Goldman Downgrades Booz Allen Hamilton To ‘Sell’ Amid DOGE Contract Cancellations

Management consulting firm Booz Allen quietly evolved into a government-wide contracting behemoth over the past few decades. By 2024, an astounding 98% of its revenue came directly from government agencies.

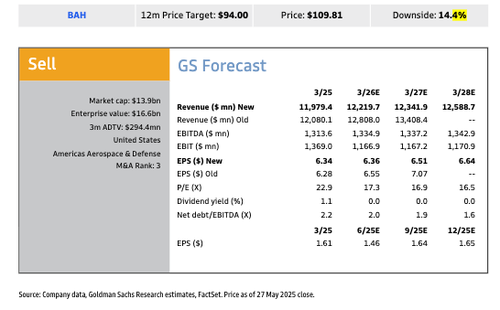

Now, enter the DOGE era: Goldman analysts have downgraded Booz Allen from “Neutral” to “Sell,” noting medium-term revenue growth is expected to be flat as federal civilian spending comes under pressure and priorities shift within various federal agencies.

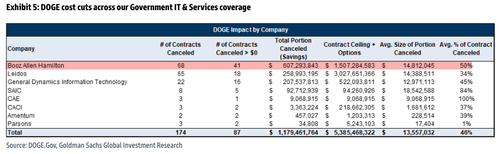

Highlighting top-line pressures, analysts Noah Poponak, Anthony Valentini, and Connor Dessert told clients Wednesday morning that Booz Allen shows up on the DOGE contract cancellation website more often than any other government services firm.

“Federal civilian agency budgets are under pressure, as other areas of spending within the government are prioritized,” Poponak said.

He noted, “Booz Allen is on the DOGE contract cancel website more than other government services companies. We think several efforts to reduce Fed Civ spending remain underway. We now expect Booz Allen organic revenue growth closer to flat for the next several years, which could take time for the stock to digest following the strong growth run of the last few years.”

DOGE data shows that Booz Allen has had 68 contracts canceled, with 41 of these being contracts that had not been fully paid out, and the remainder having been fully paid. The 60 contracts account for over $600 million in deals.

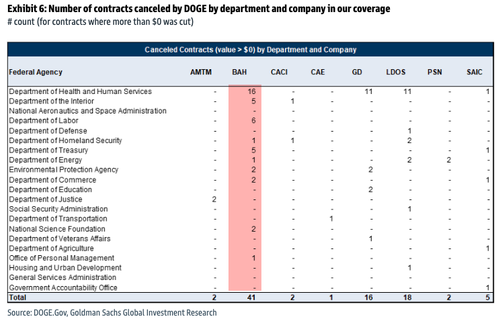

Booz Allen’s canceled contracts are spread across multiple federal agencies, with the majority concentrated in the Department of Health and Human Services.

Highlights from the report:

-

Downgrade Rationale: Booz Allen is downgraded from Neutral to Sell due to concerns about limited revenue growth, margin compression, and valuation risk over the medium term.

-

Revenue Outlook: GS Analysts now expect Booz Allen’s organic revenue growth to be flat through FY28 as federal civilian agency spending is cut and DoD priorities shift. The company also appears frequently on DOGE’s contract cancellation list.

-

Margins Under Pressure: The shift toward outcome-based and fixed-price contracts increases risk for contractors. Margin compression is likely as competitive pricing intensifies in a fragmented industry.

-

Valuation Risk: While Booz Allen trades at 17x CY26E P/E and 12x EBITDA—near historical averages—those multiples are at risk if earnings stay flat. GS analysts sees 14% downside to their revised $94 price target.

-

Weak FY26 Guidance: Initial FY26 guidance calls for 0–4% revenue growth and EBITDA below consensus. FCF guidance also came in ~19% below consensus.

-

Book-to-Bill Concerns: Q1 FY26 book-to-bill ratio was just 0.71x, a sharp drop from prior quarters and an early signal of slowing growth

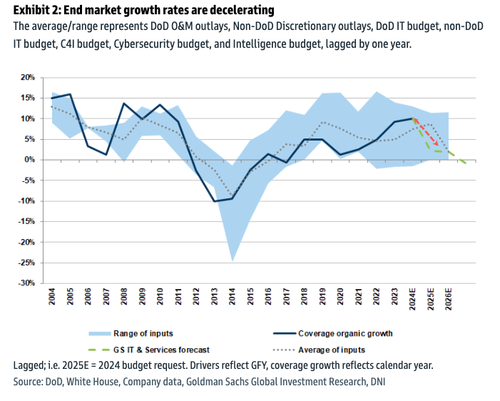

More broadly, Government IT outlays are set to slow this year and into next, driven by declining federal spending.

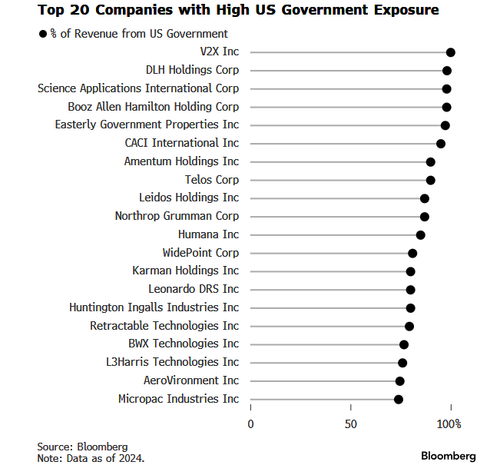

Besides Booz Allen, here are the 20 other companies with the highest percentage of revenue from the US Gov’t.

Welcome to the era of DOGE. It won’t be pretty for the elite class in the Mid-Atlantic area.

Tyler Durden

Wed, 05/28/2025 – 12:25

ZeroHedge News

Bitcoin

Ethereum

Monero

Donate Bitcoin to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Bitcoin to The Bitstream

Donate Ethereum to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Ethereum to The Bitstream

Donate Monero to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Monero to The Bitstream

Donate Via Wallets

Select a wallet to accept donation in ETH BNB BUSD etc..