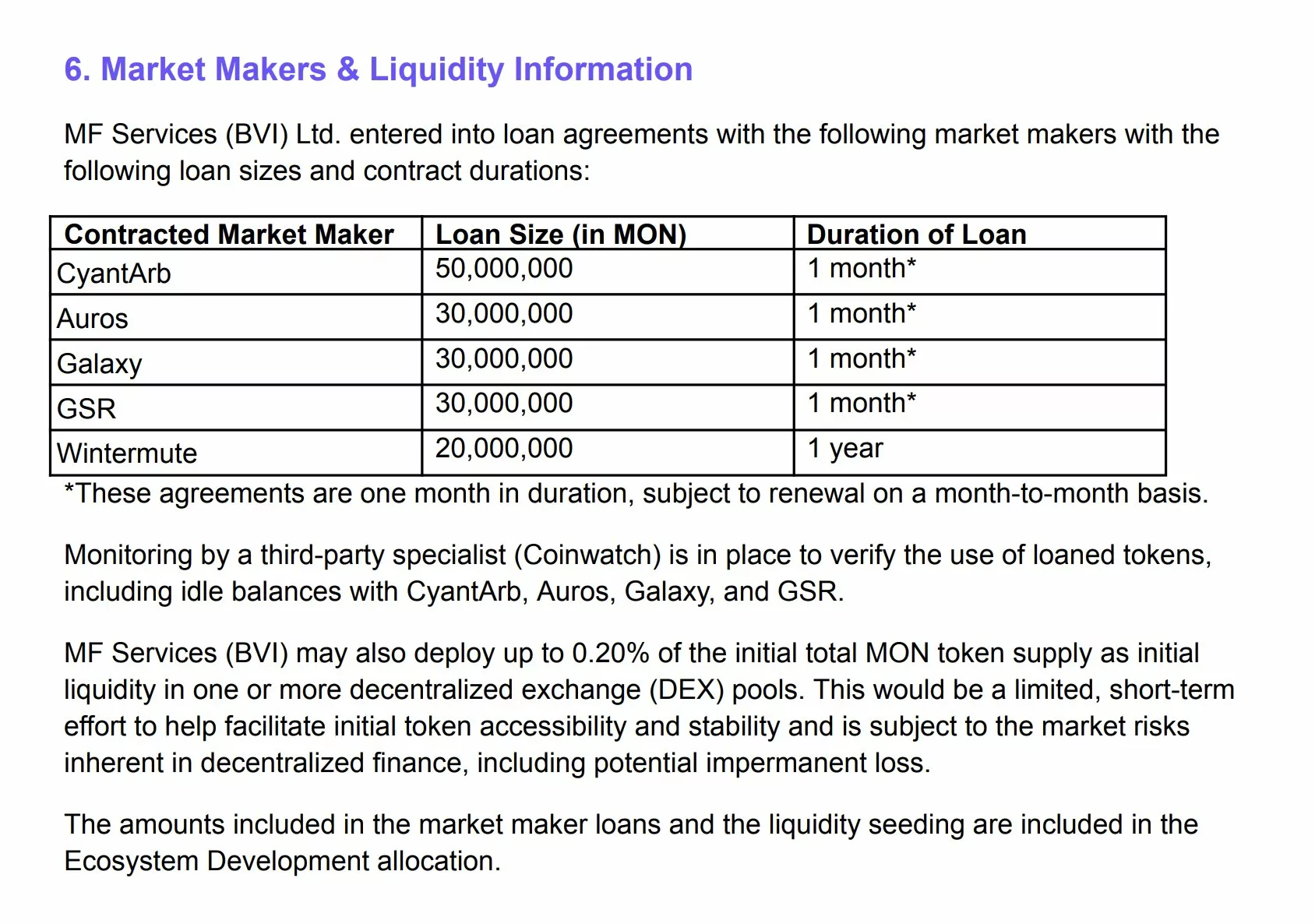

Coinbase made a rare move of disclosing the full list of market makers involved in the Initial Coin Offering (ICO) for Monad. The disclosure includes not just the names of the five firms, but also how many MON tokens each one is receiving and for how long.

According to the document, 160 million MON tokens have been loaned out, which are worth about $4 million based on the initial price of $0.025 per token.

(Source: Coinbase Document)

These agreements can be renewed monthly and will be monitored by Coinwatch.

Coinbase Brings Back Token Sales: But This Time, It’s Fundraising With A Seatbelt

Coinbase is all set to reintroduce token sales in the US for the first time since 2018. Its new platform is an attempt to bring back the excitement of community-driven fundraising, but with guardrails to protect investors.

The goal with this platform is to make token launches fair and transparent, and also to have a calmer and structured approach. The platform will kickstart with token offerings from Monad, a Layer-1 blockchain. Its token offering will run from 17 – 22 November. Additionally, this sale will release 7.5% of Monad’s total supply.

The project has already raised $248 million in earlier funding rounds, including a massive $225 million Series A in 2024.

Interested investors will have a whole week to place their bids using USDC, and once the window closes, an algorithm will decide who gets how much. Smaller bids will be favoured so that more people get a chance to participate.

Solana Rebounds On ETF Momentum, Faces $190 Resistance

Solana is trying to bounce back after falling out of a long-term uptrend that it had held since April this year. The drop, triggered by a sell-off on 3 November, found its support near $146 from where it began to recover.

Now, Solana is aiming to hook back into its previous trend, but it faces strong resistance at $190. Before that, it must contend with smaller resistances at $166 and $169.

CryptoQuant Flags Bear Risk If Big Buyers Cool Down Buying Spree

CryptoQuant founder Ki Young Ju pointed out that whales have been shedding BTC since its price hit $100,000. According to Ju, the bull run should have been earlier in 2025.

Bitcoin whales have been cashing out billions since $100K.

I said the bull cycle was over early this year, but MSTR and ETF inflows canceled the bear market. If those fade, sellers will dominate again.

There is still heavy selling pressure, but if you think the macro outlook is…

— Ki Young Ju (@ki_young_ju) November 11, 2025

However, because of a buying spree from major players like Strategy and BTC Spot ETFs, its price has been maintained. Moreover, according to SoSoValue, these ETFs are now seeing $1.15 million in daily inflows, recovering from a recent slowdown.

Ju warns that if Strategy slows down its buying of BTC and ETF inflows drop, sellers could wrestle back control again.

The post Crypto News Today: ETH And BTC Continue To Consolidate Despite Institutional Buying appeared first on 99Bitcoins.

Altcoins, Altcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]