When Defense Secretary Pete Hegseth canceled the Air Force’s Cloud One Next contract earlier this year, he declared it would save taxpayers $1.4 billion—the maximum billings under the contract.

But current and former Air Force personnel who are familiar with Cloud One say it’s not as simple as that.

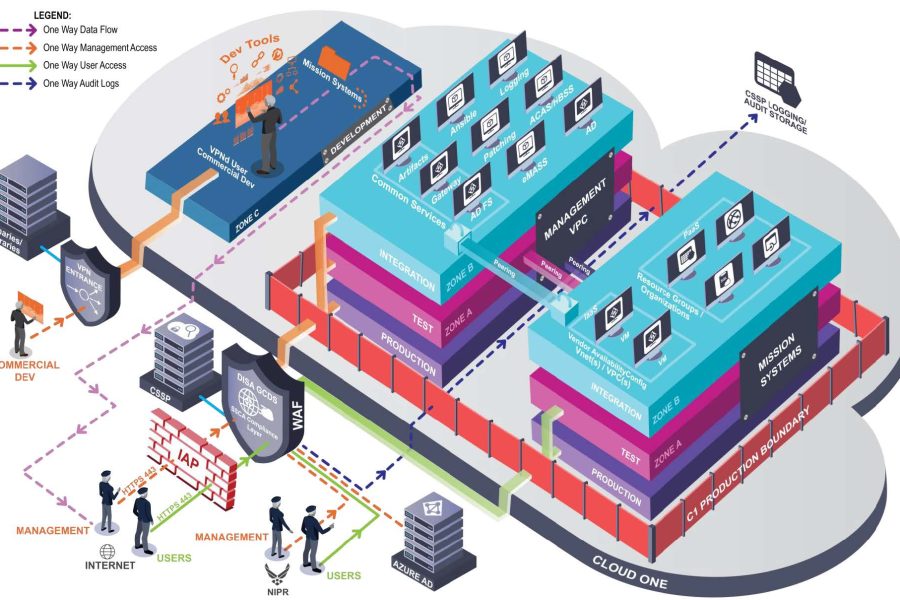

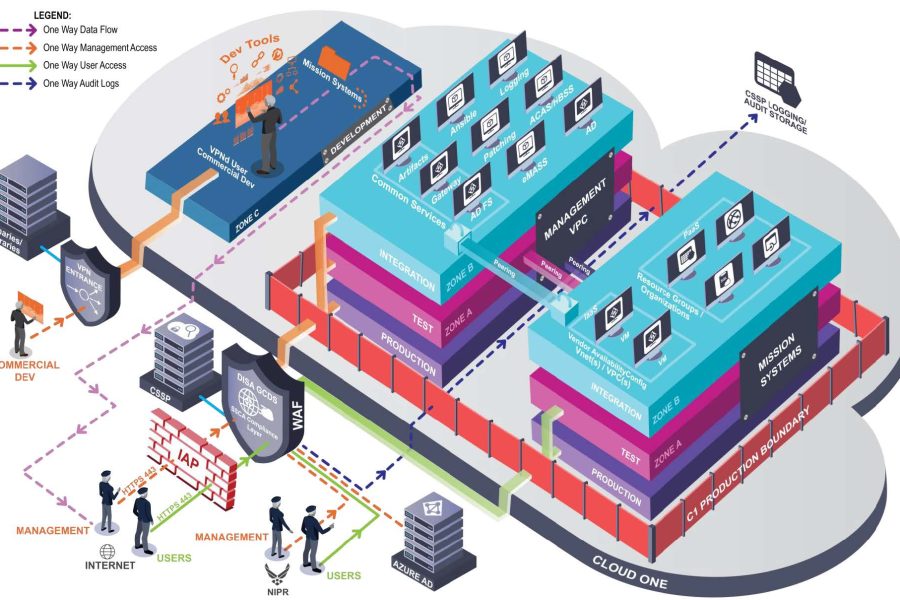

Cloud One was intended to provide a one-stop shop through which DOD users could buy a variety of cloud computing services from any major provider in a single approved marketplace, managed by Accenture. With the Cloud One contract gone users can still access those services, but will have to buy them through a different contracting vehicle.

Cancelling Cloud One was “optimizing on the optics, not on the cost or the mission needs,” said one former Air Force civilian official who worked on the Cloud One contract and asked for anonymity because their current employer did not authorize them to speak to the media. In this individual’s telling, canceling the contract means “walking away from the big discounts that Cloud One was able to offer by leveraging the enormous scale of the commercial buying power” of Accenture.

Under Cloud One Next, Accenture provided bulk discounts on cloud computing services more valuable than those available through the Army’s cloud procurement vehicle, Cloud Account Management Optimization, or CAMO, which advertises 15 percent to 38 percent discounts for unclassified cloud services, according to procurement documents.

One Air Force servicemember who has worked with Cloud One told Air & Space Forces Magazine that those discounts could have been worth as much as $300 million if the contract reached its $1.4 billion ceiling.

Now, however, canceling the contract is “costing more money than it’s saving,” said a program manager who has worked with Cloud One.

But a former Defense Department official now in the industry countered that Cloud One was “a badly designed, overpriced, Frankenstein’s monster.”

Granted anonymity because their current employer did not authorize them to comment, the individual critiqued the entire concept behind Cloud One.

“What you want to do is to get as close to the way the commercial world buys cloud as you can,” the former official said.“ Cloud One is not more like commercial, it’s less like commercial.”

Any discounts Cloud One might offer, he said, would have been canceled out by the additional costs of operating its program office and hosting environment. “They may negotiate a 30 percent discount, but they’re not passing all 30 percent on to the user, because someone has to pay to operate that program office, to pay the overhead of creating that layer between the cloud provider and the user,” the former official said, ”It was adding complexity and adding cost.”

The program office had been set up to offer a hosting environment, the former DOD official said, but there were never enough customers to generate the income needed to staff up correctly. “It’s badly designed. It’s under resourced. It requires an enormous amount of manual labor by a very understaffed workforce,” the former official said. “So they have a huge backlog because they created an enormous bottleneck.”

Cloud One has roughly 1,300 customers—offices and programs that currently buy services using its contract vehicle. According to the Cloud One website and other sources they include:

- The Air Force’s Cloud-Based Command and Control system (CBC2) being built for NORAD

- The Working Dog Management System (WDMS), an app for tracking training, vaccination, and medical records for the military’s canine warriors

- The Enterprise Logging Ingest and Cyber Situational Awareness Refinery system (ELICSAR), a database security teams and automated programs scour for evidence of hackers, cyberattacks or other anomalies

- Air University applications, including admissions, enrollment, and graduation data, along with course offerings, learning records, transcripts and demographic data.

All these customers must now migrate their workloads to another cloud contract, the Joint Warfighting Cloud Capability, or JWCC, a DOD-wide contracting vehicle run by the Defense Information Services Agency (DISA), according to current and former Air Force personnel.

Acting DOD CIO Katie Arrington told the House Armed Services Cyber, Information Technologies and Innovation Subcommittee May 8 that the Pentagon wants to migrate as much cloud purchasing as possible to centralized cloud contract vehicles.

Noting that the Army had recently selected JWCC as its primary cloud contracting vehicle, she declared, “We are actively streamlining cloud contracting and reducing sprawl.”

Joint purchasing vehicles are generally preferable for a couple of reasons, said former DOD Deputy Chief Information Officer Jack Wilmer. “The DOD is a significant size customer for a lot of these CSPs,” he noted. By negotiating department-wide, rather than service by service, “You actually combine your buying power into one enterprise offering, [and] you can get better terms for the government.”

Enterprise-wide procurement also means that DOD speaks with a single voice to each CSP on issues like security and interoperability, said Wilmer, now CEO of cybersecurity service provider SIXGEN.

Cloud One and JWCC both offer cloud services from the same hyperscale providers—AWS, Microsoft Azure, Oracle, and Google Public Cloud. But they aren’t exactly the same.

“There’s not as many services available [in JWCC] that our customers currently use,” the program manager said. Workloads built on one architecture in Cloud One may have to be reengineered for a different provider later.

“There’s a lot of personnel hours going into this,” the manager said. The Cloud One program office is seeking to shield its customers from the impact of the changes, the manager said.

JWCC is set up to allow cloud providers to bid on a requirements package from the customer, to drive down costs through competition. But structuring it that way makes it harder for users to know in advance what their costs will be—and whether a transition will save money or cost more.

The transition away from Cloud One is not expected to be complete until next summer. By then, the JWCC contract will be just a year from expiring. It is scheduled to be replaced in 2027.

“We’ll just have finished this transition and then [the customers] will have to turn round and do another transition to JWCC Next,” the name of DISA’s planned successor contract vehicle, the manager said.

The post DOD Canceled the Air Force’s $1.4B ‘Cloud One’ Contract. Did it Save Any Money? appeared first on Air & Space Forces Magazine.

Data in Defense, IT Modernization, Technology, acquisition, Cloud, Cloud One, Hegseth

Air & Space Forces Magazine

[crypto-donation-box type=”tabular” show-coin=”all”]