BMI Dismisses Trump’s Copper Tariff As Likely Just A “Negotiating Tool, Not Serious Proposal”

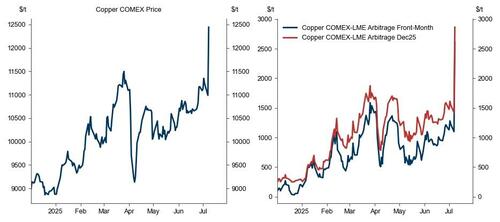

The global copper industry had been on edge since the start of President Trump’s second term amid rising tariff threats. Earlier this week, those fears materialized when the Trump administration announced a 50% tariff on all copper imports, set to take effect August 1, citing a strong national security assessment. Still, questions remain over how long the tariffs will last—and whether they’ll ultimately be reversed.

Analysts from BMI Research, a unit of Fitch Group, view the impending 50% copper import tariffs as merely a negotiation tactic rather than a serious policy, intended to pressure trading partners into fairer agreements.

“The tariff threat is, of course, a negotiating tool more likely rather than a serious proposal,” BMI analysts wrote in a Thursday report to clients.

In fact, tariffs are primarily used by the Trump administration as economic tools to pressure trading partners into offering market access, policy reforms, or more favorable trade terms. This view is echoed by the analysts, who believe the president will ultimately walk back the copper tariff, summed up by the acronym TACO: “Trump Always Chickens Out.” They said the president “always backs down on his tariff threats.”

However, the analysts warned of a painful market adjustment if the tariffs are not reversed. They cautioned that the policy could backfire by undermining the competitiveness of American manufacturing firms without meaningfully reducing the country’s reliance on imports. Additionally, they noted it could harm the U.S. refining sector, as a widening spread between domestic and global copper prices would likely prompt foreign exporters to redirect finished copper products toward the U.S. market.

So, with Chinese stocks dwindling and U.S. stocks soaring, and by the way, Goldman expects a further acceleration in shipments into the U.S. in the coming weeks, as the incentive to front-run the tariff implementation has increased…

… tariffing copper right now is interesting in its timing—whether it’s intended as a negotiation tactic with trade partners or, as a strategy to flood the U.S. with copper supplies to bridge the gap until domestic supply chains come online.

Related:

. . .

Tyler Durden

Fri, 07/11/2025 – 10:45

ZeroHedge News

[crypto-donation-box type=”tabular” show-coin=”all”]