OPEC+ Pauses Output Hikes After Small December Increase

Eight OPEC+ countries on Sunday agreed to raise oil output in December by a modest 137,000 barrels per day but will pause further hikes in the first quarter of 2026, as the group balances its push for market share against signs of an emerging supply glut.

The cartel member states led by Saudi Arabia agreed during a brief 14-minute video conference on Sunday to increase output by about 137,000 barrels a day next month as expected, matching increases scheduled for October and November (it is unlikely that even this modest increase will be fully implemented). However, the group also announced it will hold off on further increases during January to March. The proposal was raised to account for weaker seasonal demand, according to a delegate. The full 22-nation OPEC+ alliance is due to meet next on Nov. 30 to review production levels for 2026.

And this is the official press release: https://t.co/8u6uSp0faK #OOTT

— Amena Bakr (@Amena__Bakr) November 2, 2025

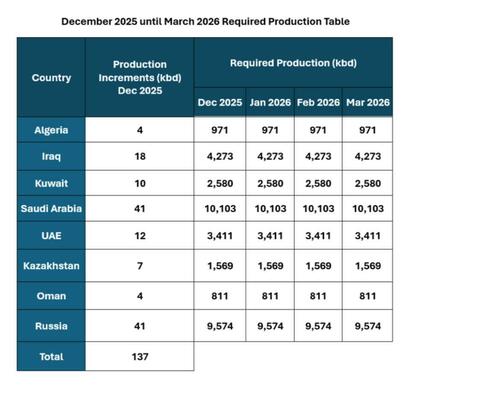

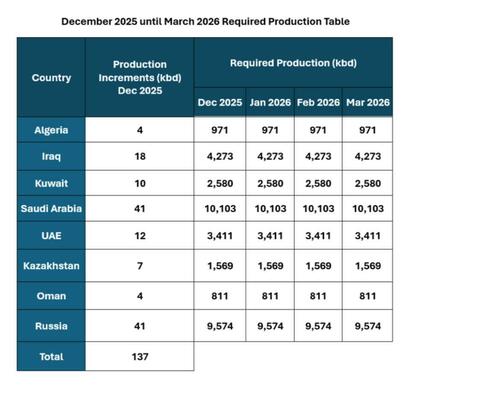

The new quotas for December and into Q1 2026 as as follows:

OPEC+ has been gradually reintroducing the return of 1.65 million barrels a day halted two years ago, after rapidly restarting another layer of production earlier this year. However, signs have been mounting that a long-awaited surplus is emerging, amid warnings of a bigger glut next year.

The meeting also takes place against a backdrop of increased pressure on Russia, the co-leader of the alliance, after the US sanctioned its two largest oil producers last month in a major escalation. While the move helped support prices after they dropped to a five-month low, one delegate said earlier that it’s too early for OPEC+ to gauge the overall market impact of the measures.

As Kpler’s Amena Bakr reminds us, at the start of 2025 the OPEC+ group decided NOT to add any barrels and the same is happening again in q1 2026, “So it’s just a repeat of market policy to avoid additional over supply when stocks normally build during this period.”

Meanwhile, Saudi Crown Prince Mohammed bin Salman heads later this month to Washington to meet President Donald Trump, who has repeatedly called on OPEC to help bring down fuel prices.

Brent crude futures are down about 13% this year, settling below $65 a barrel on Friday. As well as the sanctions on Russia, they’ve also drawn support from a one-year truce on trade tariffs reached last week between Washington and Beijing.

OPEC+’s actual output increases have fallen significantly short of the advertised volumes, as some members offset earlier overproduction and others struggle to pump more, limiting the impact on the market. OPEC+ has repeatedly said that its decision to revive production this year, despite industry-wide warnings of a price slump, has been driven by “healthy market fundamentals” and low inventory levels. The resilience of prices for much of the year, the result of a massive campaign by China to top up its strategic reserves which amounts to over 500kb/d even as OPEC+ restored a 2.2 million-barrel supply tranche a year early, has validated its stance.

Yet there are increasing signs that, with demand in top consumer China cooling and supply across the Americas booming, the world market is now tipping into oversupply. Top trading houses like Trafigura Group say the excess has arrived, pointing to an accumulation of barrels on the world’s tanker fleet.

The International Energy Agency in Paris predicts that world supplies could exceed demand this quarter by more 3 million barrels a day, and then balloon to an unprecedented glut next year, at least on paper. JPMorgan and Goldman Sachs forecast further price losses below $60 per barrel, although judging by their terrible track record, it likely means $100 oil is inevitable.

The market downturn is also taking a toll on oil producers such as America’s shale drillers. While the US remains the biggest source of supply growth this year, it’s projected to stall in 2026, and shale executives have warned that as investment ebbs, the industry is hitting a “tipping point.”

Separately, Bloomberg notes that Saudi Arabia’s departure from years of effort to shore up crude prices is also having consequences for the kingdom itself. The country’s budget deficit deepened in the third quarter, and it has been forced to scale back spending on some economic transformation projects, including the futuristic city of Neom.

Tyler Durden

Sun, 11/02/2025 – 13:25

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]