Trump Targets Big Pharma: Slashes Drug Prices With ‘Most Favored Nation’ Rule, Aims To Cut Out Middlemen

Update (1122ET):

Executive order signed.

The new NPC narrative pic.twitter.com/NadxAuiYj5

— Planet Of Memes (@PlanetOfMemes) May 12, 2025

* * *

Update (1047ET):

President Trump will sign an executive order to reduce prescription drug prices. He said the “most favored nation” policy would tie the prices the U.S. government pays for certain medications to lower rates charged in other developed countries.

The president pledged to eliminate middlemen from the drug supply chain to make pricing more transparent and direct for consumers. Additionally, the president said select medications would be imported to help drive prices down further.

Trump warned that, if necessary, his administration would launch investigations into pharmaceutical companies, vowing to confront the pharmaceutical industrial complex and powerful pharma lobby groups.

The order is set to be a major hit to the pharmaceutical industry and …

If Trump bans pharma ads on TV, half the mainstream media will die overnight https://t.co/v3sIy1XnBM

— zerohedge (@zerohedge) May 12, 2025

Global pharmaceutical stocks came under pressure in Asia and Europe ahead of President Trump’s press conference. However, about an hour into his remarks, the SPDR S&P Biotech ETF (XBI) was up 2.5%. Despite the rebound, the XBI remains down 15% year-to-date.

* * *

Update (0935ET):

President Trump and Health Secretary Robert F. Kennedy Jr. are expected to give a press conference about lowering drug prices via an executive order.

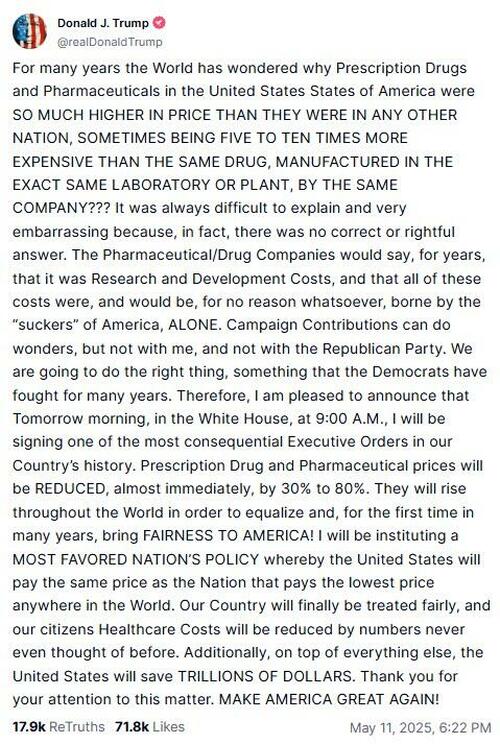

Ahead of the conference, Trump wrote on Truth Social:

DRUG PRICES TO BE CUT BY 59%, PLUS! Gasoline, Energy, Groceries, and all other costs, DOWN. NO INFLATION!!! LOVE, DJT

Live coverage provided courtesy of Right Side Broadcasting Network.

* * *

Update (0755ET):

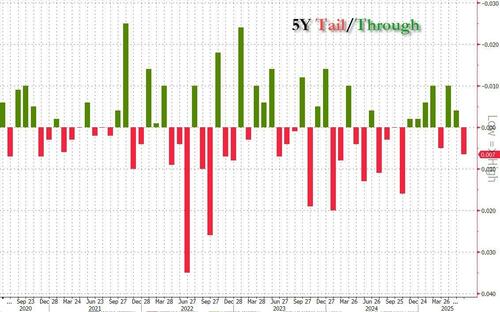

Pharmaceutical stocks slid globally Monday after President Trump said he would sign an executive order to slash U.S. prescription drug prices by 30% to 80%, aligning them more closely with international prices. The move, unveiled on Sunday on Truth Social, is seen by investors as a direct threat to profitability, raising concerns over pricing power and future earnings growth.

European drugmakers, including AstraZeneca, Roche Holding, and Novo Nordisk, missed out on the global equity rally sparked by trade optimism this morning. All three European pharma stocks were down between 3% and 4%. In Asia, the pharmaceuticals subgroup in Japan’s Topix Index recorded its largest daily decline since August. In premarket trading in New York, Bristol-Myers Squibb, Eli Lilly, Pfizer, and Merck were down between 2% and 3%.

Bank Vontobel analyst Stefan Schneider wrote in a note, “This has the potential to be very negative for the industry.” He said the order will probably target Medicare, Medicaid, and hospitals.

Goldman analyst James Quigley and others provided clients with more color on Trump’s incoming order this morning and what it means for European pharma stocks:

Last night on the social media platform Truth Social, President Trump confirmed that the administration intends to pursue the Most Favored Nation (MFN) Model for drug pricing, which calls for reducing U.S. drug prices to be more in line with international prices. Details of how this will be administered and specifically to which channels (i.e. Medicare Part B & D, Medicaid) will be disclosed in an Executive Order at 9am ET/2pm UK.

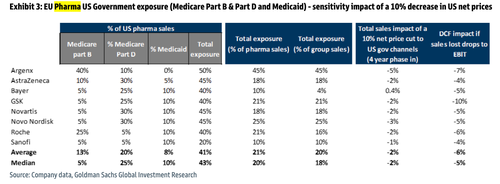

As a broad sensitivity analysis, for illustrative purposes if we assume a 10% reduction in U.S. Medicare Part B and Part D and Medicaid prices, this implies an average -2% impact on revenues across our EU Large cap coverage (assuming a 4-year phase in) and a -6% impact on our DCF valuations, all else equal. Exposure across Medicare Part B & Part D and Medicaid is fairly balanced across the industry, with Argenx, Astra, Novo and Novartis having the highest exposure (50% for ARGX and 45% of U.S. sales for the others) and Sanofi the lowest exposure (20% of U.S. sales) across these channels. On a channel specific basis, we estimate Argenx and Roche have the largest Medicare Part B exposure vs. Novo, Astra and Novartis with the highest Medicare Part D exposure. At the company level, our broad sensitivity analysis, all else equal and without assuming any costs savings offset, suggests GSK could be most exposed from a DCF standpoint followed by Roche/Argenx.

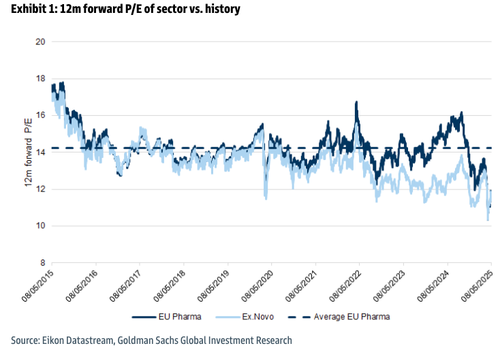

We note that EU Large Pharma has underperformed the wider market in Europe by -6%/-17% YTD and since the U.S. election on November 5, 2024, and now trades around 11.4x (11.4x ex-Novo) one year forward P/E, which is an 20% discount vs. the 10-year average multiple of 14.2x (13.5x ex-Novo, c.16% discount ex-Novo). Given this (and acknowledging other sector level concerns and FX), we believe the market is already pricing in some risk of U.S. price reform, but we would expect this to weigh on the multiple until the impact is fully digested in earnings estimates.

Quigley pointed out the EU pharma stocks with the highest exposure in the U.S. market.

Evan Seigerman, head of health-care research at BMO Capital Markets, told clients that Trump’s plan likely only affects the drugs up for price negotiations under the Inflation Reduction Act.

“Importantly, the government has no power to set prices in the commercial market,” Seigerman noted, adding that any effort beyond the executive order could face pushback from House Republicans, limiting the scope of potential legislation.

Trump wrote on Truth Social that he will be signing the order at 0900 ET.

* * *

President Donald Trump announced late on May 11 that he would sign an executive order which would reduce prescription drug prices in the US by 30% to 80% “almost immediately” while also raising drug prices “rise throughout the World in order to equalize and, for the first time in many years, bring FAIRNESS TO AMERICA!”

To achieve that, Trump would institute what he called a most-favored nation policy “whereby the United States will pay the same price as the Nation that pays the lowest price anywhere in the World.” Healthcare costs in the US “will be reduced by numbers never even thought of before,” he said.

Trump’s Truth Social post, which was preceded by an earlier one that promised as one of “most important and impactful” statements he has ever issued, didn’t detail how the order would work.

He also didn’t specify potential limits on the policy, such as whether it would apply only to government programs such as Medicare or Medicaid, if it would be limited to certain drugs or categories of drugs or if the White House sees a way to apply this more broadly.

Asian pharmaceutical companies fell in early Monday trading. Japanese drugmaker Chugai Pharmaceutical Co. dropped as much as 7.2%, the most in a month, with peers Daiichi Sankyo and Takeda Pharmaceuticals losing around 5%. In South Korea, SK Biopharmaceuticals Co., Celltrion Inc. and Samsung Biologics Co. all fell over 3%.

Americans pay the most in the world for medicines, fueling innovation and driving the growth of the pharmaceutical industry. Drugmakers have said revamping the system will slash revenue and stifle the development of breakthrough therapies that have the potential to lengthen and improve lives.

Trump cited the industry’s argument, but said it meant that “the ‘suckers’ of America” ended up bearing those costs “for no reason whatsoever.”

As Bloomberg notes, the US government already negotiates prices for some of the highest-cost medicines used in Medicare health insurance under the Inflation Reduction Act, which passed in 2022 under former President Joe Biden, with more slated to be added every year. The first two rounds of drug price negotiations haven’t included physician-administered drugs, but the next round might.

Billionaire hedge fund manager Bill Ackman suggested Trump might have been inspired by an idea he floated on X in March, when he said the best way to reduce US drug prices “is to make it illegal for drug companies to sell the same drugs abroad for lower prices than they sell them for here.”

The United States has subsidized the world on trade, defense, drugs, ‘NGOs,’ and more. Our global subsidy has contributed to our $37 trillion of national debt. President @realDonaldTrump is the first president in history to rectify the situation. He deserves enormous credit for… https://t.co/qlkdMr5aQ1

— Bill Ackman (@BillAckman) May 11, 2025

The best way to reduce drug prices in the U.S. is to make it illegal for drug companies to sell the same drugs abroad for lower prices than they sell them for here.

This will force a globally negotiated price that will be lower than the prices that U.S. consumers pay now and…

— Bill Ackman (@BillAckman) March 8, 2024

In his first term, Trump proposed a Medicare pilot program for drugs with no low-cost generic competition that are given in doctor’s offices, saying he wanted to bring prices in line with countries like France and Japan where they cost dramatically less.

That plan, which would have phased in over three years, aimed to ensure Medicare paid the lowest price offered to a group of 22 nations.

The effort was struck down in federal court after drug companies challenged it, claiming the administration hadn’t properly carried out the rulemaking process. The Biden administration didn’t appeal that finding, and instead pursued legislation that led to the Inflation Reduction Act.

Tyler Durden

Mon, 05/12/2025 – 10:47

ZeroHedge News

Bitcoin

Ethereum

Monero

Donate Bitcoin to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Bitcoin to The Bitstream

Donate Ethereum to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Ethereum to The Bitstream

Donate Monero to The Bitstream

Scan the QR code or copy the address below into your wallet to send some Monero to The Bitstream

Donate Via Wallets

Select a wallet to accept donation in ETH BNB BUSD etc..