Bears anticipate more pain as Bitcoin struggles to stay above $104,000. As of early November,

3.28%

Bitcoin

BTC

Price

$101,113.72

3.28% /24h

Volume in 24h

$106.94B

<!–

?

–>

Price 7d

is trading around $103,960, its lowest level since late June 2025, and nearly 20% below its October high of $126,500. The recent weakness comes as the U.S. government shutdown enters its 35th day, matching the record set in 2018–2019. Let’s take a look at the latest Bitcoin news.

According to Polymarket, betting odds suggest the shutdown could extend beyond November 16, adding uncertainty to global markets.

Meanwhile, the U.S. Dollar Index (DXY) has climbed above 100 for the first time since August 1, signaling stronger demand for the dollar. A rising DXY usually puts pressure on risk assets, including Bitcoin and major tech stocks. The combination of a government shutdown and tighter liquidity has led to one of the most difficult trading environments of the year — and Bitcoin is feeling it first.

EXPLORE: 10+ Next Crypto to 100X In 2025

Understanding the US Government Shutdown and Its Market Impact

A US government shutdown happens when Congress fails to pass funding bills that allow federal agencies to operate normally. When this occurs, government employees are furloughed, some services are halted, and the Treasury is unable to release funds to departments or projects. The result is not just political noise: it directly affects liquidity and cash flow across financial markets.

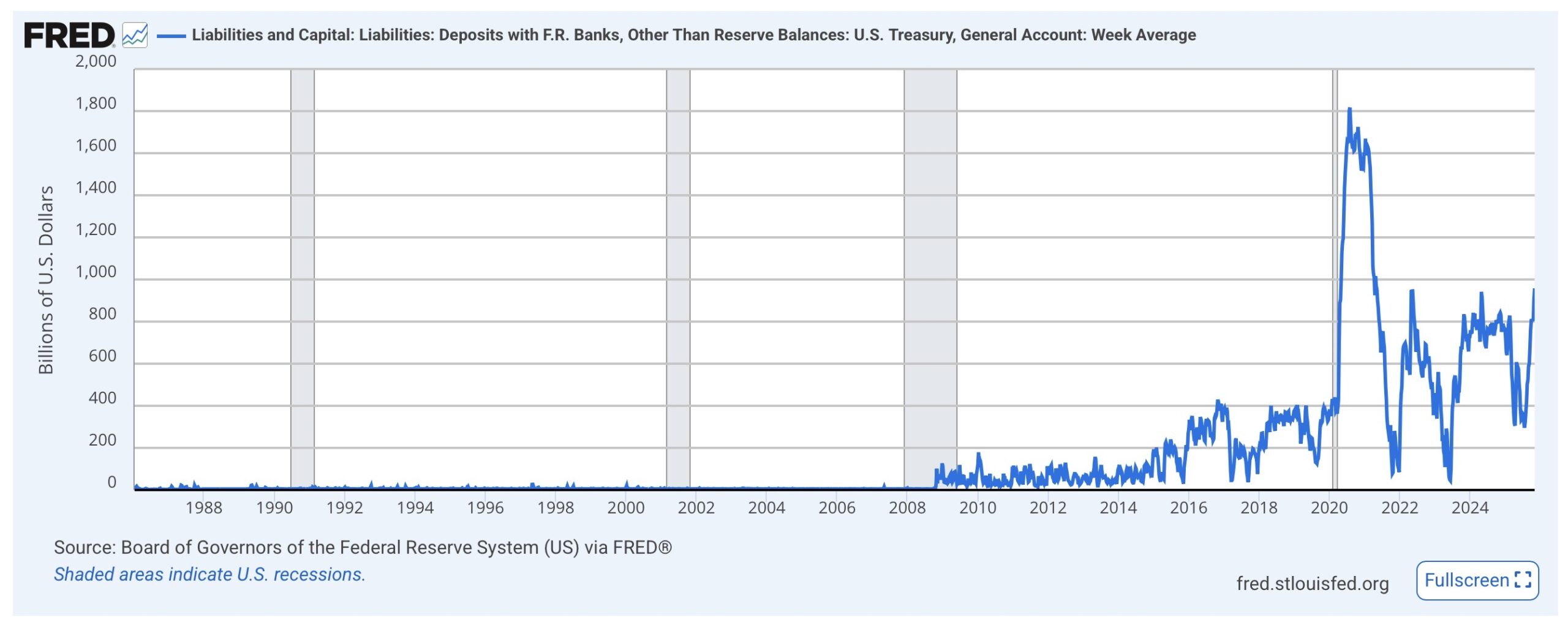

During a shutdown, the U.S. Treasury General Account (TGA) ceases spending but continues to receive tax payments and issue debt. That means money is effectively being pulled out of circulation. According to the latest data, the TGA balance has increased to approximately $965Bn, a rise of roughly $150Bn since October alone. This represents cash that is no longer flowing into the economy or financial markets.

(Source: FRED)

At the same time, the Reverse Repo Program (RRP) has increased by roughly $20 billion this week, as banks temporarily park funds with the Federal Reserve. These two forces, the rising TGA and RRP, together drain liquidity from the market. That’s one reason why Bitcoin and other high-beta assets are struggling to find momentum.

The pressure is also evident in bank reserves, which have dropped to the lower range of what the Fed considers “ample.” This has led to tighter funding conditions, visible in rising SOFR spreads and record usage of the Standing Repo Facility (SRF) — with banks borrowing over $10 billion recently, the highest since its launch in 2021.

While this doesn’t signal financial panic, it reflects a short-term liquidity squeeze that keeps Bitcoin trapped in a choppy range.

DISCOVER: Binance CEO Denies Investing In Trump-Backed Stablecoin Through WLF For CZ’s Pardon

Positive News for Bitcoin – A Liquidity Outlook: Why Bitcoin Could Rebound in Late November

Despite current headwinds, the broader liquidity picture is expected to improve later this month. Once the U.S. government resolves the shutdown, the Treasury will resume spending, drawing down its massive TGA balance. That process will push hundreds of billions of dollars back into the financial system, improving bank reserves and easing funding stress.

In addition, after the end of October’s “window dressing” period, the RRP should start declining again, returning another $20 billion or more in cash to the market. By early December, the Fed’s Quantitative Tightening (QT) program is also scheduled to end, potentially setting the stage for balance sheet expansion for the first time in years.

DISCOVER: ZEREBRO Leads Meme Recovery: Analysts Call NPC, M, and MAXI Best Memecoin to Buy

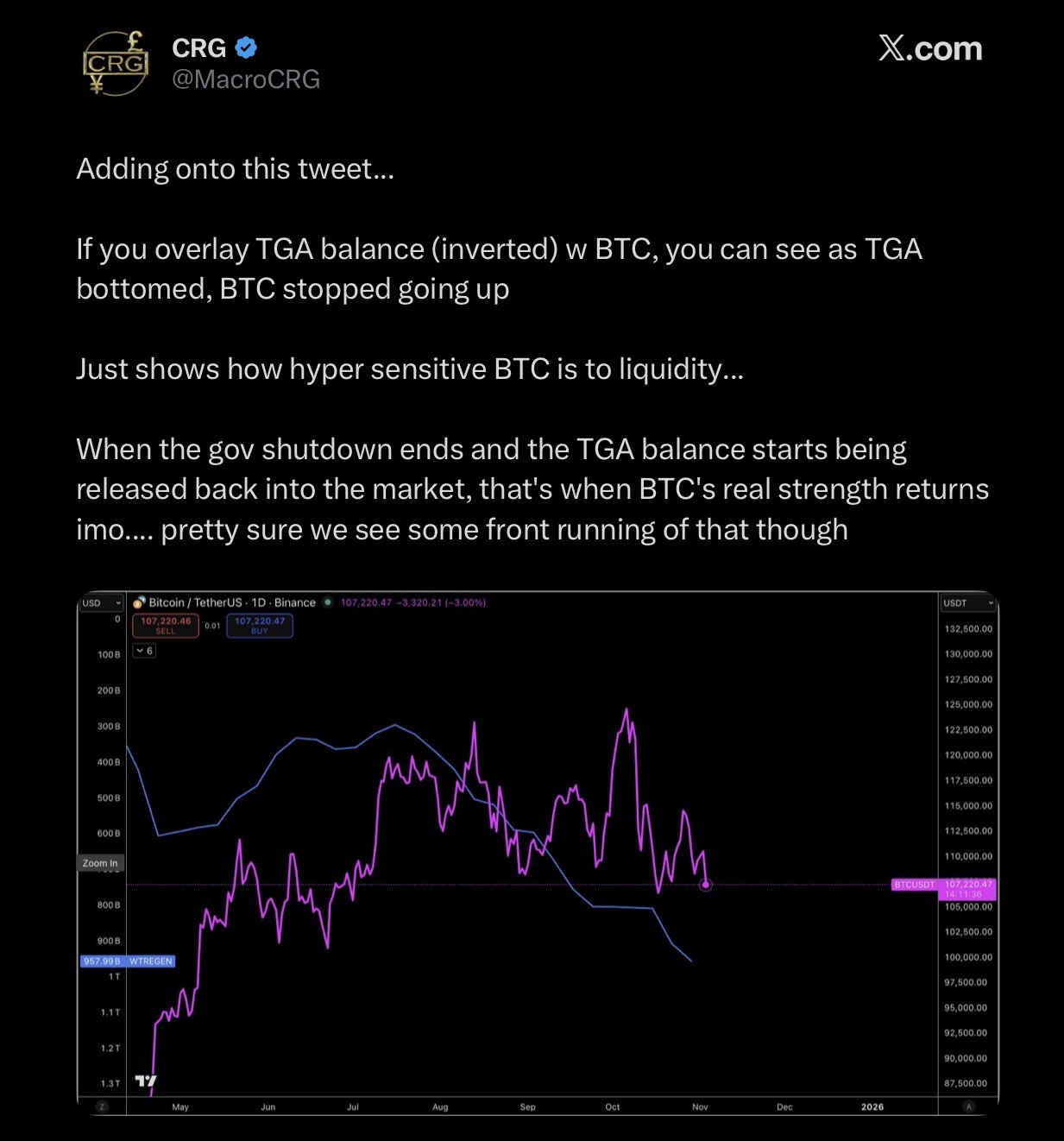

These factors, when combined, could create a powerful liquidity tailwind for Bitcoin and other risk assets. Historically, BTC reacts strongly to liquidity shifts, and traders are already watching for signs of a bottom. Some analysts believe that the current dip toward $100,000 may represent the final washout before a rebound.

In other words, this week might mark the tightest point for U.S. liquidity before conditions ease into year-end. As liquidity returns, Bitcoin could be the first asset to benefit. For traders with patience, this may be an opportune time to accumulate positions ahead of the next leg higher in November and December.

The ongoing U.S. government shutdown and high Dollar Index have created a tough backdrop for Bitcoin, but as the liquidity squeeze fades, conditions could turn bullish again.

In the fast-moving world of Bitcoin news, one thing remains consistent — markets move fastest when liquidity flows, and that may be exactly what’s coming next.

EXPLORE: Top 20 Crypto to Buy in 2025

Key Takeaways

- Liquidity Drain Pressures Bitcoin: The prolonged U.S. government shutdown and rising Dollar Index have tightened liquidity, pushing Bitcoin below $104,000.

- Once the shutdown ends and Treasury spending resumes, renewed liquidity could trigger a Bitcoin price recovery in late November.

The post US Government Shutdown Hits Day 35 – Bitcoin News: Will Liquidity Hunters Push BTC USD Higher In November? appeared first on 99Bitcoins.

Bitcoin (BTC) News Today, Bitcoin News Today

99Bitcoins

[crypto-donation-box type=”tabular” show-coin=”all”]