French Bonds, Stocks Tumble As Government Risks New Collapse In Weeks

And just like that, Europe is gripped by another political crisis (but… but… the euro is soaring) after French Prime Minister Francois Bayrou called a confidence vote that may topple France’s government as soon as September 8, prompting a selloff in French assets as investors hedged for more political uncertainty.

The conservative National Rally party, the leftist France Unbowed and the Greens all said they would vote against the Sept. 8 motion while even the Socialists – so pretty much the entire political spectrum in France – said they wouldn’t back the government. If a majority of lawmakers vote against Bayrou, which now appears to be the case, he’ll be forced to submit his government’s resignation. This would be overdue for a government which should have been bounced long ago.

The failure of another French government — the previous prime minister, Michel Barnier, lasted only 90 days — would underscore the tenuous position of President Emmanuel Macron, whose party and its allies lost any semblance of a parliamentary majority in 2024. Marine Le Pen’s National Rally, which became the largest party in the lower house in that vote, is calling for a new election

Here is a recap of all the latest developments:

- French PM Bayrou has called for a Vote of Confidence (Article 49.1) to take place on Sep 8th

- This vote requires a simple majority of votes cast, which is different to a Vote of No-Confidence (Article 49.3) which require an absolute majority in parliament

- This makes it harder for the PM to win the vote, as abstentions do not help him – he will need MPs to explicitly vote for his government’s survival

- If Bayrou loses the vote, Macron will have the option to dissolve parliament and trigger new parliamentary elections or to appoint a new PM

- Speaking last week, Macron rejected the prospect of a second snap parliamentary election in as many years

- Even if the PM wins the vote, there is still the issue of passing the budget which would likely trigger several votes of no confidence over October / November

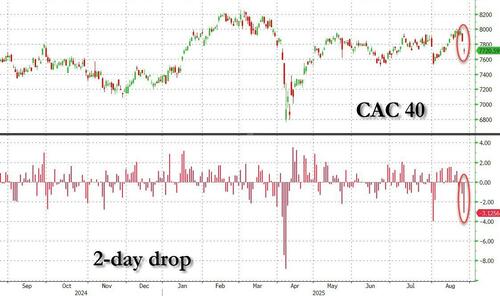

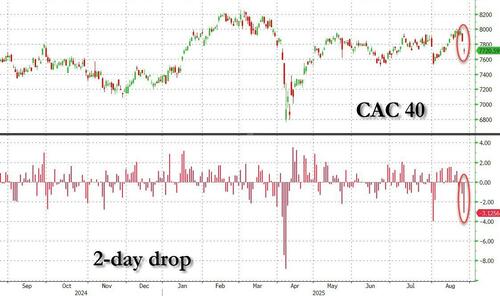

This has put French risk back into the spotlight and we are now likely to see continued headlines and volatility in the region over the coming months. Indeed, for the second day in a row, France’s CAC 40 has tumbled more than 1%, Europe’s worst performing index, and the 2nd biggest two day drop for the CAC since the Liberation Day plunge.

It’s not just stocks: French bonds are also getting hammered with 10Y OAT yields spiking since the announcement…

… which is to be expected: as these Goldman charts show, French domestic stocks have performed well in recent months despite a widening in sovereign spreads which may well have sensed that this showdown is coming.

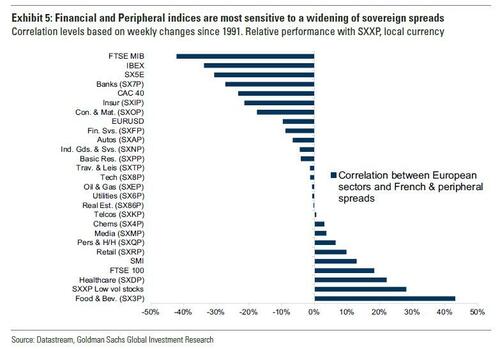

While Goldman naturally sees French domestic stocks as the most sensitive slice of the market to French political risks, the bank shows in the chart below other European indices and their long-term correlation with sovereign spreads (French and Peripheral spreads). Southern European indices, Banks, CAC 40, Cyclicals and the EUR tend to be most sensitive, while Consumer Staples, Healthcare, Low vol stocks and FTSE 100 are most positive positively correlated (in terms of relative performance) when sovereign spreads widen.

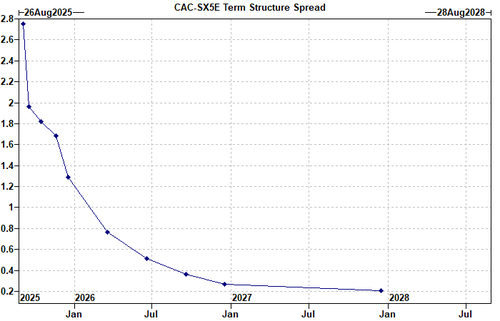

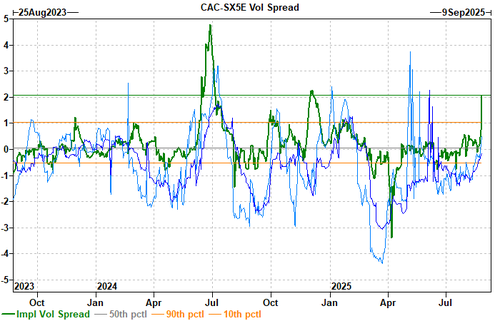

So how to hedge a worst case outcome? Below we lay out some ideas from Goldman’s Thilo Deller, writes that implied vols have moved higher in the front-of the curve, albeit from low levels. With the CAC vol term structure now slightly inverted here…

… Goldman prefers owning vol in Dec, where the likelihood of capturing a potential election is higher. While the implied move for the 8th of September has moved higher (~1.1% in SX5E), the options market has started to price increased volatility in the months following the vote on the back of potential elections and budget uncertainties.

Separately, for traders seeking broad French equity protection, these are the trades:

CAC Dec25 95%/85% Put Spread costs 1.35% [20-delta | 7.4x pay-out]

For more targeted French exposure Deller likes the bank’s French domestic basket. This has >50% domestic exposure vs ~15% for CAC. We can see that historically and on a day like today, it exhibits a high beta to French risk (today CAC -1.8% vs basket -3.8%).

As a hedge ::

- GSXEFRDO Dec25 95%/80% Put Spread costs 2.4% [24-delta | 6.2x pay-out]

For reversion ::

- GSXEFRDO Oct25 105%/110% Call Spread costs 0.95% [19-delta | 5.2x pay-out]

Finally, here is an excerpt from a Goldman Q&A on the French Confidence Vote (full note available to pro subs)

Q1. What happened?

French Prime Minister Bayrou held a press conference yesterday (August 25) in which he announced that he would call a confidence vote on September 8.

The announcement was unexpected, as there had been no leaks or hints ahead of the press conference. The decision to call for a confidence vote is all the more surprising because the government does not have a majority in parliament, and because the upcoming budget vote was in any case likely to lead to several no-confidence votes.

Q2. How likely is the government to collapse?

The confidence vote will follow Art 49.1 of the Constitution, which requires a simple majority of votes cast (for or against, but excluding abstentions) against the government for it to collapse. This makes for a lower bar than a no-confidence vote under Art 49.3 of the Constitution, which requires an absolute majority of all votes (including abstentions) against the government.

At the time of writing, a majority of opposition parties in Parliament have announced they would vote against the government. These include RN (far-right), LFI (far-left), as well as the socialist, green, and communist parties (left), totalling close to 330 seats in Parliament. In comparison, the government is supported by the parties allied to President Macron and LR (centre-right), amounting to around 210 seats.

The government could survive the confidence vote if some of the opposition parties flip their vote in support or end up abstaining in large enough numbers. It could also be that turnout on the day of the vote is surprisingly favourable to the government, as only the votes cast for or against the government will count towards the tally.

But the most likely outcome at this point is that the government loses the confidence vote and is forced to resign. Prediction markets accordingly assign more than an 80% chance of PM Bayrou leaving office by September 30.

Q3. What would be the next steps?

If the government were to collapse, President Macron would have the choice between appointing a new government under the current Parliament or calling for new parliamentary elections.

The current Parliament makes for limited government options, because coalitions that include LFI (far-left) and RN (far-right) are unlikely to reach a majority. We think the most viable option remains the broad centrist majority spanning President Macron’s allies (centre), LR (centre-right), and the socialists (centre-left). President Macron could therefore re-appoint a centrist or centre-right PM (similar to current PM Bayrou or former PM Barnier), appoint a centre-left PM, or appoint a more technocratic PM. In that case, the change in government could be relatively swift, such as when Bayrou took office 9 days after Barnier was forced to resign.

The key difference to when the government collapsed last December is that early parliamentary elections are now possible again. President Macron has until now expressed a preference not to call early elections. But he might have to if a majority of parties in Parliament call on him to do so (in practice, by pledging to veto any government until elections take place).

Opinion polls have not changed significantly since last year and continue to show voters split roughly three ways between the far- and centre-left, President Macron’s allies and the centre-right, and the far-right. But three important differences are that the alliance between the far- and centre-left has collapsed again, that far-right leader Marine Le Pen is now banned from running for office, and that local elections are scheduled for March 2026.

Q4. What would be the implications for the budget?

The potential collapse of the government underscores that the targeted deficit reduction (from 5.4% of GDP this year to 4.6% next year) looks too ambitious. We had already assumed that the government would make concessions to opposition parties and eventually raise the deficit target for next year to 5%.

If President Macron were to appoint a new government under the current Parliament, political parties could still have time to find a compromise and pass a budget before year-end. But the initial budget proposal would probably be less ambitious and still require concessions during parliamentary debates. In that case, we would look for a deficit of 5.2% of GDP next year and we are raising our baseline forecast accordingly. We expect the government debt-to-GDP ratio to increase from 116% this year to 122% by 2030.

If President Macron were to call for new parliamentary elections, the content of the budget would depend on the composition of the new Parliament. Given that current polls still point to a political deadlock, the most likely budgetary outcome might not look very different from that under the current Parliament. But there would be two important differences. First, the range of possible budgetary outcomes would become wider, because one of the three main political groups might secure a majority. Second, the change in government would likely take longer, and might lead to renewed concerns regarding slippage on this year’s budget. In that case, we would look for a slightly larger deficit this year and next, compared with our new baseline forecast of 5.4% in 2025 and 5.2% in 2026. As a result, the government debt would increase further than in our baseline forecast.

A collapse of government and corresponding increase in deficit expectations would also make further rating downgrades more likely. Fitch (AA-, negative outlook) will report on September 12, Moody’s (Aa3, stable outlook) on October 24, and S&P (AA-, negative outlook) on November 28.

Q5. What would be the implications for growth?

The implications for growth would be ambiguous. On the one hand, a smaller deficit reduction into next year would imply a smaller fiscal drag and be positive for growth, all else equal. On the other hand, the tightening in financial conditions and increase in policy uncertainty would likely be negative for growth. Taken together, growth would likely continue to run below trend (which we estimate at 1% in France). We are therefore leaving our growth forecast at 0.6% in 2025 and 0.9% in 2026.

More in the full notes from Goldman research (here and here) and trading (here) both available to pro subs.

Tyler Durden

Tue, 08/26/2025 – 10:41

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]