TACO Tuesday

By Michael Every of Rabobank

TACO Tuesday(?)

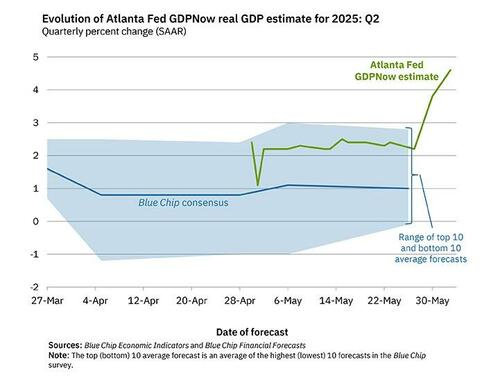

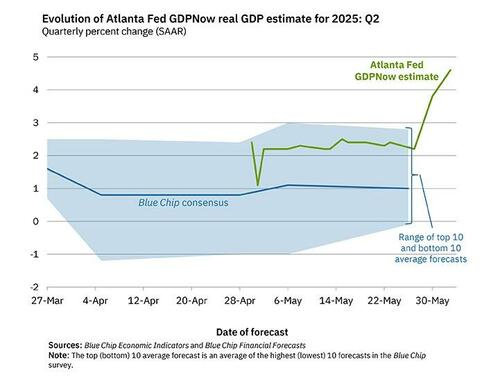

As always at turning points – more so with under-funded and/or politicized stats services – data show a Mexican stand-off or are a salsa confusion. There was a huge reduction in the US trade deficit for April from $162.3bn to $87.6bn; monthly personal income gains in 2025 so far of 0.5%, 0.8%, 0.7%, and 0.8% vs. 0.4% average in 2024 (0.3% excluding a bumper 1.3% in January that year); the Q2 Atlanta Fed GDPNow forecast is up to 4.6% q-o-q annualised, reversing the Q1 dip…

… yet the US ISM survey saw a weaker 48.5 headline and the import sub-index at 39.9, the lowest since 2009, with export orders 40.1, a five-year low. On the other hand, China’s Caixin manufacturing PMI this morning was 48.3 vs. 50.7 expected. So, who’s el pollo loco?

The latest market acronymic giggle is Trump Always Chickens Out (TACO) on trade wars: so, lay back, enchilada out, and wait for the return of neoliberal business as usual. But don’t burrito your head in the sand like a guacamole – that isn’t going to happen. Neomercantilism is here to stay.

The ‘We ♥ Free Trade’ EU just used its International Procurement Instrument for the first time to freeze Chinese medical devices out of its public procurement markets for five years unless China opens its market to EU equivalents. That’s economic statecraft with muscle, underlining that there are lots of tools in the mercantilist toolkit besides tariffs.

While the US extended its tariff pause on some Chinese goods to August 31 –more restocking is needed– and Trump and Xi will “likely” speak this week, says the White House, China has the US over a barrel on rare earths… for now. Yet that won’t be the case forever because rare earths aren’t rare, and no major economy will stay reliant on a rival: supply chains *will* shift locally or geopolitically. Moreover, Trump posted if the courts rule against his IEEPA tariffs it would threaten US “economic survival.” That puts the “International” and “Economic” and “Emergency Powers” into the IEEP Act which Congress passed to let presidents decide on such matters.

Friday saw under-reported tensions between two Chinese automakers as a BYD executive slammed as “alarmist” comments by the Great Wall Motor chief that the industry was “unhealthy” and drawing a parallel to failed property developer Evergrande without naming names (or talking about 35% price cuts). If you want to shout, “Because markets!” perhaps look in that direction? But, of course, geopolitics will get in the way: Chinese EVs are clearly winning market share globally even if individual companies may not be thriving – so, green light go.

More broadly on geopolitics and trade, last year’s Israeli pager and walkie-talkie attacks on Hezbollah showed finished goods could be weaponized. Ukraine’s ‘Pearl Harbour’ Operation Spiderweb now shows false cargo containers holding cheap drones can destroy a staggering amount of assets and there’s nothing to prevent it in the current global trading system.

Are we going to screen every container and every truck? Too slow and expensive. Will we screen those from some countries? That’s still slow and expensive and says geopolitical bifurcation – and note who makes all the containers. Are we going to reinforce critical infrastructure and military assets? With what money? Or are we just going to pivot back to “When rate cuts/When no tariffs?”

Meanwhile the latest Russia-Ukraine peace talks in Turkey lasted an hour and saw an agreed prisoner exchange but no ceasefire or likelihood of peace.

At the same time, the EU’s Von der Leyen and US Senator Graham discussed an 18th package of sanctions targeting Russia’s energy revenues, banks, and lowering the crude oil price cap – Graham is pushing even more aggressive US sanctions legislation. The tail risks to markets should be clear there as the EU continues to escalate vs Russia on many fronts; though that’s also as Poland’s PM Tusk will call a confidence vote to reassert his authority after an opposition presidential election victory – which won’t stop gridlock ahead; and a German court overruled Chancellor Merz’s recent closure of the border to new asylum seekers, which could see the far right AfD move even higher in the opinion polls.

The UK’s Strategic Defence Review, which PM Starmer claims will bring the country to “war-fighting readiness”, proposes a Kids Army —”closer engagement with school leavers to help retention crisis” as the Telegraph puts it— and is seen full of aspirations not deliverables; as politicians make a last-ditch attempt to block the treaty handing the British Chagos Islands housing the Diego Garcia airbase to Mauritius via first time use of constitutional legislation.

Australia’s former chief of army General Leahy said it must take urgent action vs. global risks being exacerbated by the US-China trade war and called for significantly more funding for defence now and well into the future, adding, “The almost total lack of consideration of defence matters during the recent election campaign and the current focus on a far-off distant, enormously-expensive force demonstrates how willing our politicians are prepared to tolerate risk. This is an abrogation of the primary responsibility of our elected representatives to provide for the defence and security of the nation and the safety of our servicemen and women. Those who wear Australia’s uniform place great trust in those who task and equip them. This trust is not being honoured.” Putting up minimum wages by 3.5%, as the government just announced, and bringing in a 15% tax on unrealised capital gains for superannuation over $3m from July, encouraging people to buy houses to save instead, may not be the ‘what GDP is for’ ticket the General is thinking of.

Then again, neither are rate cuts that don’t help channel liquidity into the armed forces, but again traditionally flow to already vastly expensive housing. There, the RBA minutes today showed the Bank could have gone 50bps at its last meeting to help protect the economy from tariff fall out –like a rising A$ vs. the US$ and higher inflation?– but instead opted to cut 25bps, against a backdrop of low unemployment, above-target inflation, and a sea of already asset-rich housing speculators waiting at the starting line like sprinters, in order to remain “predictable” to markets in times of rising uncertainty. Let’s just say that there was never any uncertainty that the RBA would be anything other than predictable in that predilection.

Less predictable, President Trump denied an Axios report to post that he would never allow Iran the ability to enrich uranium, while Iran told the US it will continue talking but won’t stop enriching (to near weapons grade, according to the IAEA). What Israel will do remains unclear. The fat tail risk isn’t.

The FT’s Gideon Rachman op-eds that Trump always chickens out on foreign policy too, listing all the wars he didn’t start despite bellicose rhetoric, before then concluding “it’s rarely a good idea to mock a bully,” and that countries who think the US won’t ultimately act should keep quiet. In which case, shouldn’t some op-ed writers too?

Tyler Durden

Tue, 06/03/2025 – 11:25

ZeroHedge News

Bitcoin

Ethereum

Monero

Donate Bitcoin to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Bitcoin to The Bitstream

Donate Ethereum to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Ethereum to The Bitstream

Donate Monero to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Monero to The Bitstream

Donate Via Wallets

Select a wallet to accept donation in ETH BNB BUSD etc..