Business “Very Slow, No Uptick In Sight”: Dallas Fed Respondents Turn Even More Apocalyptic-er

As we detailed in late September, President Trump’s plans to bring down oil prices was hammering sentiment in the Dallas Fed region (among manufacturers) with apocalyptic comments from respondents…

“I may have to close the company. Orders have stopped coming in, and we do not know why. “

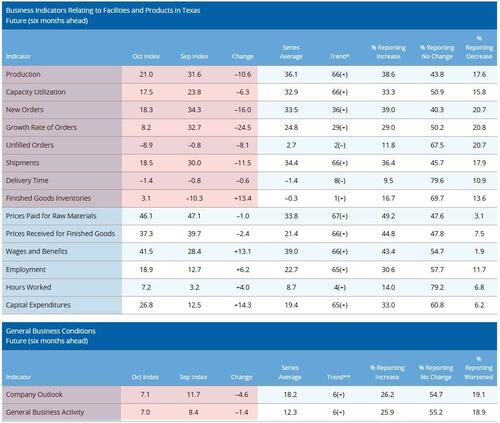

And while today we see October’s raw headline sentiment (General Business Activity) number improve very marginally (from -8.7 to -5.0 – still negative), under the hood it was not pretty with production flat, capacity utilization down notable, new orders still shrinking, shipments down, and hours worked and capex tumbling.

Worse still, forward-looking expectations are a shitshow…

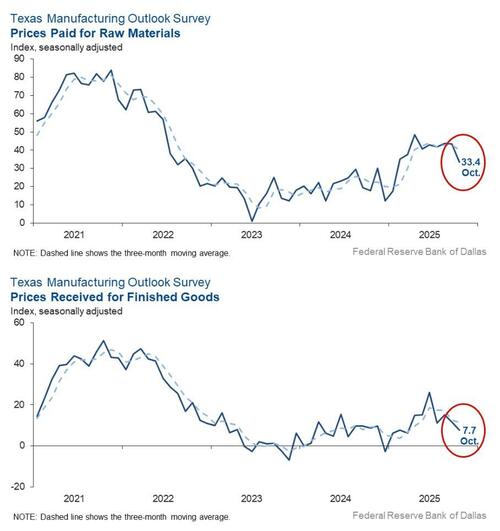

The one silver lining in the report was the both input and output prices are falling…

However, it’s the comments from respondents that most noteworthy in that they just got more apocalyptic.

Suffice it to say that the locals are hardly delighted with either tariffs, high interest rates, falling demand or general economic malaise, which is to be expected from a regional Fed that is largely dependent on the US energy industry (read Texas shale) which in turn has been crippled by Trump’s demands to keep oil prices as low as possible if not lower, and has hammered the US oil E&P industry.

Beverage and tobacco product manufacturing

Overall uncertainty about the strength of the economy is our largest concern. We believe the risk of a recession has increased, although it is hard to quantify. Lower economic opportunities, especially for younger people, is putting downward pressure on our future sales.

Computer and electronic product manufacturing

We are considering closing our company at the end of the year and filing for bankruptcy. We have had a huge drop in sales, and I think it’s due to the loss of government funding. I don’t think I can recover the company from it.

Fabricated metal product manufacturing

Our sales outlook is slightly down for 2026.

Customers are delaying projects to 2026, and requests for quotes have decreased.

Our customers want to buy, but they lack cash on hand. Multiple competitor closures are funneling demand, but our customers lack liquidity to fund required deposits and interim payments.

Furniture and related product manufacturing

There’s a slowdown of commercial construction bid requests.

Machinery manufacturing

Sales have been strong and steady over the past few months. We hope this trend continues.

The free market is prevailing despite the central planners’ well-intentioned but misguided tariff policies.

Up and down, back and forth. We are thankful for the work, but the waves continue.

We expect some gain as well as some loss going forward in 2026 and through the remainder of the current year. We do believe the good will outweigh the bad overall. The DFW area continues to thrive, Texas remains a good place to do business, and the U.S. remains favorable for business as opposed to many world markets. We’re thankful we are where we are─geographically and economically.

Miscellaneous manufacturing

Tariffs. We manufacture in the U.S., but input materials come from China. We don’t have $600 million to get relief from tariffs like some companies do.

Paper manufacturing

Business is steady at very slow; no uptick in sight at this time.

Primary metal manufacturing

We suspect other countries, including Mexico, Vietnam and Cambodia are cheating and not paying full Section 232 tariffs on aluminum-extruded products coming into the U.S. This has been reported to the Commerce Department. They are producing two invoices, one for the raw aluminum and another for the other portions of their prices resulting in not paying the full Section 232. If this is allowed to continue our industry will lose jobs and shutter equipment. Most of the foreign countries are subsidizing exports to the U.S. to the detriment of our industry.

Printing and related support activities

We have gotten very slow and we worry about the general state of our industry. We have a few large jobs that are keeping people busy in the plant, but soon if things don’t change there will need to be some significant reduction in hours worked on the plant floor. There is just not much going on right now, and we believe it’s all tied to the chaos and uncertainty coming from Washington. We are hearing about significant price increases on materials coming soon due to the effect of tariffs.

Tariff costs (a tax) are having an impact of slowing down economic activity in all sectors. It’s all to do with economic uncertainty.

Textile product mills

We are very unsure of how the holiday season will play out. Input prices continue to increase as duties and tariffs take effect and remain in place. We are unsure of demand, and we will also need to increase our prices due to rising costs.

Transportation equipment manufacturing

The interest rate reduction is positive. There’s a need to improve the government shutdown and trade turmoil, and the outlook would be very promising.

Continued volatility with import tariffs and interest rates continue to stifle the trucking market. Trucking companies continue to struggle, and there is a regular cadence of bankruptcies being reported.

Business is up, yet we are also affected by the government shutdown in our ability to work with regulators to approve next steps.

So, with President Trump doing everything in his powers to bring down the price of oil (and therefore gas), it appears the locals can’t take it anymore.

Tyler Durden

Mon, 10/27/2025 – 11:30

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]