Solid 20Y Auction Stops Through Thanks To Record Directs

With bond yields sliding thanks to the ongoing stock drawdown, there wasn’t many concerns about demand for today’s 20Y auction. And rightly so, because the sale of $16 billion in 20 year bonds went through without any difficulty amid solid, if hardly stellar, demand.

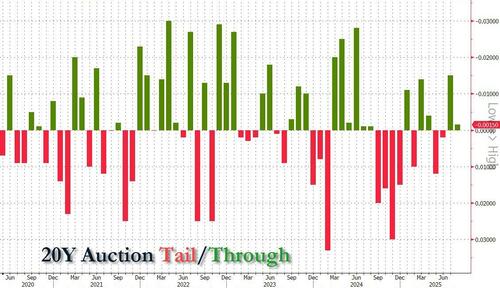

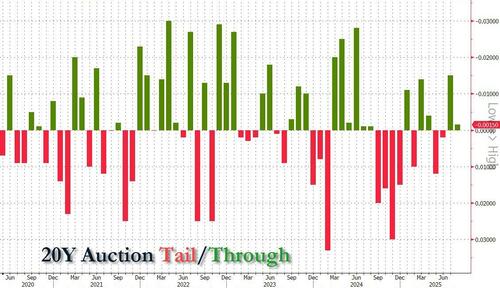

The auction prices at a high yield of 4.876%, down from 4.935% in July and stopped through the When Issued 4.877% by 0.1bps, the second consecutive stop through after 2 tails.

The bid to cover was 2.54, down from 2.79 and the lowest since May; it was also below the six-auction average 2.63.

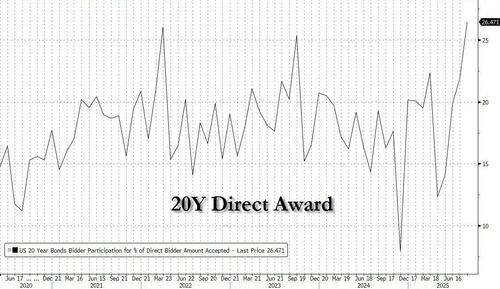

The internals were on the weak side, with foreign buyers stepping back as Indirects took down just 60.6%, down from 67.4% and the lowest since Feb 24. And with Directs stepping up to buy a record 26.5% of the auction…

… Dealers were left with 12.9%, below the recent average of 14.1%.

Overall, this was a solid, if forgettable, auction and the market response confirms as much: the 10Y did pretty much nothing after the break, with yields grinding lower all day and hitting fresh session lows shortly after the auction priced.

Tyler Durden

Wed, 08/20/2025 – 13:26

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]